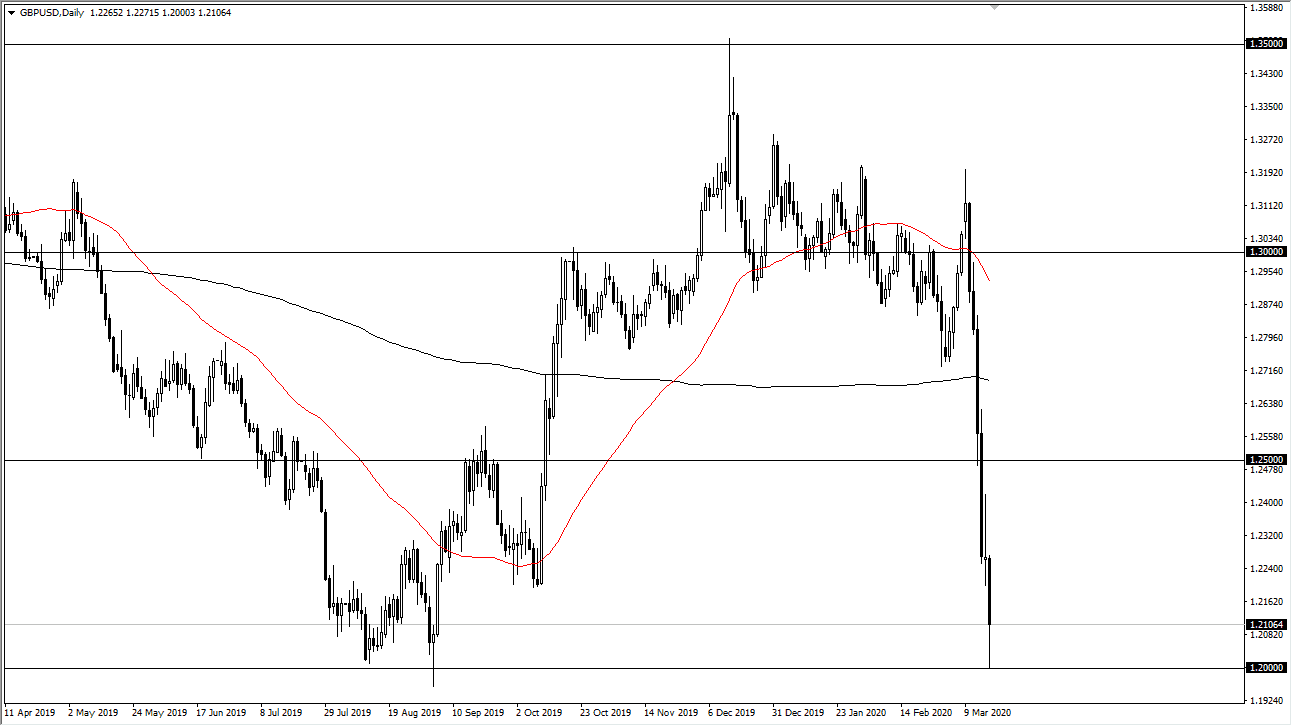

British pound traders had a wild ride during the trading session on Tuesday, as the market reached all the way down towards the 1.20 level before bouncing significantly. As the United States is going to get involved in massive spending, this drove down the value of the US dollar and helped recoup some of the losses by other currencies around the world. At this point, it’s likely that the British pound will trying to get back all of the losses from the trading session on Tuesday, meaning that the 1.2250 level is very likely to be challenged. Because of this, buying dips should work as long as we can stay above the 1.20 level. That is a large, round, psychologically significant figure and an area that has been important more than once.

If we were to break down below the 1.20 level, then it’s possible that we may drift down to the 1.18 level but I don’t think that is likely to happen in the short term due to the fact that so much stimulus has been suggested in America. Ultimately, I think that the market will try to test that inverted hammer from two sessions ago, meaning that we are likely to see a lot of volatility, but I think that the upward pressure is going to continue in this pair. It has been oversold anyway, so a bounce would have made sense regardless. I don’t like the idea of shorting a market that has fallen this hard unless it can clear the obvious support level at the 1.20 level.

The British pound of course has its own issues but at the end of the day it’s likely that we will continue to see a lot of volatility in both directions as market participants try to figure out what to do next. There is still a lot of demand for the US dollar, but if the market is going to get flooded with them, then it’s likely that we will see a bit of a relaxing of that dynamic. Because of this, the Trump administration may finally get the cheaper US dollar that it so desperately wants. I would be surprised if the market breaks above the 1.25 level though, because that would show a massive move in favor of Sterling, so I anticipate that it is essentially the “ceiling” in the market.