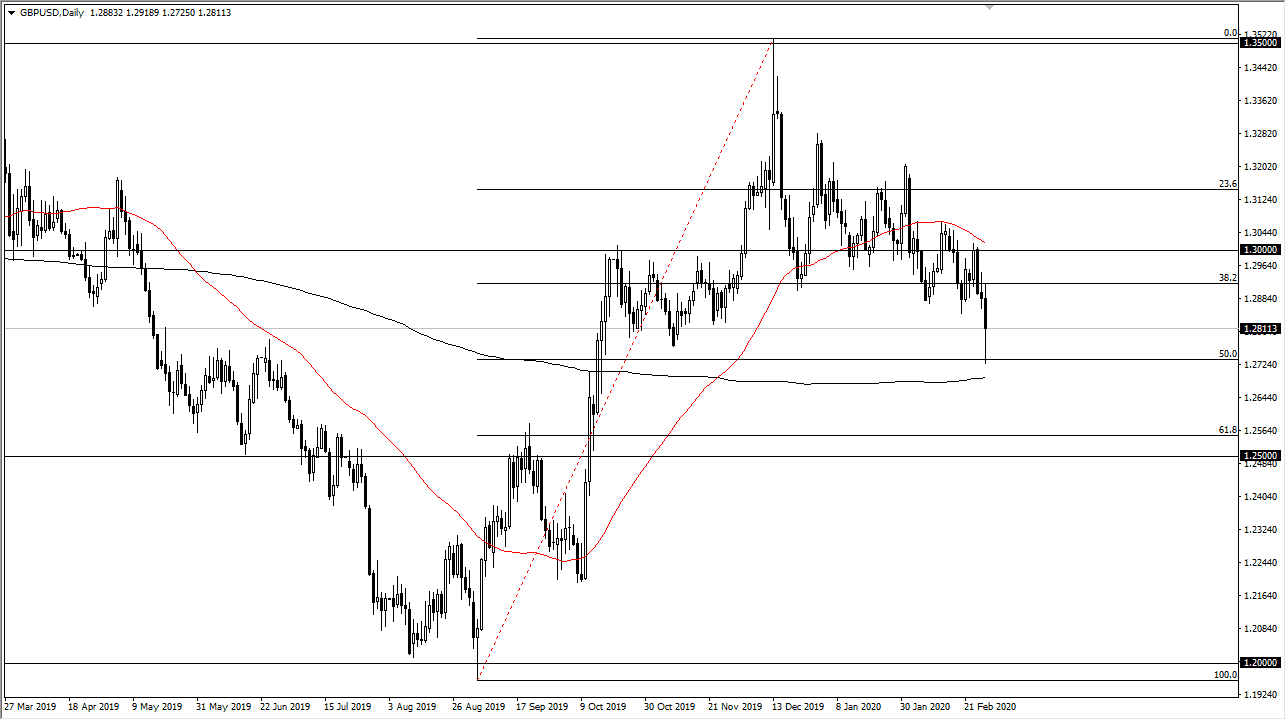

The British pound broke down a bit during the trading session on Friday, slicing through the 1.28 level before finding buyers yet again. We turned around to show signs of strength, and therefore it looks as if it will be somewhat resilient. The 200 day EMA underneath is going to continue showing signs of important, and the fact that the market has turned around to show signs of life. The candlestick for the trading session on Friday is somewhat of a hammer, and it is noteworthy that traders around the world are starting to expect some type of coordinated central bank action over the weekend, so that is influencing the way that the currency markets are moving. The British pound continues to suffer at the hand of a safe haven flow into the US dollar, although that seems to be all over the place right now as well.

For what it’s worth, the 50% Fibonacci retracement level was touched before the bounce, so it’s likely that the technical traders will be paying attention to that. That being said though, if the market breaks down below that level, then it’s likely that we go down towards the 1.25 handle which is also right around the 61.8% Fibonacci retracement level.

To the upside, the market seems to have quite a bit of resistance built in at the 50 day EMA, which of course is a crucial technical figure. However, if the market was to get above there and break above the 1.30 level as well, that could be a very bullish sign. At that point, it’s very likely that the market goes looking towards 1.35 handle which was the recent high. At this point, I expect a lot of noise in a lot of concern when it comes to currencies, as the volatility is only going to cause more issues than anything else. Keeping a small position size is probably crucial, as Monday could be all over the place in reaction to a central bank move, or just more negativity due to the coronavirus expansion. The negotiations between the United Kingdom and the European Union of course don’t help, but that seems to have taken a backseat to all of these other issues going on around the world right now. Keep in mind that the US dollar is considered to be a safety currency, so we could continue to see a lot of negativity.