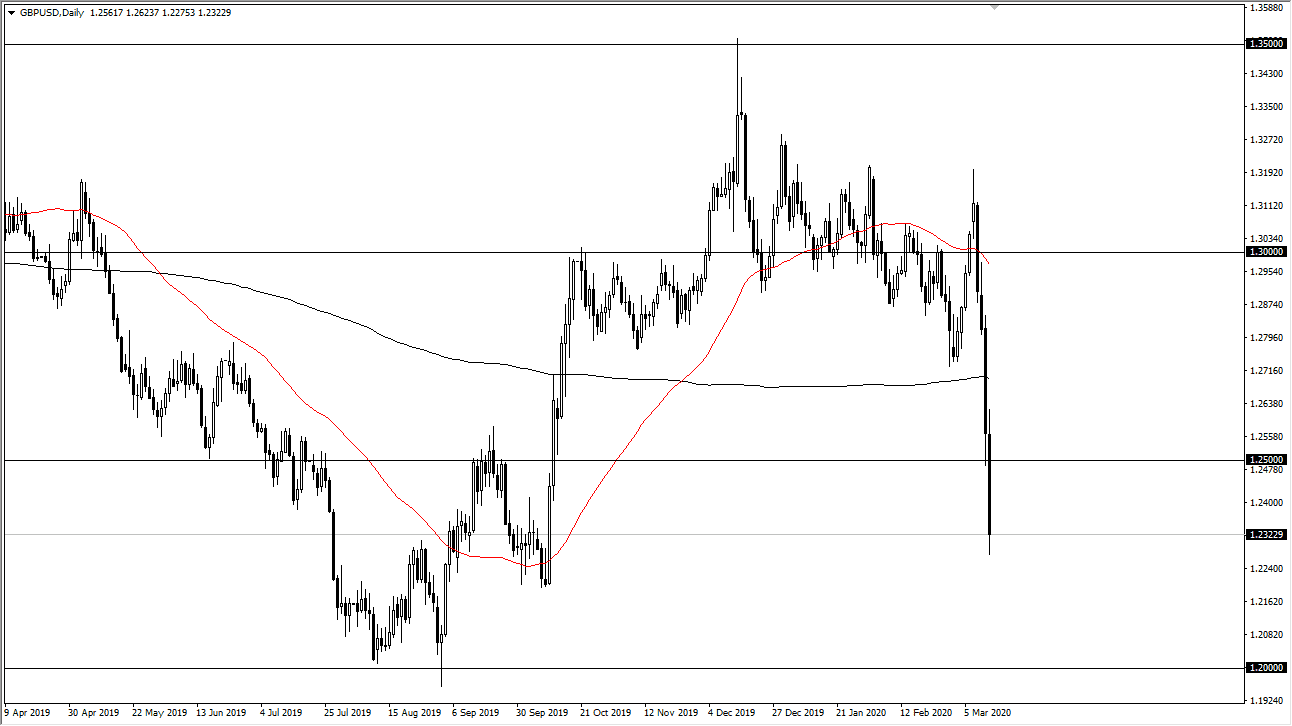

The British pound initially tried to rally during the trading session on Friday but found enough exhaustion above the turn around and slice through the crucial 1.25 handle. That is a large, round, psychologically significant figure that should be enough to catch attention, as it did offer a bit of support on Thursday. That being said, we not only slice through the 1.25 handle, but then just absolutely fell after that without much slowing it down.

Looking at the size of the candlestick, it shows that we are going to continue to see sellers in this market in that makes sense considering that there is a major “risk off” feel to most markets. The US dollars the first place people go to, and of course the treasury markets have been driving yields down in America as money flows into the United States. All things being equal, this is a market that I think you should be looking to sell rallies and, unless of course something changes quite drastically over the next couple of days.

Unfortunately, we are going into a weekend. This means that there will be a lot of headlines that the market will have to digest over that we can in the open can be very rough. However, depending on the direction it could offer a nice opportunity. At this point, it looks as if the British pound probably gets faded on rallies, with the 1.25 level being an obvious resistance barrier. If that does in fact happen, then it’s very likely we revisit the 1.2250 level, and then go looking towards the 1.20 level underneath. The 200 day EMA is above at the 1.27 level, but we have sliced through that like a knife through hot butter and therefore I wonder whether or not it can actually offer any significant resistance. Adding more volatility in this pair is the fact that the British pound is dealing with the entire Brexit situation as well. At this point in time, it seems as if the market is struggling to find a reason to own the British pound. Fading rallies will be the way to go, but I would urge you to keep those position size is small. If we do get some type of significant rally, it could be quicker than you anticipate as it tends to be during bear markets. Ultimately, I think that we will go looking towards 1.20 level, but this move may not be straight down.