After eight consecutive trading sessions in which the EUR/USD pair succeeded to achieve upward correction, based on which, the general trend turned upward by moving towards the 1.1213 resistance. The pair returned with profit taking sales and with expectation that the European Central Bank will move to stimulate the slowing Eurozone economy, on that, the pair retreated to the 1.1095 support before settling around the 1.1135 level, at the time of writing. The pressure on the single European currency was exacerbated by the outbreak of the Coronavirus, which forced to close all Italian schools. Calm returned to the financial markets elsewhere, although the outlook for the virus still indicates that it will slow down global economic growth.

The Euro was lower against all other major currencies, except for the Japanese yen, a safe haven of choice for investors. Where calm returned to the markets after a decision by the US Federal Reserve suddenly to reduce US interest rates by 50 basis points to 1.25%, a performance that does not coincide with the traditional relationship of the Euro with the desire for risk. The Euro rose 2.2% last week after recovering from multi-year lows near 1.08.

The risk correlation in the Euro faded last week with the collapse of emerging market currencies and global stock markets amid panic over the spread of coronavirus outside China, and therefore the Euro performance on Wednesday was expected, although it also came along with reports from ANSA noting that the Italian government has ordered the immediate closure of all schools and universities in the country until March 16 in an attempt to contain the coronavirus.

The Italian government immediately denied that it intended to close schools, although it later announced that all schools would be closed from Thursday to March 15.

On the economic side: Final survey data released by IHS Markit on Wednesday showed that the growth of the private sector in the Eurozone hit its highest in six months in February, as initially estimated, despite the outbreak of the Coronavirus. The composite output index rose to 51.6 in February from 51.3 in January. According to the data of the index, any reading higher than the 50 level indicates growth.

Commenting on the results, Chris Williamson, chief economist at IHS Markit, said that the Eurozone economy has shown resilience in the face of turmoil caused by the outbreak of the Coronavirus in February, but with deeper research into the data, there are indications that are problems still ahead. The strong growth in the private sector is reinforced by a strong rise in the activity of the service sector, along with a decrease in industrial production.

From the United States of America, the ADP survey recorded higher than expected jobs in the non-agricultural sector, but less than last month numbers. Activity in the US services sector grew unexpectedly at a faster rate in February. The ISM Services PMI rose to 57.3 in February from 55.5 in January, and any reading above the 50 level indicates growth in the services sector.

The increase in the reading on the services sector came as a surprise to economists who expected the index to drop to 54.9. With the unexpected rise, the non-manufacturing index reached its highest level since February 2019, when it reached 58.5.

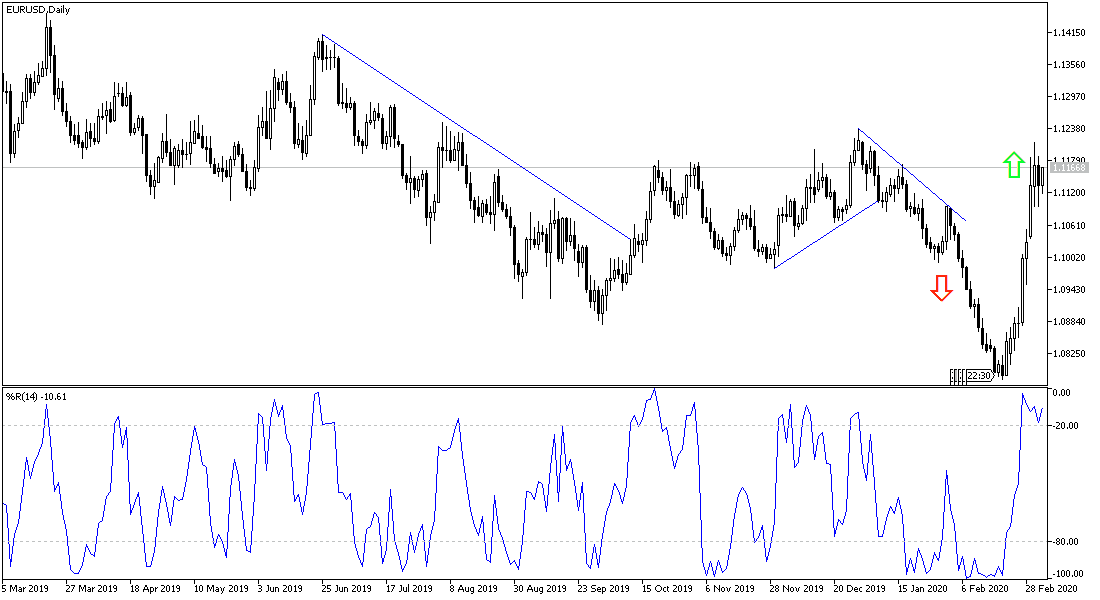

According to the technical analysis of the Pair: The opportunity for a bullish correction for the EUR/USD remains valid as long as it is stable above the 1.1000 psychological resistance, and the strength of the bulls controlling the performance will resume if the pair returns to break the next resistance at 1.1200. A reversal of this trend will be achieved by moving below the 1.0900 support. The pair may remain in a limited range until the European Central Bank announces plans to stimulate the Eurozone economy.

As for the economic calendar data today: The focus will be on US non-farm productivity data, the cost of employment index and claims for the unemployed.