In early trading this week, and amid profit-taking sales and technical indicators reaching overbought areas, the EUR/USD pair retreated to the 1.1010 support after gains at the end of last week's trading to the 1.1147 resistance amid stronger pressure on the US currency. Investors returned to interact with the limited numbers of European losses from the deadly Corona epidemic, as cases of COVID-19 in cluster countries increased, and in Spain, intensive care requirements exceeded the capacity of the country over the weekend - while Eurozone governments have not yet agreed to open the European Stability Mechanism - which may provide rescue for the most affected countries, Such as Spain and Italy.

Some analysts believe that the inability of the Eurozone countries to agree on a unified response to the economic losses caused by the outbreak of coronavirus is the main driver of the weak Euro exchange rate.

Last week, Eurozone finance ministers tried to unite on an agreement to address the economic losses caused by the coronavirus, as some countries requested that the Eurozone offer joint bonds to be issued to finance recovery from the crisis. However, there are some countries like the Netherlands, who were against this proposition. In general, the Eurozone remains divided when it comes to financial unity, which would be negative for any gains for the Euro in the coming period.

In the United States. The COVID-19 epidemic has spread quickly and with rates of injuries and fatalities that may be worse than Italy, and analysts believe that US President Trump may have to extend the ban and social separation period again for a period that may extend to April 30. This is amid expectations that the peak of the US epidemic cases will reach about 570,000 cases in about 20 days. This represents almost three times the previous projections of peak around 200,000 cases. In general, the United States still has limited quarantine measures compared to Italy or China.

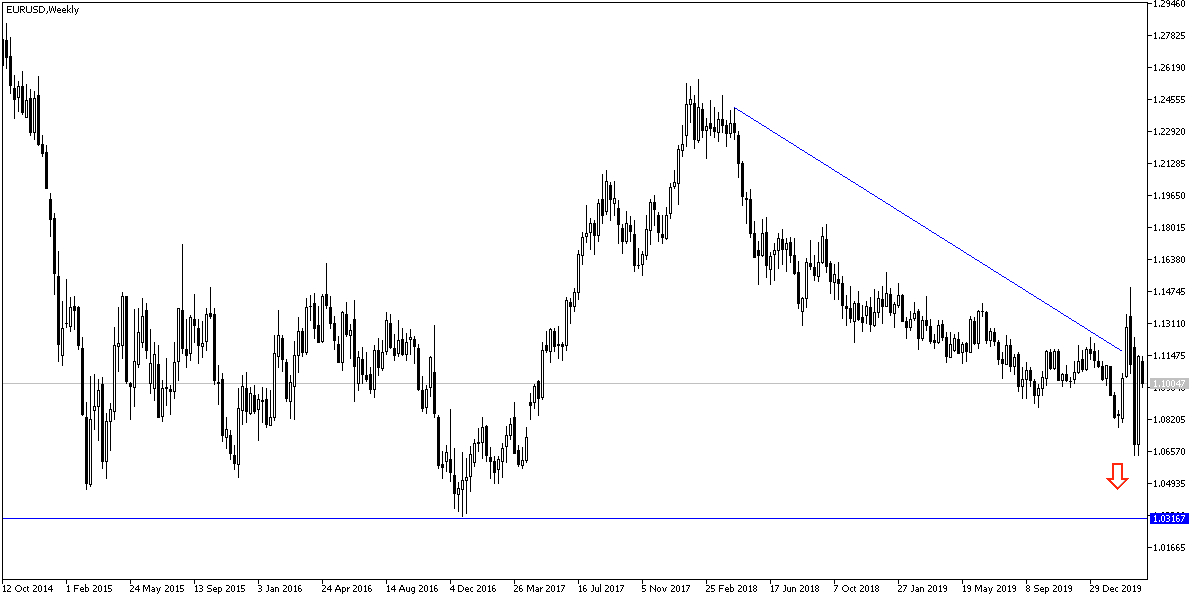

According to the technical analysis of the pair: As we expected in the recent technical analyzes, gains of the pair EUR/USD may be subject to quick evaporation, as the Corona epidemic remains a strong and clear threat to any gains for the Euro, especially with the variation of the stimulus force to face the economic crisis between the United States and the Eurozone. The pair returning to the 1.0955 support will raise the strength of the bears again to push the pair to new record support levels. On the upside, bulls are waiting for a new impetus to cross the 1.1200 resistance barrier to strengthen the formation of the last bullish channel.

As for the economic calendar data today: The German unemployment change rate will be announced, then inflation figures for the Eurozone. From the United States, consumer confidence index data will be announced.