For seven trading sessions in a row, the EUR/USD price is moving in an upward correction and the last three sessions were the strongest among those gains, and the pair reached the 1.1185 resistance, the highest level for nearly two months before settling around the 1.1170 level in the beginning of today’s trading. The European single currency has benefited strongly from the amazing sales in the global stock markets over the past ten days, and the demand for the Euro continues even as the stock markets recover some of their losses.

Global stock markets are currently trying to recover some of the major losses they incurred last week, but make no mistake, the markets are still fragile and it will take days of recovery to convince them that minimum sales have been achieved due to concerns about the Corona virus. Contributing to the rebound in equity indices is the expectation that the US Federal Reserve is ready to cut interest rates. After Powell's recent statements, the bank’s governor predicted that 100 basis points could be cut in 2020, due to the effects of the slowdown in growth caused by the COVID-19 outbreak in the global economy. However, the timing of interest rate cuts is largely uncertain.

This will be much more than the measure expected from the European Central Bank (ECB), as the bank does not have enough room to further reduce their interest rates. We have found that economists are increasingly seeing that the Federal Reserve should act decisively to prevent a shock of confidence in global markets, which will have a negative impact on the financial system.

Global markets continue to reflect growing investor fears that an outbreak - and attempts to prevent its spread - will lead to a significant global economic slowdown. At the end of this week, China released data showing that the containment measures enacted in early January severely restricted economic activity. The Composite PMI - which gives a glimpse of February's economic activity - fell to a record low of 28.9, from 53.0 in January. During the financial crisis in 2008, the activity index decreased to 38.8 only.

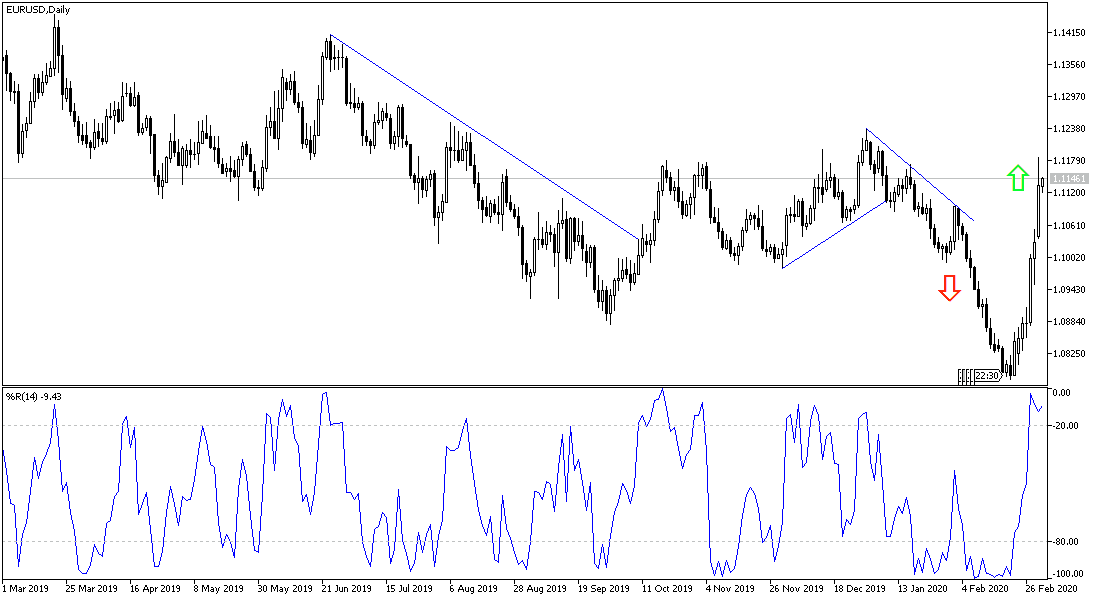

According to the technical analysis of the pair: With the success of the EUR/USD pair in breaching the 1.1100 psychological resistance, there was a reversal of the general trend to bullish, according to the performance on the daily chart. Optimism returning to global stock markets and improved investor sentiment, may cost the Euro some of its recent gains, as focus turns to the economic performance of the Eurozone, which remains weak. Bulls may now target the 1.1240 resistance, the most prominent on the daily chart. On the downside, the closest support levels are 1.1110, 1.1045 and 1.0960, respectively.

As for the economic calendar data today: The focus will be first on the announcement of the consumer price index from the Eurozone along with the unemployment rate and the producer price index. There are no significant US economic releases today.