In the flaming last week of February, the EUR/USD pair returned upward with gains to the 1.1053 resistance, before closing trading around the 1.1029 level, with the best weekly performance of the pair since January 2018. Last Thursday's trading session saw the best daily performance for the pair since August 5, 2019. The rise of the Euro came at a time when global stock markets and currencies of emerging economies collapsed amid a state of panic over the spread of the Coronavirus outside China, and some analysts indicated that the Euro could continue to rise at least in the short term. The Chinese Yuan, which fell to its lowest level in a decade, led the collapse in the currencies of emerging economies.

The dollar's decline was supported by the announcement of U.S contingency plans to deal with the epidemic after the detection of infected cases, amid fears of a repeat of the Chinese scenario in the largest economy in the world. Infections and deaths continued to rise across the world, emptying the streets of tourists and workers, and shaking global economies. In Japan, panic became a daily habit, and tourist sites throughout Asia, Europe, and the Middle East were deserted, governments closed schools and banned large gatherings. Parks were closed and concerts canceled.

Iran, Italy and South Korea have seen increasing cases. Meanwhile, the United States recorded its first death, a man in his fifties in Washington who suffered from underlying health conditions but has not traveled to any affected area. "It is possible that additional cases will occur in the United States, but healthy individuals should be able to fully recover," US President Donald Trump said at a news conference on Saturday, as officials announced increased warnings about traveling to certain areas in Italy and South Korea.

On Sunday, China recorded a slight rise in new cases over the past 24 hours to 573, the first time that this number has exceeded 500 a day. These cases are still almost entirely confined to the worst-affected Hubei Province with its capital Wuhan, the epicenter of the outbreak. The list of countries hit by the virus has risen to nearly 60. More than 86,000 people worldwide have been infected with the virus, and the number of deaths has reached 2,900.

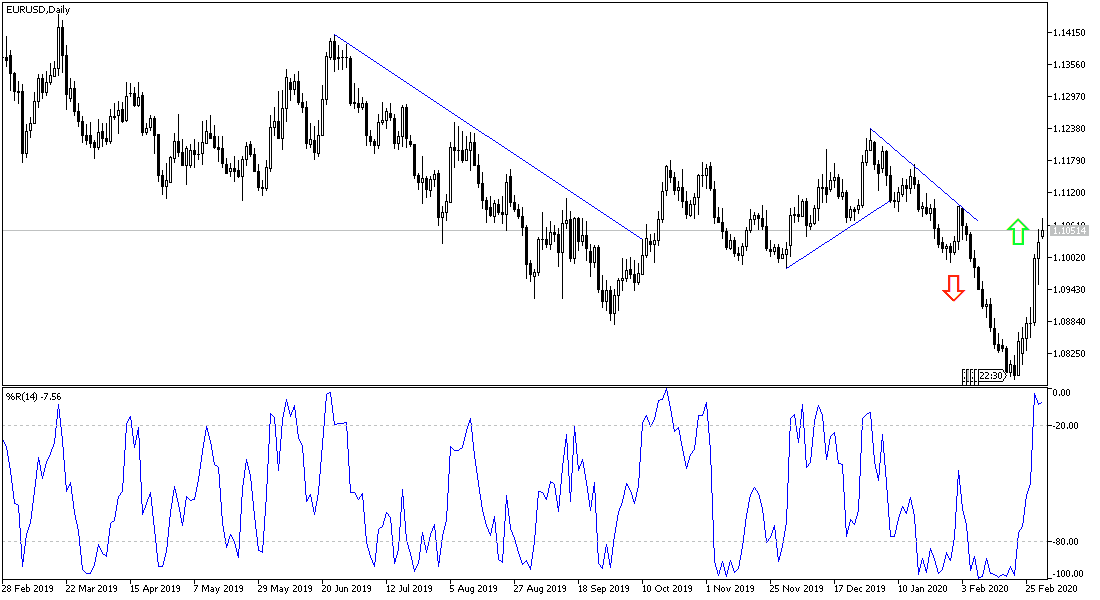

According to the technical analysis of the pair: The continuation of the EUR/USD pair above the 1.1000 psychological resistance will continue to support the uptrend of the pair, but we still want to test higher resistance levels such as 1.1120 and 1.1200 to confirm the reversal of the general trend. On the other hand, a return to around and below the 1.0900 support would support the return of the bear's control over the performance.

As for the economic calendar data: From the Eurozone, the manufacturing PMI for will be announced. From the U.S, the ISM manufacturing PMI and the construction spending index will be announced.