The downward pressure on the EUR/USD pair increased during yesterday's trading session, with the announcement of the lowest reading for the ZEW economic confidence index for the largest economy in the Eurozone, as the pair fell to the 1.0955 support, the lowest in three weeks before settling around the 1.1045 level at the time of writing. The ZEW survey came at the right time as it will take into account the impact of the coronavirus outbreak on the German economy, which confirmed a significant deterioration in business sentiment due to the virus, prompting economists to say that Europe's largest economy is now in recession.

The German ZEW forecast for March came in at -49.5, down from 8.7 in February. Expectations were for a sharper reading of -26.4, the bleak reading explaining the Euro’s poor performance in global currency markets at the time of writing. With this a decrease of 58.2 points in mind, this is the largest decrease that ZEW has recorded since they began recording data in 1991.

The ZEW Institute says that the only time they experienced such a drop in business expectations was during the 2008 financial crisis. Therefore, ZEW President Professor Achim Wambak stated, “The economy is on alert. Financial market experts are currently expecting to see a drop in real GDP in the first quarter, while also considering another drop in the second quarter, most likely. For the whole of 2020, most experts currently expect a decrease in real GDP growth by nearly one percentage point as a result of the Corona epidemic”.

On the American side, the US Department of Commerce announced that retail sales fell - 0.5 percent in February after rising 0.6 percent, adjusted for January. The announced drop came as a surprise to economists, who expected retail sales to rise 0.2 percent compared to the 0.3 percent increase originally announced in the previous month. Excluding a 0.9 percent drop in car sales, retail sales are still down 0.4 percent in February after rising 0.6 percent in January. Previous car sales were expected to rise 0.2 percent.

The unexpected drop in sales came with gas station sales falling 2.8 percent in February amid a sharp drop in gasoline prices.

To face the devastating consequences of the Corona epidemic, President Donald Trump has acted to mitigate the impact on the US economy, especially with global markets fluctuating amid fears of an economic recession, the President consulted with executives in the field of tourism in addition to restaurant leaders, retailers and suppliers. His administration was expected to propose an emergency economic stimulus of approximately $850 billion to tackle the potential recession, in conjunction with the government's steps the Federal Reserve Bank has sprung up to cut interest that has pushed it towards the 0% level. Besides, it has announced quantitative easing plans to protect economic performance from the Covid19 epidemic which started spreading recently in the United States of America.

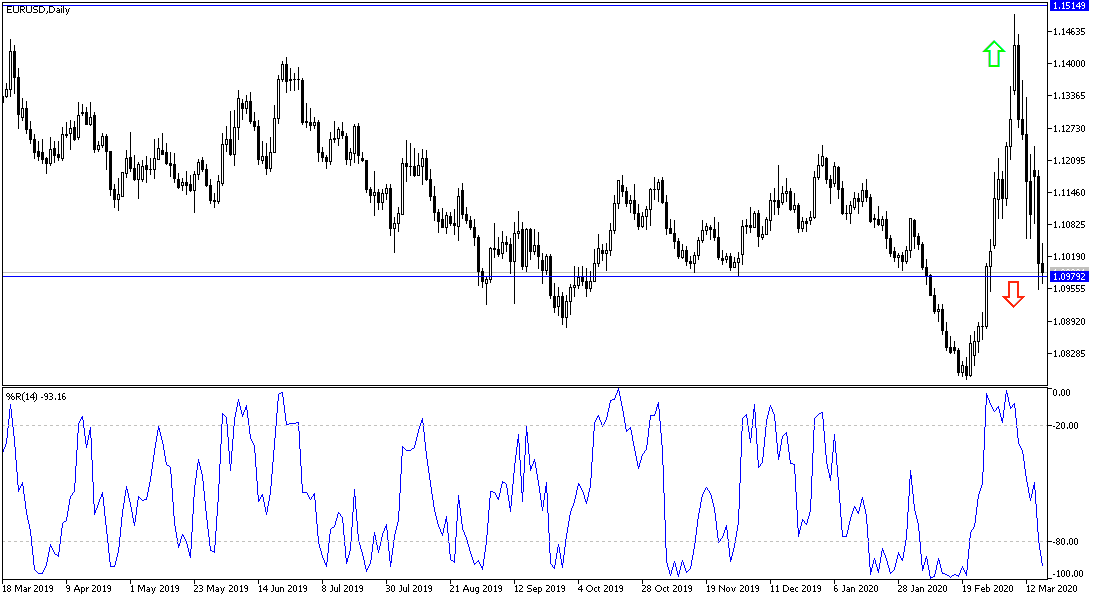

According to the technical analysis of the pair: As I mentioned before, the stability of the EUR/USD pair around and below the 1.1000 support will give a strong catalyst to the bears in controlling performance, especially after the recent violent reversal of the pair. The pair is likely to test stronger support levels, especially if European losses from the Corona virus increased. The 1.0965, 1.0880 and 1.0800 levels will be the closest targets for the bear to gain control. It will not return to the last ascending channel without moving and breaking the 1.1360 resistance. The US stimulus plans are more than what the European Central Bank announced and thus the demand for the dollar will be stronger.

As for the economic calendar data: The Eurozone consumer price index will be announced. And building permits data will be announced from the United States of America.