In the beginning of this week’s trading, the EUR/USD pair attempted to rebound higher, but gains did not exceed the 1.1236 level, and the US dollar rose again, pushing the pair back to the 1.1095 support before settling around the 1.1170 level in the beginning of trading on Tuesday, as Europe still suffers much from turning the bloc into a hotbed of the deadly Corona epidemic, the most feared place after China. European Union leaders will hold a video summit on efforts to contain the spread of the deadly Coronavirus, which has infected more than 50,000 people across Europe, and has killed more than 2,000 people.

Most of the virus cases and deaths were from Italy, the worst affected area after China, the source of the epidemic, which prompted neighboring countries such as Austria, Slovenia, Germany, Poland, Slovakia and Cyprus to impose more restrictions in an attempt to prevent the spread of the disease.

European Council President Charles Michel, who chairs the summits of the 27 prime ministers and heads of state of the European Union, tweeted on Monday that he is calling for what will be the second meeting of its kind in two weeks. Michel said: "Containing the spread of the deadly virus, providing adequate medical equipment, promoting research and reducing economic repercussions is essential." Italy and Spain were closed on Monday. Schools and restaurants and bars have been closed in many countries.

Michel's call for the summit came on Tuesday, shortly after talks with French President Emmanuel Macron, German Chancellor Angela Merkel and European Commission President Ursula von der Lin.

On the American side. With the US economy closed, the Dow Jones Industrial Average fell nearly 3,000 points, or 13%, its biggest one-day drop in decades. The rapid cessation of activity has worried Americans about their jobs and savings, and has threatened to confuse unemployment benefit programs, amid growing concerns that the United States will slide into recession. The number of cases in the United States has risen to about 3,800, with at least 70 deaths, nearly two-thirds of them in the severely affected Washington state. Many other states have invited people to stay in their homes as much as possible.

These massive damages pushed the US Federal Reserve to cut US interest rates deeper to the threshold of 0% and increased stimulus plans with more quantitative easing. In the same context, the US government worked to stimulate the economy.

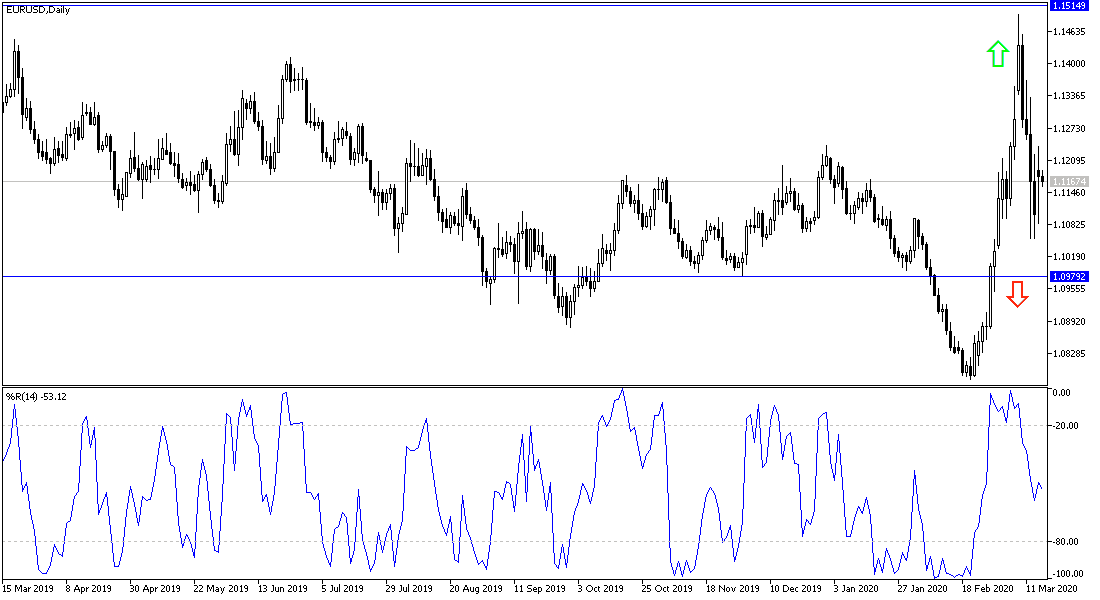

According to the technical analysis of the pair: Attempts to correct higher for the EUR/USD pair are still weak, with demand for the US dollar and avoidance of the Euro, which will suffer from the continued human and economic losses due to the outbreak of the Corona epidemic. Therefore, the pair is exposed to more bearish momentum, and the pair may return to the support levels 1.1120, 1.1045 and 1.0980 again. The opportunity for an upward correction wont be technically stronger without the pair breaking the 1.1500 resistance. I still prefer selling the pair from all upside bounces.

With regards to the economic calendar data today: The German ZEW economic sentiment index will be announced first. From the United States, retail sales and industrial production figures will be announced.