Throughout last week's trading, the EUR/USD pair was under downward pressure and failed in last two trading sessions in breaching the 1.1055 support, closing the week's trading around the 1.1025 level, down from the 1.1496 resistance reached in the beginning of trading, and is stable around the 1.1132 level, at the time of writing. The pair is a poised for more downward pressure amid the disappointment of markets and investors from the European Central Bank policy under the leadership of Christine Lagarde, as the bank only offered some stimulus plans without compromising interest rates, as did other global central banks, including those who cut interest twice during the current month. Financial markets have lost historical liquidity after their recent losses and banks are trying to ease their policy by strengthening liquidity to restor confidence in the markets. The deadly Corona epidemic - Covid19 - still terrifies investors and markets and is a major cause of violent and incomprehensible fluctuation due to the large number of reports of increasing infections and deaths around the world, with Europe being the most active point of the disease after the epidemic spread beyond the Chinese borders.

The main drivers for the Euro this week are the announcement of retail sales in the Eurozone on Thursday, the German data at the end of the week and the continued speculation about what the European Central Bank is likely to do at its next meeting. A new quantitative easing program (QE) is widely expected to commence. The data will be important in the context of the slowdown in the Eurozone, especially Germany.

Retail sales in July are expected to show a -0.6% decrease from 1.1% previously when the statement is released next Thursday at 10.00 GMT. A higher reading is expected to be positive for the EUR, while a lower than expected reading should be taken as negative.

German data over the weekend is likely to fuel or mitigate current concerns about Europe's largest economy. German factory orders in July are expected to show a 1.5% decrease after a 2.5% rise in the previous month and the statement will be released on Thursday at 7.00 GMT. German industrial production in July is expected to show a 0.1% increase from -1.5% earlier when released on Friday at the same time.

Any difference from these expectations could affect the Euro. As Germany has already shown negative economic growth, and if it shows another quarter of negative economic growth, it will enter into a technical recession which starts after two consecutive quarters of recession. This is likely to have a negative impact on the single European currency.

Regarding the ECB policy, the Central Bank is expected to announce plans to stimulate economic growth in the region. This may come in the form of a QE program. It is unlikely that the European Central Bank will cut interest rates since they are already low to historical levels, and if they are reduced to lower levels, it will increase the pressure on the Eurozone banks that are already struggling, which would be a self-defeating for the financial system in the bloc.

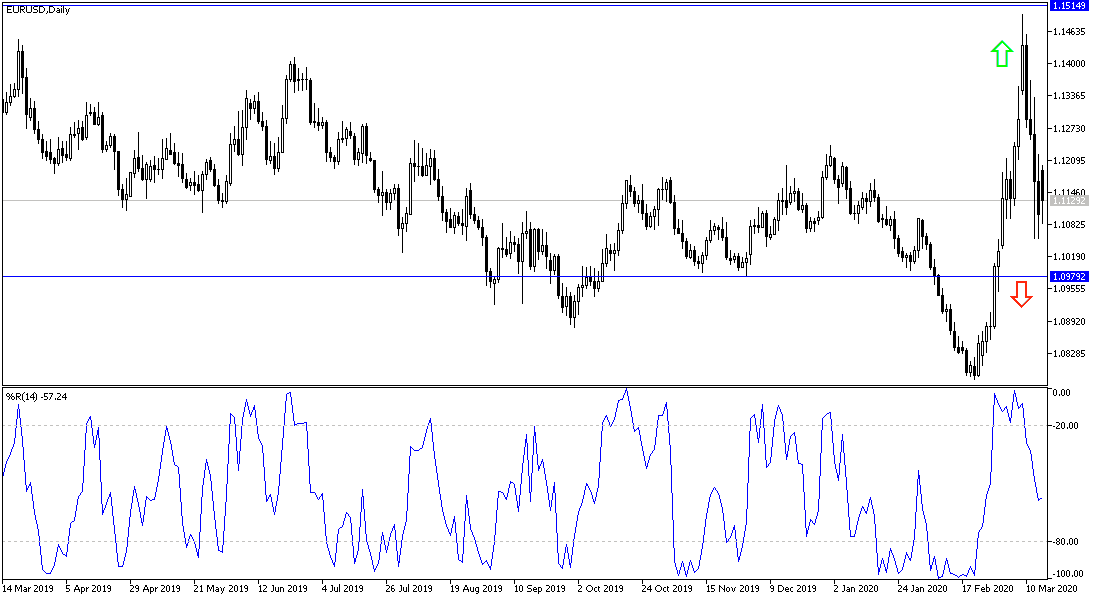

According to the technical analysis of the pair: Bears started to hold the reins of the EUR/USD pair and the charts confirm that the short-term trend is bearish after the recent decline. The 4 hours chart - used to define short-term expectations, which includes this week - confirms that the pair is retreating within a steady downtrend and heading towards new lows. The RSI has dropped to the oversold zone, increasing the risk of a pullback and slightly lowering the bearish outlook, however, it is not enough to reverse the bearish trend that is likely to continue moving towards new lows. A break below the 1.0963 level will provide confirmation that the decline will continue to the 1.0900 target at the main trend line level where the pair is likely to find support and stops according to traders’ sentiment. The daily chart shows that the EUR/USD is in a long-term downtrend which is likely to continue.

As for the economic calendar data today: There are no important economic data from the Eurozone or from the United States, and we will be interacting with the decisions of the G7 emergency meeting.