All eyes are watching carefully for the decisions that the European Central Bank will announce today to stimulate the European economy in the face of the Corona epidemic consequences in the E.U led by Italy, which recorded the largest numbers of cases and deaths after China, the source of the epidemic. Prior to Lagarde’s decisions, the price of the EUR/USD pair fell for the second consecutive day, reaching the 1.1257 support, from the 1.1496 resistance in the beginning of the week’s transactions, which was the highest since January 2019. The pair is stable around the 1.1263 level in the beginning of Thursday’s trading. Italians face restrictions on travel at home and abroad, other countries have isolated Italy by imposing a flight ban, and the country implemented comprehensive quarantine measures at the national level in a desperate government attempt to slow the silent spread of the new coronavirus.

Internationally, Italy's status as the epicenter of the Corona virus outbreak in Europe continued to strengthen after the Italian government extended the boundaries of procedures imposed in northern Italy, to cover the entire country to slow the infection.

Malta and Spain announced a ban on air traffic from Italy. Malta has stopped another cruise ship, and some airlines, including British Airways and Air Canada, have canceled flights to the entire country. Neighboring Austria and Slovenia prevented travelers from Italy from crossing their borders without a medical certificate. Britain, Ireland, Hong Kong and Germany have either promoted travel advice or urged their citizens to leave Italy.

After the US Federal Reserve announced a rate cut, it was followed by announcements by other central banks in Canada, Australia, and Britain of cutting interest rates and stimulate the economy. The turn is now on the European Central Bank, led by Christine Lagarde, and expectations have increased that the Bank officials will announce more monetary stimulus when they meet Thursday. Expectations indicate the possibility of a deeper rate cut, more bond purchases, and support for SMEs in the face of the devastating effects of the epidemic.

The European Commission plans to create a 25 billion Euro (28 billion dollar) investment fund to support the health care system, companies and labor market measures. The Italian and British governments provide separate support groups of at least the same size.

Britain, which is no longer a member of the European Union but still an important trading partner, has provided 30 billion pounds ($ 39 billion) in its new budget to mitigate the effects of the outbreak. The Bank of England added an incentive by lowering the key rate to 0.25% from 0.75%. Even Germany is softening its opposition to spending more public funds to boost growth. The government has discussed measures including 3.1 billion Euros in additional annual investment spending from 2021 to 2024. This represents only 0.1% of GDP, but experts say it can be increased.

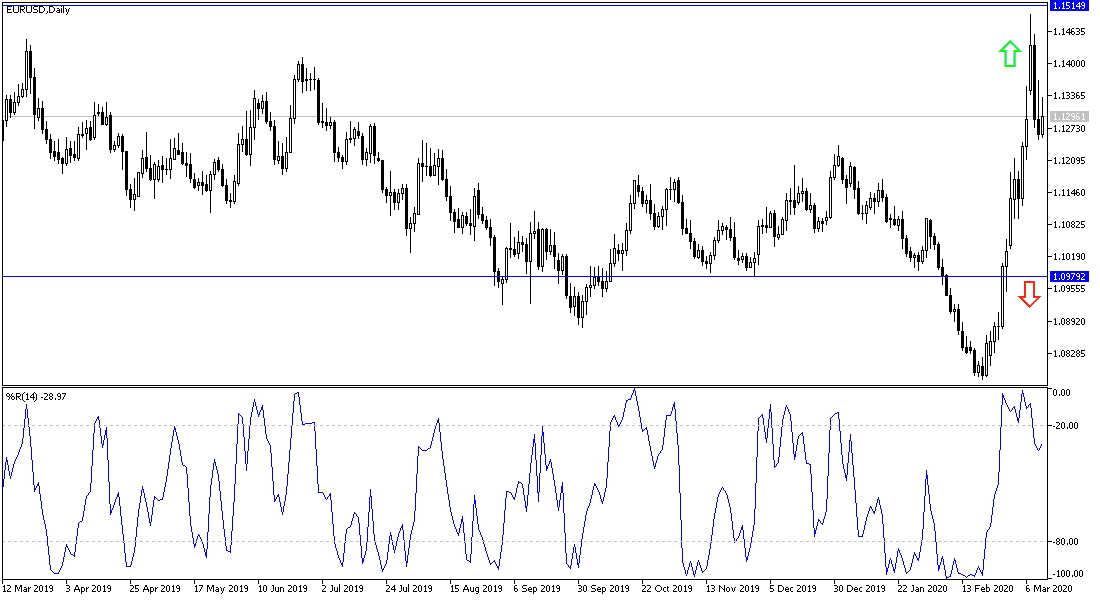

According to the technical analysis of the pair: On the daily chart, the EUR/USD pair is still on in an upward path despite the recent correction of its stronger gains. Stability above 1.1000 psychological resistance still supports bulls’ control. Their strength will return if the pair moves towards the 1.1335 and 1.1500 resistance levels again. There would be no real reversal of the trend without moving towards the 1.0900 support. I still prefer buying the pair from every lower level.

As for the economic calendar data: The beginning will be with the announcement of the industrial production rate in the Eurozone, and at a later time, the ECB will announce its monetary policy decisions, then a press conference by the governor of the bank, Lagarde. From the United States, the producer price index and unemployed claims data will be announced.