With the OPEC+ deal collapse adding to global economic issues on top of Covid-19, trade negotiations between the EU and the UK have taken a secondary role. The first week of talks illustrated anticipated broad-based differences. After the EUR/GBP ascended into its resistance zone, bullish momentum faded quickly. Economic data out of the UK has consistently outperformed that of the EU, and Forex traders are slowly adjusting their bias from bullish to bearish in this currency pair. The UK is well-positioned to grow, while the EU cannot afford more economic stress resulting from a WTO type trading environment.

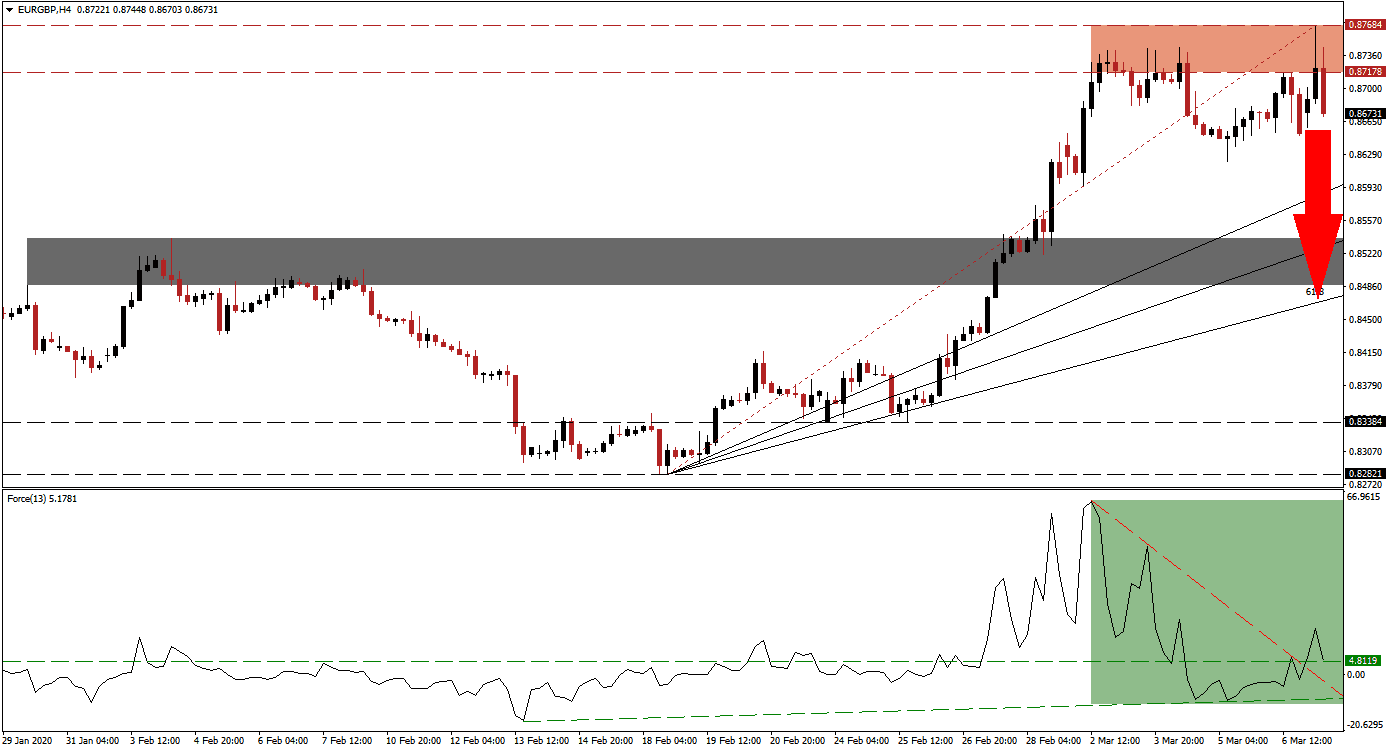

The Force Index, a next-generation technical indicator, offered an early red flag that the advance in the EUR/GBP is vulnerable to a correction. A negative divergence materialized with this currency pair creating a marginally higher high, while the Force Index accelerated to the downside. It was able to reverse after reaching a higher low, allowing for a new ascending support level to form. This technical indicator converted its horizontal resistance level into support, temporarily elevating it above its descending resistance level, as marked by the green rectangle. A reversal below the 0 center-line is expected to extend the breakdown sequence.

Following the rejection in this currency pair below its resistance zone located between 0.87178 and 0.87684, as marked by the red rectangle, a profit-taking sell-off is pending. This morning’s better than forecasted German data for January failed to provide relief to breakdown pressures in the EUR/GBP. The overnight collapse in oil prices, after a near 10% drop during Friday’s session, is posing a more significant challenge to the global economy than Covid-19. It increased the likelihood of a ten basis points interest rate cut by the European Central Bank, magnifying weakness in its currency.

Forex traders are advised to monitor the intra-day low of 0.86212, the low of a previously reversed contraction in this currency pair, which led to a higher high. A breakdown below this level is favored to invite the next wave of net sell orders in the EUR/GBP. It will additionally place price action below its ascending 38.2 Fibonacci Retracement Fan Support Level. An accelerated sell-off into its short-term support zone located between 0.84874 and 0.85380, as marked by the grey rectangle, is anticipated to follow. A breakdown cannot be ruled out, due to the increasingly bearish bias. You can learn more about the Fibonacci Retracement Fan here.

EUR/GBP Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 0.86750

Take Profit @ 0.84850

Stop Loss @ 0.87200

Downside Potential: 190 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 4.22

An advance in the Force Index off of its horizontal support level, pushing it farther away from its descending resistance level, which acts as short-term support, could result in a price spike in the EUR/GBP. The next resistance zone is located between 0.88316 and 0.88690, providing Forex traders with an excellent short-selling opportunity, as the outlook continues to take a bearish bias due to fundamental conditions.

EUR/GBP Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.87550

Take Profit @ 0.88350

Stop Loss @ 0.87200

Upside Potential: 80 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.29