After the Reserve Bank of Australia opted to decrease its benchmark interest rate by 25 basis points to a historic low of 0.50%, the AUD/USD advanced. Markets were caught by surprise, but valid reasons for this move exist. While the Australian central bank lowered rates, the US Federal Reserve is anticipated to move more aggressively. Long-term downside pressure on the US Dollar by far exceeds that of the Australian Dollar, while the Australian economy is well-positioned to recover from Covid-19 at a significantly faster pace. Following the bounce in this currency pair off of its support zone, more upside is anticipated to emerge.

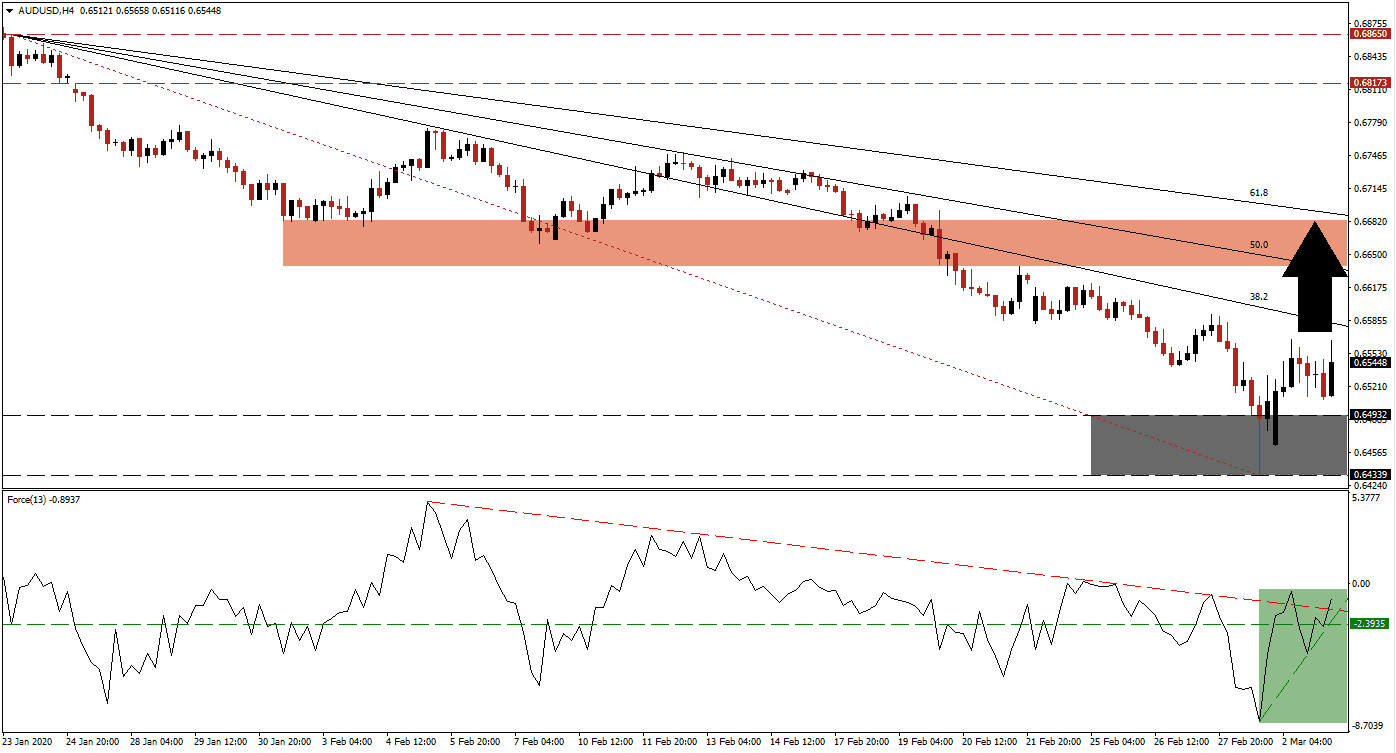

The Force Index, a next-generation technical indicator, confirms the breakout in the AUD/USD. After contracting to a fresh 2020 low, a quick reversal materialized, leading to the conversion of its horizontal resistance level into support. A steep ascending support level is adding upside pressure on the Force Index, which resulted in a push above its descending resistance level, as marked by the green rectangle. This technical indicator is now favored to cross above the 0 center-line, granting bulls control of price action.

Breakout pressures are on the rise after this currency pair exited its support zone located between 0.64339 and 0.64932, as marked by the grey rectangle. The AUD/USD is now on track to challenge its descending 38.2 Fibonacci Retracement Fan Resistance Level. While the RBA noted that it is prepared for more interest rate cuts if the economic situation deteriorates further, two of the four major banks note that today’s cut will be fully passed on to consumers, easing risks for more easing. You can learn more about the Fibonacci Retracement Fan here.

One key level to monitor is the intra-day high of 0.65913, the peak before price action accelerated to its current intra-day low. A breakout above this level is expected to attract new net buy orders in the AUD/USD. This will provide the required boost to elevate this currency pair into its next short-term resistance zone located between 0.66383 and 0.66839, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level enforces this zone. A breakout is possible but will require a fresh catalyst.

AUD/USD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.65450

Take Profit @ 0.66800

Stop Loss @ 0.65100

Upside Potential: 135 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 3.86

In case of a reversal in the Force below its ascending support level, the AUD/USD may attempt a reversal. Given the dominant fundamental outlook for this currency pair, supported by the evolving technical scenario, the downside potential for a move to the downside remains limited to the bottom range of its support zone. Forex traders should consider this as a second buying opportunity, as price action carries a distinct bullish bias.

AUD/USD Technical Trading Set-Up - Limited Reversal Scenario

Short Entry @ 0.84900

Take Profit @ 0.84350

Stop Loss @ 0.85100

Downside Potential: 55 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 2.75