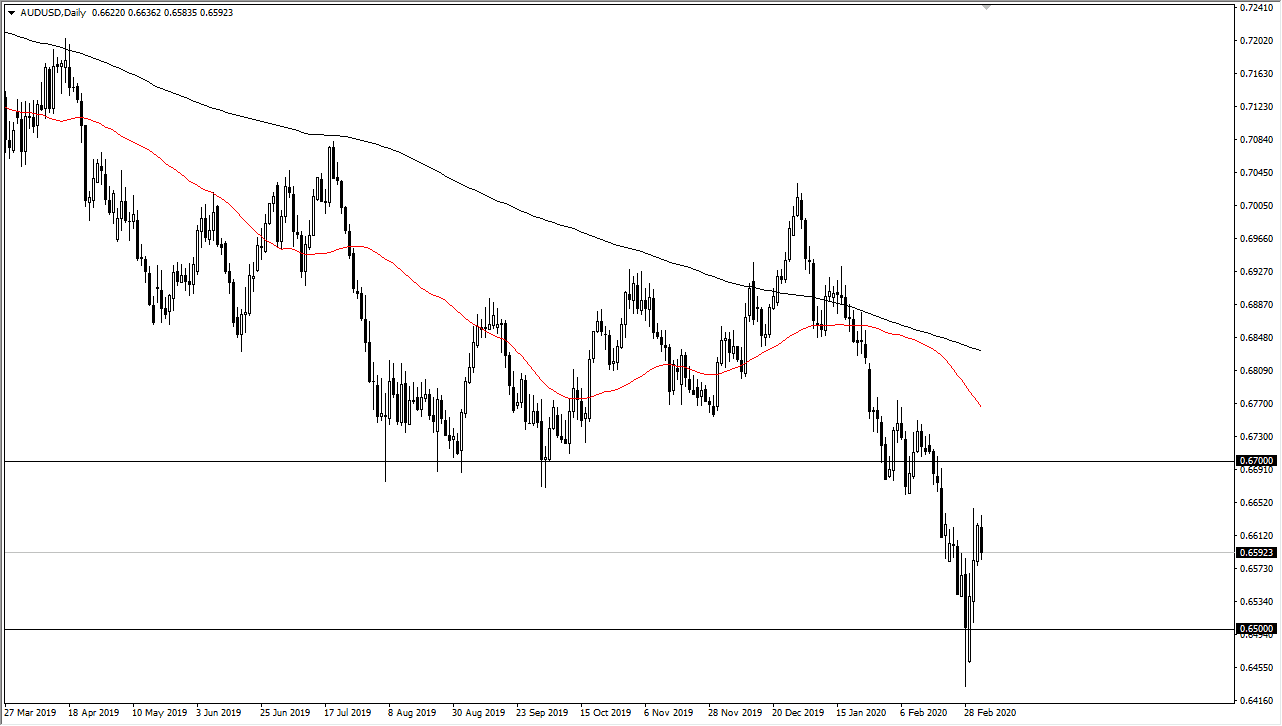

The Australian dollar has fallen during a large portion of the session, but as you can see, we turn right back around to show signs of life again. The Australian dollar is going to be interesting considering that the interest rates in the United States or falling, so it gives the greenback a bit of softness, but at this point the Aussie is far too levered to China to simply skate by the coronavirus issues. However, the Chinese situation does seem to be at least stabilizing and that is something to pay attention to.

The Reserve Bank of Australia recently cut rates, but it only cut 25 basis points as opposed to the Federal Reserve cutting 50 basis points. Because of this, it is a relative play on interest rate differential and future hikes or cuts, and at this point the Australian dollar is getting a little bit of a boost due to the fact that it’s considered to be “less bad” than the US dollar. We are starting to see a significant change in the attitude of currencies around the world in relation to the greenback, and the Aussie will be any different, but it may be a bit slower.

Hourly chart showing support

The hourly chart did pull back a bit during the trading session, but it looks as if we are starting to see a bit of support near the 0.6580 level. I do believe that it is only a matter of time before traders continue to pick up the Aussie dollar, or for that matter, sell the US dollar. If Chinese economic conditions start to improve, it’s very likely that this pair will be one of the first to rally due to that. After all, China is a major supplier of commodities and raw materials to China, so with that I believe that it is only a matter of time before somebody steps up and starts buying. The jobs number could be the catalyst in the short term, but right now I think it’s a matter of looking for an opportunity to pick up a bit of value, meaning buying dips. I don’t have any interest in shorting the Aussie right now, although it should be noted that if you are going to try to pick up the Aussie, you need to do so with a small position, not using a huge amount of leverage so that you can keep your stop loss very big.