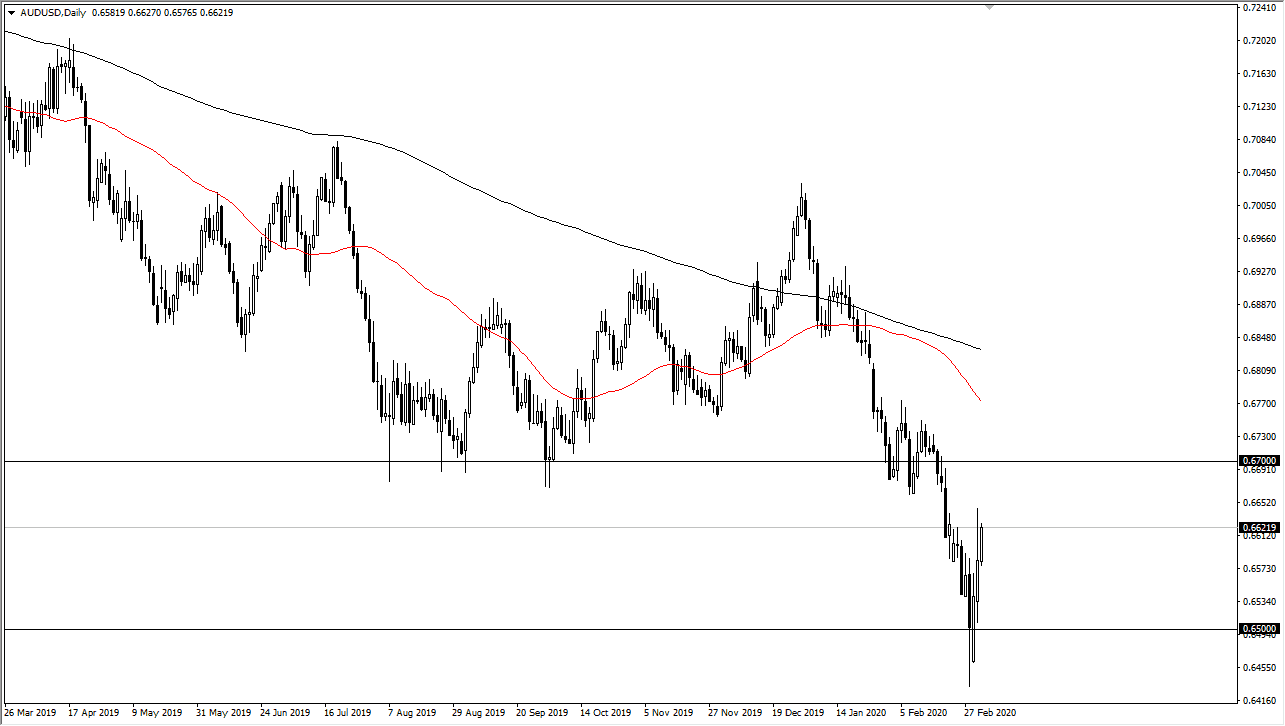

The Australian dollar has rallied significantly during the trading session on Wednesday, reaching towards the 0.6650 level. The candlestick from the previous session gave back quite a bit of the gains but it looks like we are going to continue to try to press to the upside. The question now is whether or not we can break above the 0.67 handle? At this point, I think that area will bring in some sellers, but in the short term it certainly looks as if we will reach towards that area.

The Fed Funds futures suggest that there are another 50 basis points coming as far as interest rate cuts are concerned, and it is weighing upon the US dollar. That doesn’t mean that we are going to simply take off to the upside in the US dollar is going to completely collapse, but at any sign of strength coming out of China, the Australian dollar will explode to the upside as it been so heavily punished. I think that there will certainly be a lot of selling pressure above, but if we were to get above the 0.6775 handle, that could be the first sign that the trend is changing for the longer term.

Hourly chart looks bullish

The hourly chart ended the day on Wednesday forming a bit of an ascending triangle, so that does suggest that there is more momentum coming into the market to the upside. The 50 EMA on the hourly chart has just crossed above the 200 EMA, which in and of itself is a relatively bullish sign. While the situation in China has been so bad, it is starting to get better as workers are being forced back into the factories, which of course is what the markets care about.

The Reserve Bank of Australia has cut interest rates by 25 basis points, but the fact that the Federal Reserve was so aggressive in looks to continue to be suggests that there is a bit of repricing that needs to be done in this market, and that more than likely means that the Australian dollar needs to go higher. Remember, it’s fundamentals the drive markets not simple candlestick formations. I look at this market as one that you can buy on dips, at least until we were to break down below the 0.65 handle which would show yet another collapse in risk appetite.