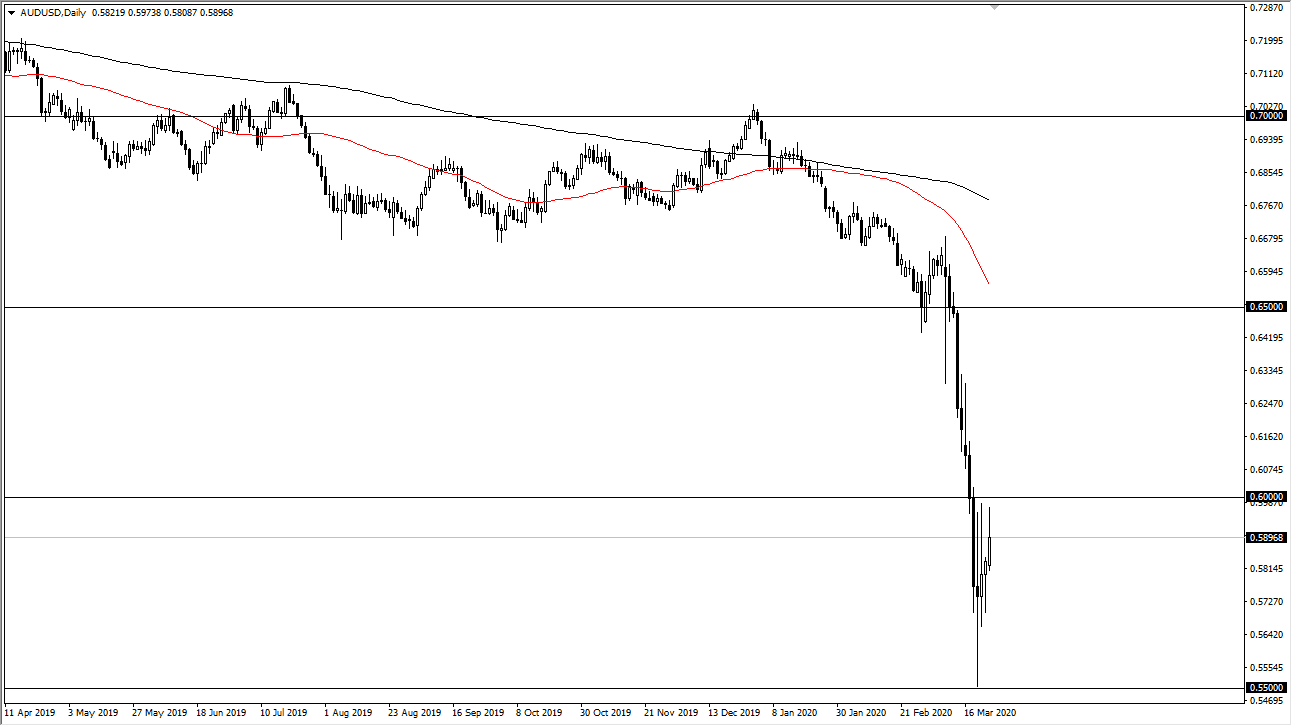

The Australian dollar rallied during the trading session on Tuesday, reaching towards the 0.60 level above before pulling back. That of course is a large, round, psychologically significant figure and it is also an area where we have seen sellers at previously. That being said, the level seems to be holding the Australian dollar under its weight, and as a result I think the market is trying to build up some type of base in this general area. If we can get a daily close above the 0.60 level on a daily close, it’s likely that the market would then go looking towards the 0.6250 level above where we have seen an inverted hammer and a gap that has since been filled.

Keep in mind that the Australian dollar is highly sensitive to China, which seems to be getting back to work. That could be part of the reason we are rising slightly but at the same time you have to keep in mind that the market could also be reacting to the Federal Reserve opening up “infinity QE”, which should work against the US dollar. I don’t know that we are at the end yet, but we are in the later part of the downtrend. I do think that given enough time this will be a nice buying opportunity for those who are more long-term inclined.

However, even if you are bullish you need to see that daily close above the 0.60 level, or perhaps a pullback that shows signs of support underneath. However, if we were to turn around a break down below the lows of the 0.55 handle it opens up the idea of the 0.50 level later which is a massive ultra-long-term area that has been crucial. Overall, I think that buyers on dips will probably be rewarded over the longer term, but I think you have plenty of time before we get an explosive move to the upside. At this point, the key will be 0.60 which is looking more and more resistive as time goes on. At that juncture, I believe that more people will jump in. That doesn’t mean that we are going to go straight up in the air, but it does suggest that the worst has been seen. Quite frankly, as countries around the world are starting to show signs of turning their economies back on, that should bode well for this pair.