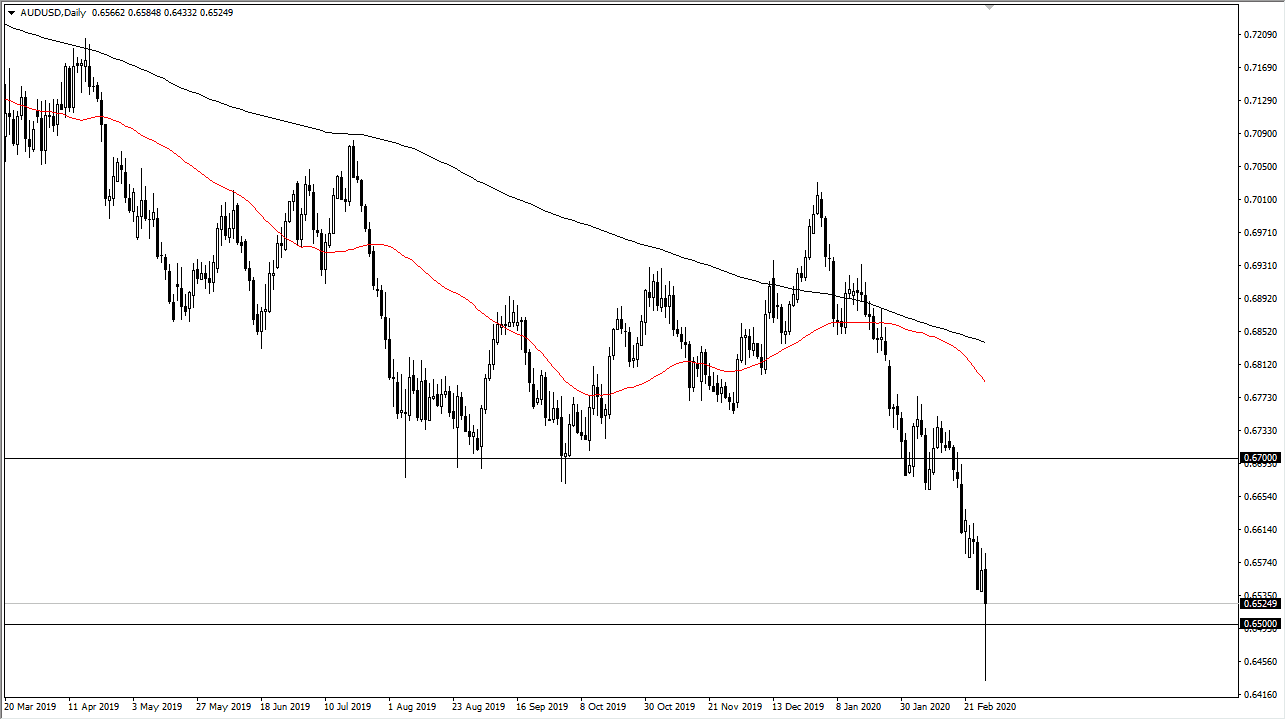

The Australian dollar has broken down during the trading session on Friday, slicing through the 0.65 handle initially before bouncing significantly after Jerome Powell suggested that the Federal Reserve was looking to do whatever it could to help protect the markets. At this point, the candlestick looks very much like a hammer, but it is a huge range, and it shows that we either had a bit of a blowout, or perhaps this just has been yet another erratic candlestick. If the market can break above the highs of the day, the 0.66 level will offer resistance. Above there, the market than likely goes towards the 0.67 handle. Any sign of a bounce towards that overall region should find plenty of sellers, and therefore I’d be more than willing to short this market on signs of exhaustion.

Keep in mind that the Australian dollar is highly sensitive to the Chinese economy, which of course is being punished for being the Ground Zero area of the coronavirus. The demand for copper and aluminum, as well as iron will continue to drop as long as China is not at work. Remember, the Australian economy is one of the biggest suppliers of raw materials for the Chinese economic engine, so the two economies are interconnected. In other words, the Australian dollar is a way to play the bullishness or bearishness of the Chinese economy on the whole.

If the market was to break down below the bottom of the candlestick, then the market could go down to the 0.63 level, which is the bottom of the financial crisis consolidation area. That being said though, I think that we are more than likely going to see some type of bounce heading into the week, but I think that only offers the US dollar “on the cheap.” The pair has been in a downtrend for quite some time, and until the situation in China gets markedly better, it’s difficult to imagine a scenario where the Australian dollar can rally for a significant and longer-term structural move. That being said, I do believe that by the end of the year the Australian dollar could be one of the bargains in the Forex world, and it could kick off a “buy-and-hold” type of scenario. We obviously aren’t there yet so I would be very patient before trying something like that. Short-term rallies will continue to attract sellers at the first signs of trouble.