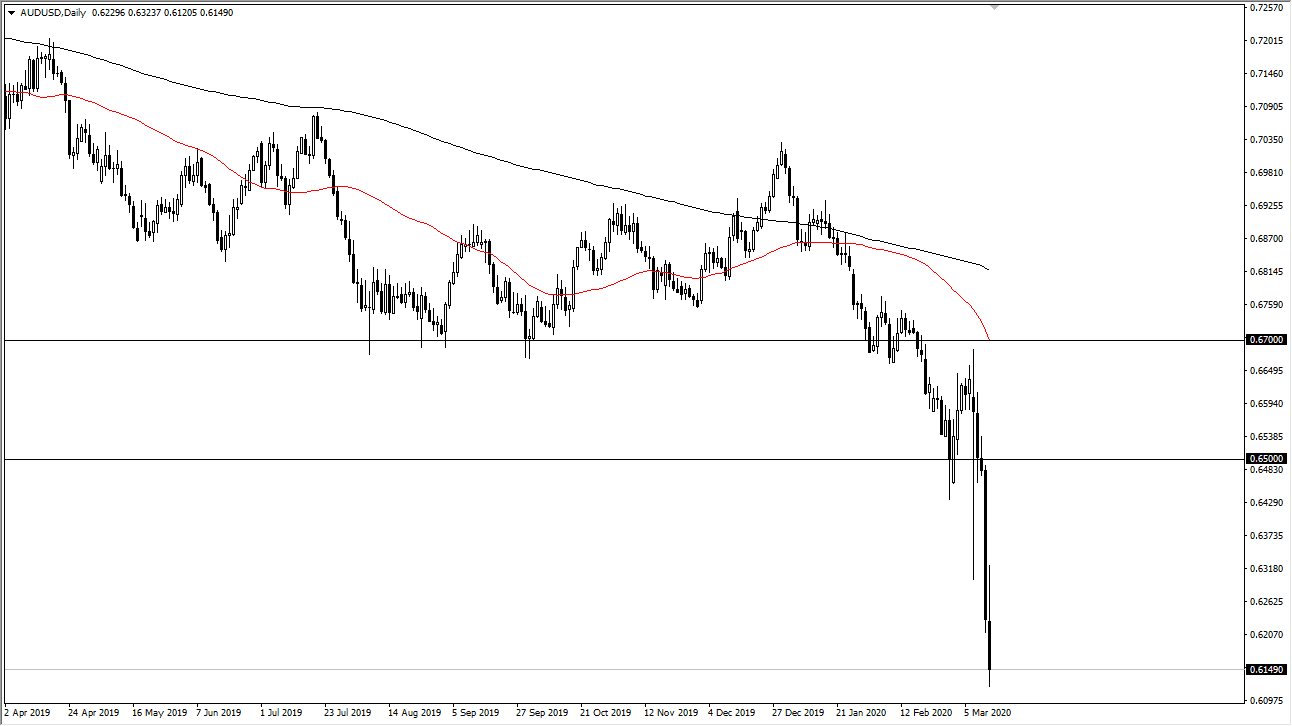

The Australian dollar has completely collapsed during trading on Friday, after initially trying to recover some of the losses. At this point, we are getting ready to test the bottom of the financial crisis situation, which is a major milestone in this pair. That is between the 0.63 level and the 0.60 level underneath, and it certainly looks as if we are going to try to get down there. In the meantime, we are completely oversold and it’s likely that we will continue to see rallies to be looked at with suspicion.

The candlestick for the Thursday session was extraordinary, so it’s likely that regardless of any rally that we see we will probably get sellers coming in to take advantage of what is an obvious trend. Quite frankly, I don’t have a scenario in which a willing to buy the Australian dollar quite yet, but certainly this will be the type of trade that could make a career once we get a longer-term “buy-and-hold” signal. We are probably several weeks from there, but that’s going to be the real trade: buying the Australian dollar when it offers an opportunity to do so. That being said, we will need to see some type of good news involving global trade in order for the Aussie to hang on to gains for the longer-term move. Keep an eye on China as well, because it is starting to show signs of stabilization but it’s customers are now the problem.

We are probably quite some time from seeing this market make a complete turnaround, but this is going to be one of those scenarios where you will look back and go “that was it” when we do turnaround. In the short term though I believe that fading rallies will continue to work, but obviously we need to bounce a bit before the risk to reward ratio makes sense. I believe the 0.63 level will probably feature some resistance, just as the 0.60 level underneath should figure out a certain amount of support for the Aussie. All of that being said, expect a gap on Monday, because quite frankly there are so many elements that could jump into the market psyche at this point that it’s almost impossible to imagine a scenario where we simply go into next week at the same level. The gap should give you a hint as to where we go in the short term.