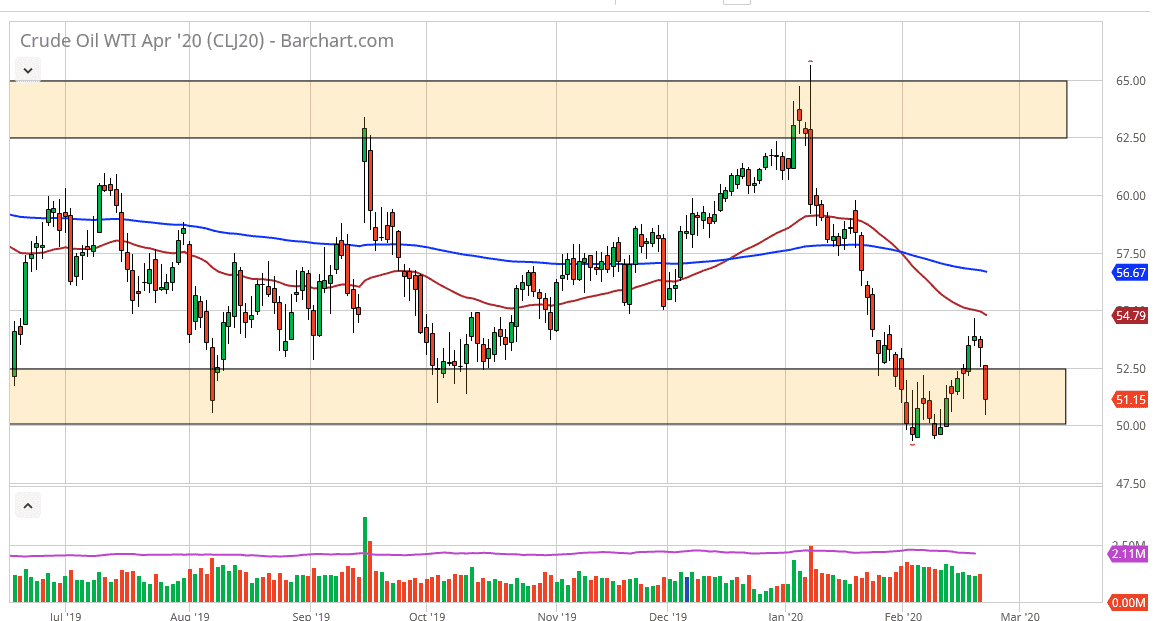

The West Texas Intermediate Crude Oil market gapped lower to kick off the trading session on Monday, breaking down below the $52.50 level almost immediately. The market breaking down below there has traders looking towards the $50 level underneath, which is an area that they did try to get to. Ultimately, they are still focusing on the coronavirus and the fact that we are starting to see more cases outside of China suggests that we are going to see even less demand for crude oil. That being said, there did seem to be some profit-taking closer to the $50 level, so perhaps we stabilize a bit and go sideways. That is a possibility, but the gap will probably offer some type of resistance as it typically does.

Breaking down below the $49 level would be a sign that we are going to go much lower, perhaps reaching down to the $45 level. Beyond that, we could be looking at the $40 level. At this point, the market shows no signs of real strength, and quite frankly most of those “gains” were late in the day as day traders took significant profits. It’s likely that market participants will continue to monitor the number of infections in places like South Korea and Italy to determine whether or not this market goes lower. One thing that I can say though, although we are sitting just above a major support level, you can also start to envision the fact that the market has made a massive bearish flag. If that’s the case, it suggests that the market could go as low as $35! I’m not calling for that right now, but needless to say it is something to think about.

The US dollar has been strengthening in general, so that of course works against the value of crude oil as well. If the infection rate of coronavirus continues to accelerate in other countries around the world, this will almost certainly drive down demand for what is already in oversupplied market. As far as buying is concerned, the market needs to break above the 50 day EMA, which is the $55 level. If that happens, then I will reevaluate the situation, but I have a hard time believing that that is going to happen in the short term. Fading rallies continues to work in my estimation.