The persistence of fears regarding the spread of the Corona virus, and its negative impact on the future of global economic growth, will remain a strong supporter for the USD/JPY losses, and for the second day in a row, the pair has settled down around the 108.30 support level, the lowest in nearly a month. The latest updates on the Corona virus increased the number of "severe cases" from 917 on January 27 to 2,110 while the number of declared deaths rose from 106 to more than 300 cases, and there are now 19,444 suspected cases, up from 6,973. Global markets will interact with the return of the Chinese stock markets after a long Lunar New Year holiday. Experts believe that if the Chinese stock indices drop between 6% and 10%, it could lead to a further fall in the rest of the other global stock markets.

Because of the long holiday or quarantine period, some companies and families may face severe cash shortages from banks, which may require a joint response from the government and the central bank. At the same time, exchange rate volatility can increase if trading volumes decrease due to the uncertainty about the spread of the Coruna virus and its overall effects. Therefore, the PBOC decided at the end of the week that it would pump 1.2 trillion yuan, 173 billion US dollars of cash into the financial system through reverse repurchases in an attempt to reduce any "liquidity" or shortage of cash.

This week, the US dollar will remain on hold until the important US job figures are released. The results of the official report for January will be released at 13:30 next Friday. The markets expect the economy to add 160 thousand new jobs in the non-agricultural sector last month and wage growth per hour to be at 0.3% on a monthly basis, and the spread of the Corona virus will continue to be the most influential, as well as monitoring Chinese efforts to contain it and investor perceptions about the potential effects on economies and markets around the world.

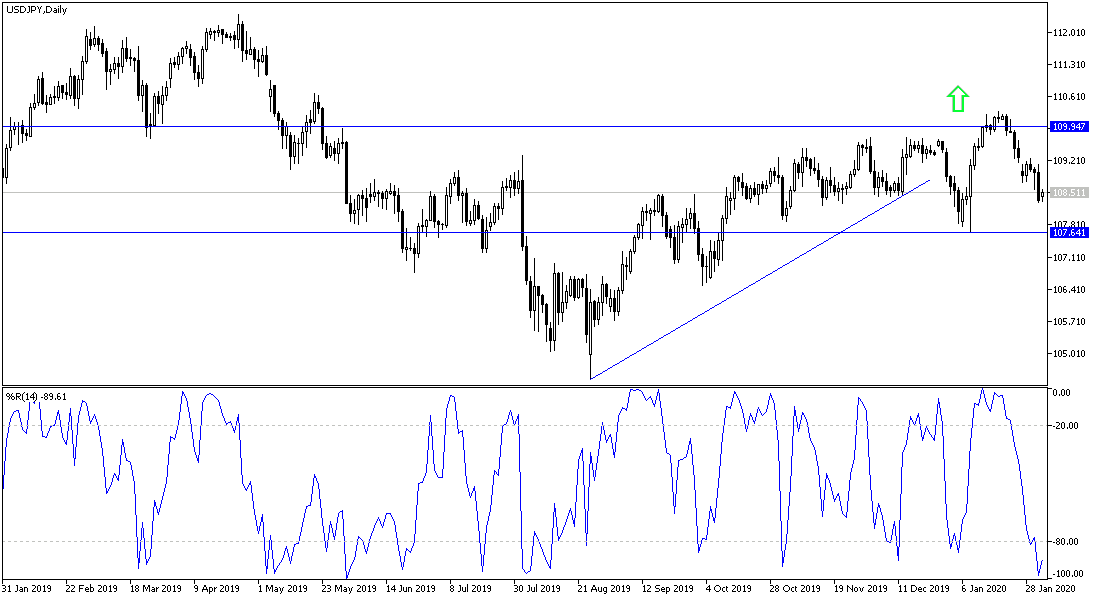

According to the technical analysis of the Pair: On the daily chart, the price of the USD/JPY is still moving inside a descending channel that is supported by the move around and below the 108.00 psychological support. The continuing concern of Corona Virus will continue to support more gains for the Japanese yen, although the US dollar is also a safe haven, however, the demand for the yen is stronger on the part of investors, as the Japanese currency has a negative interest. There will be no return to the upside and a reversal of the current situation without moving above the 110.00 psychological resistance. Technical indicators give signals of oversold, but Corona fears will support the downside for a longer period.

As for the economic calendar data: The pair will focus on the announcement of the US ISM Manufacturing PMI data.