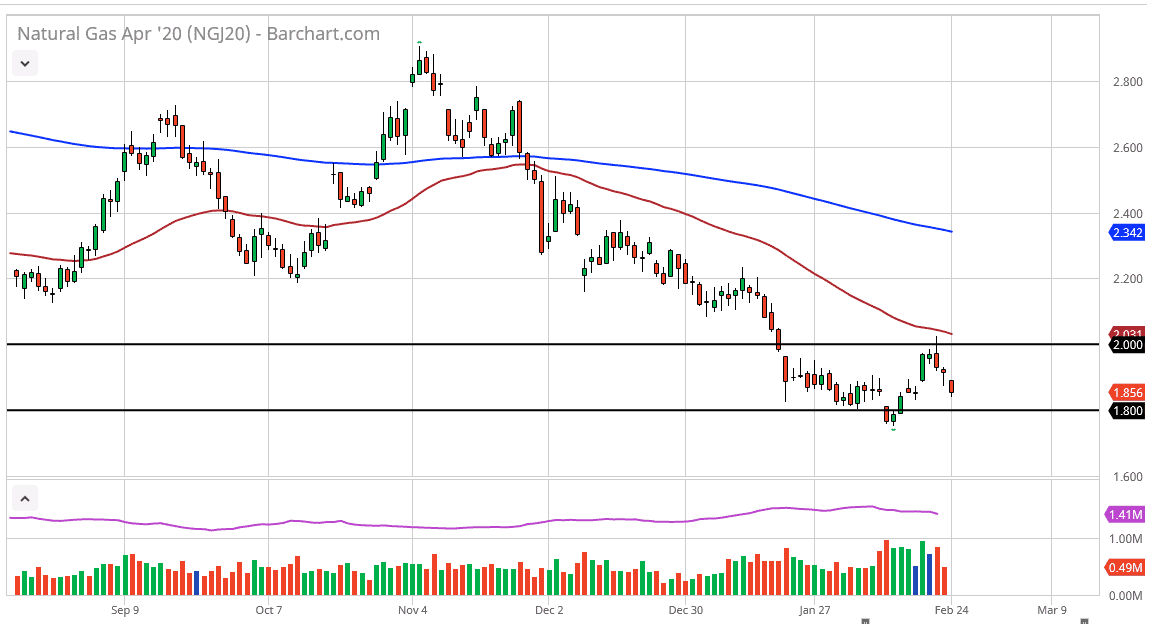

Natural gas markets fell again during the day on Monday, initially gapping lower, turning around to rally a bit, and then breaking back down. Ultimately, the market looks as if it is going to go looking towards the $1.80 level, which has been supported in past sessions. If we do break down below that level, then it’s likely that the market goes looking towards the $1.60 level after that. At this point, any rally should be looked at with suspicion as we still have an overabundance of supply and it’s very likely that we will continue to see selling due to the fact that the oversupply of natural gas is far too large to chew through. Ultimately, this is a market that will continue to find sellers on rallies, and quite frankly is probably the only way that you can trade this market.

The 50 day EMA above is going to continue to cause resistance, as it has shown itself to be dynamic resistance. The EMA is sitting right at the $2.00 level, so that of course will attract a certain amount of attention anyway. Any time this market rallies, you should be looking for an opportunity to short it at the first signs of exhaustion. If we were to break above the $2.00 level, then it’s likely that the market will go looking towards the two point to zero dollars level after that. Looking at this trend, it is very strong as it shows no real attempts at rallying lately, and of course we are starting to get warmer temperatures in the United States and Europe, so at this point the source of demand remains a mystery.

In fact, it’s not until we get a slew of bankruptcies in the United States when it comes to suppliers and drillers of natural gas that we can start to see an attempt to have the market turn around. Quite frankly, that is more of a story for later this year, not right now. As soon as we start to get larger companies go under though, then natural gas will probably start to rally, anticipating the inventory being worked through. There’s no way to buy this market, so therefore simply selling it when it gets too expensive is the only way going forward. The 1.60 level could be the target longer-term, mainly because it is an important historic low.