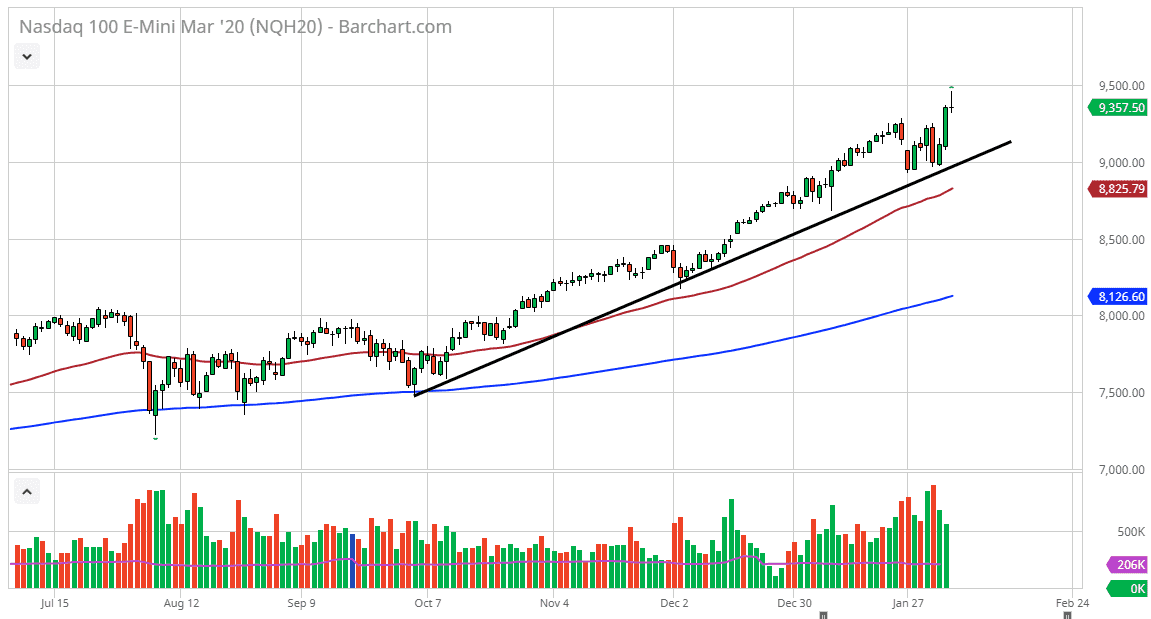

The NASDAQ 100 rallied initially during the trading session on Wednesday but found the area just below the 9500 level to be far too expensive to continue going higher. As a result, the with the candlestick ended up forming a shooting star which is a very negative sign. However, we are still very much in an uptrend so if the market was the pullback at this point, it should be thought of more or less as a simple pullback, not some type of ominous sign. After all, the 9500 level would attract a lot of attention and we just had a couple of explosive trading sessions in the NASDAQ 100.

Let us not forget that Tesla has completely skewed the numbers anyway, which of course has been out of control. In fact, Tesla lost 17% during the trading session, after gaining almost 40% over the last few days. All things being equal, the type of volatility cannot help but cause chaos with the index so I would not read too much into the candlestick other than perhaps it’s possible that it’s time for a pullback.

Looking at the chart, there is a clear uptrend line underneath it should offer plenty of support, so if we did get a pullback it should be thought of as a buying opportunity. That buying opportunity could present itself going into the jobs number on Friday, which is also likely to cause a lot of noise in the markets in general. Just below the uptrend line, you have the 9000 level which causes a certain amount of psychological support, as well as the 50 day EMA rallying simultaneously. If that’s going to be the case, then it’s very likely that we should continue to see plenty of buyers underneath.

The alternate scenario of course is that we simply break through the top of the shooting star which would in kick off an impulsive move, which could send this market much higher. Longer-term I believe that this market goes looking towards the 10,000 level but we probably have quite a few pullbacks between now and then. With that being the case, and the fact that central banks around the world continue to liquefy markets, I believe that buying dips should be the only thing you’re looking at in this market until the fundamental situation changes completely, and right now it does not look like it’s going to happen anytime soon.