While the long-term prospects for Litecoin remain bullish, a short-term corrective phase is shaping up. The impressive rally in January is now prone to a profit-taking sell-off after the LTC/USD pushed below its resistance zone. This cryptocurrency pair rallied roughly 90% since the beginning of 2020, as bullish sentiment across the entire sector accelerated. A turbulent start with the tension between the US and Iran, followed by the spread of the deadly coronavirus, kept demand for cryptocurrencies elevated.

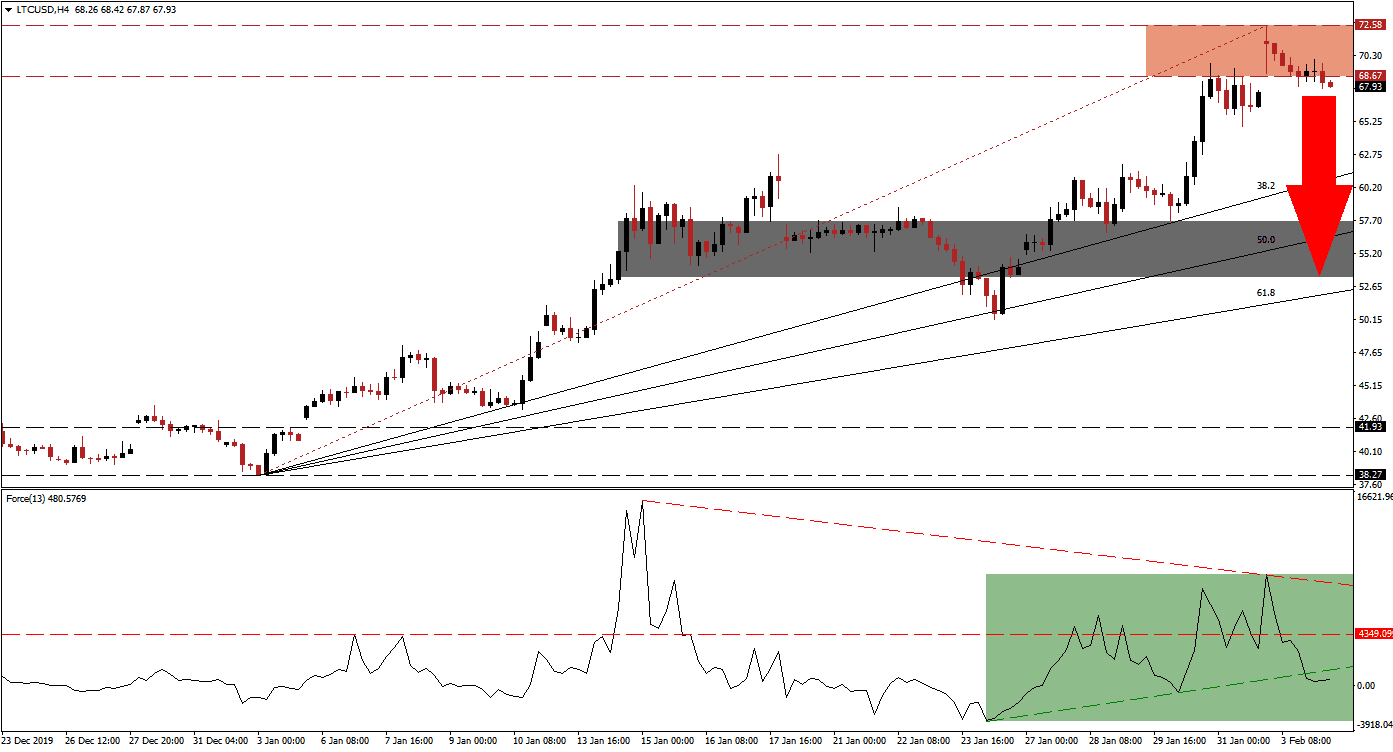

The Force Index, a next-generation technical indicator, failed to confirm the higher high in price action, resulting in the formation of a negative divergence. It provided traders an early warning sign that the advance is vulnerable to a partial reversal. The Force Index was pressured lower by its descending resistance level, leading to a converted horizontal resistance level. This technical indicator also moved below its ascending support level, as marked by the green rectangle, which now acts as temporary resistance. A pending crossover below the 0 center-line will place bears in control of the LTC/USD. You can learn more about the Force Index here.

A minor price gap to the upside was closed following the breakdown in this cryptocurrency pair below its resistance zone located between 68.67 and 72.58, as marked by the red rectangle. The LTC/USD is now expected to descend until it can challenge its ascending 38.2 Fibonacci Retracement Fan Support Level. One critical level to monitor is the intra-day low of 64.88, the low before price action spiked to a higher high. A breakdown is anticipated to result in the addition of new net short positions, adding fuel to the corrective phase. You can learn more about the Fibonacci Retracement Fan here.

This cryptocurrency pair is positioned to correct into its next short-term support zone located between 53.35 and 57.67, as marked by the grey rectangle. The 50.0 Fibonacci Retracement Fan Support Level is passing through this zone, with the 61.8 Fibonacci Retracement Fan Support Level approaching the bottom range of it. One price gap to the downside and one to the upside are also included, adding significance to it. While a further breakdown in the LTC/USD cannot be ruled out, a fresh fundamental catalyst will need to emerge.

LTC/USD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 67.50

Take Profit @ 53.50

Stop Loss @ 71.00

Downside Potential: 1,400 pips

Upside Risk: 350 pips

Risk/Reward Ratio: 4.00

In case of a breakout in the Force Index above its descending resistance level, the LTC/USD is favored to follow suit. The fundamental outlook for this cryptocurrency pair remains increasingly bullish long-term, any short-term disruption should be considered a great buying opportunity, and expected to keep the bullish trend intact. A breakout will take price action into its next resistance zone, located between 79.79 and 86.02.

LTC/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 73.50

Take Profit @ 86.00

Stop Loss @ 68.50

Upside Potential: 1,250 pips

Downside Risk: 500 pips

Risk/Reward Ratio: 2.50