UK Prime Minister Johnson left the door open for a hard Brexit, as the transition period started. Intense negotiations are expected over the next eleven months between the EU and the UK, with some noting that plenty of bad blood remains. The EU is now scrambling to fill the budget hole left by Brexit, while PM Johnson’s comments resulted in a violent sell-off in the British Pound. Forex traders overreacted by pushing the GBP/USD into the top range of its support zone. With the bullish momentum build-up, a price action reversal may follow. You can learn more about a support zone here.

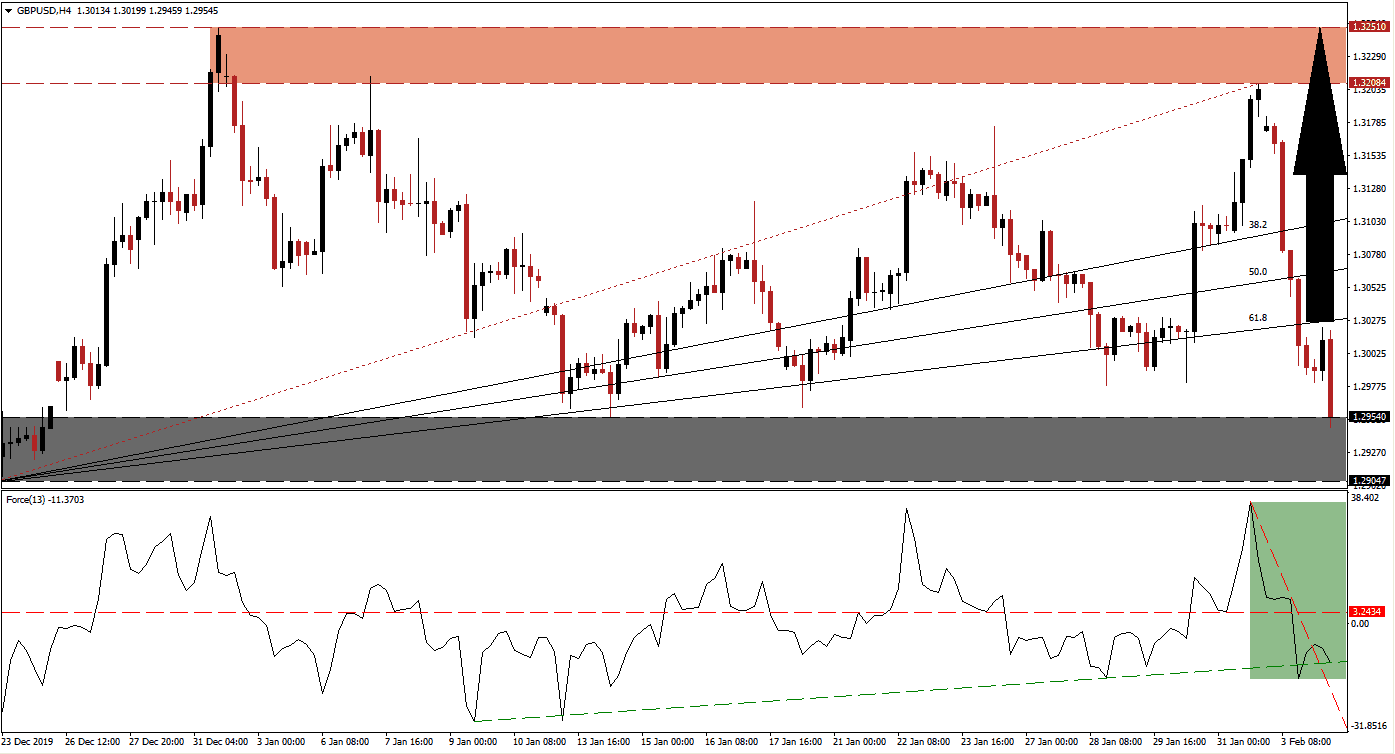

The Force Index, a next-generation technical indicator, retreated from a higher high and plunged below its horizontal support level, converting it into resistance, as marked by the green rectangle. A brief dip below its ascending support level allowed the Force Index to recover. This additionally led to a breakout above its steep descending resistance level. As bullish momentum is building, a move above the 0 center-line is anticipated to preceded an advance in the GBP/USD.

Volatility is favored to remain elevated, but wild price swings in this currency pair are unlikely after the Bank of England made its monetary policy dependent on economic data. A string of reports pointed to a sound recovery in the UK, which is expected to gain steam. With the GBP/USD entering its support zone located between 1.29047 and 1.29540, as marked by the grey rectangle, an end to the corrective phase is imminent. Given the extent of the sell-off, a short-covering rally is likely to initiate a reversal.

A retracement of the breakdown in this currency pair below its ascending 61.8 Fibonacci Retracement Fan Resistance Level is favored to add to upside pressure in the GBP/USD. Before the correction, a bullish chart pattern emerged through a series of higher highs and higher lows. While this trend has been broken with today’s price action, it can be re-established with a higher high inside of its resistance zone. This zone is located between 1.32084 and 1.32510, as marked by the red rectangle. A breakout is possible but requires a fresh fundamental catalyst

GBP/USD Technical Trading Set-Up - Price-Action Reversal Scenario

Long Entry @ 1.29600

Take Profit @ 1.32500

Stop Loss @ 1.28900

Upside Potential: 290 pips

Downside Risk: 70 pips

Risk/Reward Ratio: 4.14

Should the Force Index complete a breakdown below its ascending support level, sliding deeper into negative territory, the GBP/USD may attempt a breakdown of its own. Due to the long-term bullish outlook for the British economy, with a data-dependent central bank, any move to the downside should be considered an excellent buying opportunity. The next support zone is located between 1.27639 and 1.27940.

GBP/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.28600

Take Profit @ 1.27850

Stop Loss @ 1.28900

Downside Potential: 75 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.50