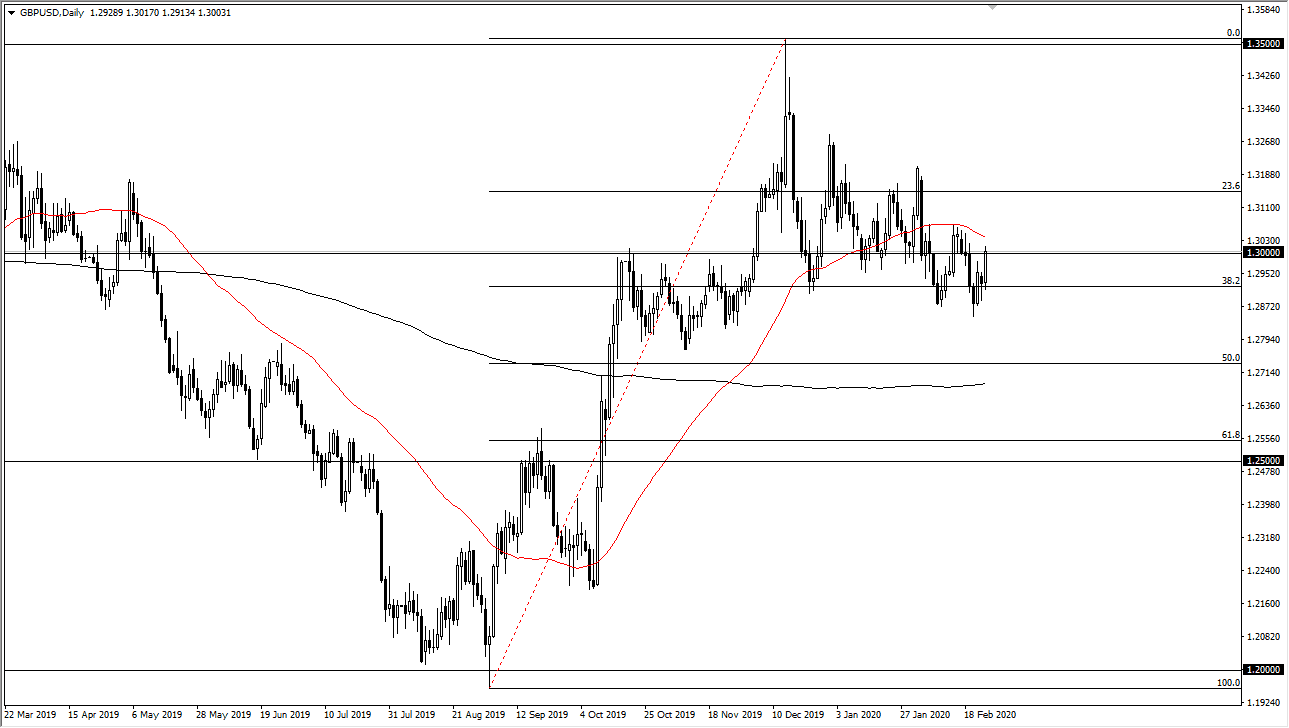

The 1.30 level is of course a large, round, psychologically significant figure that a lot of traders will pay attention to. As the British pound is slamming into it during the trading session, it looks as if we are going to try to break out to the upside, with the 50 day EMA sitting just above. That is a very important level, so at this point in time it’s very likely that the market will pay attention to that. The US dollar did get crushed during the trading session, but it should be noted that there are a lot of headwinds facing Great Britain as well.

I do think that historically the British pound is a bit cheap and I do think that it is only a matter of time before we rally. However, we need to get above that 50 day EMA to get a real push to the upside as it would essentially form a short-term “W pattern” that traders will bank on.

To the downside, the 1.2850 level should offer significant support, so if we were to break down below there the market would have to take notice and would probably go looking towards the 200 day EMA underneath. I believe at this point the market is likely to chop around in both directions, so therefore it’s very difficult to get excited in one direction or the other. Longer-term though, this is a market that will find some type of reason to move, but right now I think the coronavirus headlines continue to cause quite a bit of noise out there that is difficult to get around. I think ultimately the market will go higher, but this is probably a longer-term story because it looks like we are trying to form a bit of base, and that of course takes quite a bit of time to happen. Expect a lot of noise but perhaps there is value to be found closer to the 1.2950 level in the short term? I have no interest in shorting this pair, at least not until we break down to a fresh, new low again, and we would need to see something very England specific for me to start selling at this point. That would probably have something to do with the virus hitting the UK, or nonsense coming out of the UK/EU trade negotiations or headlines. Don’t get me wrong, that’s always a threat.