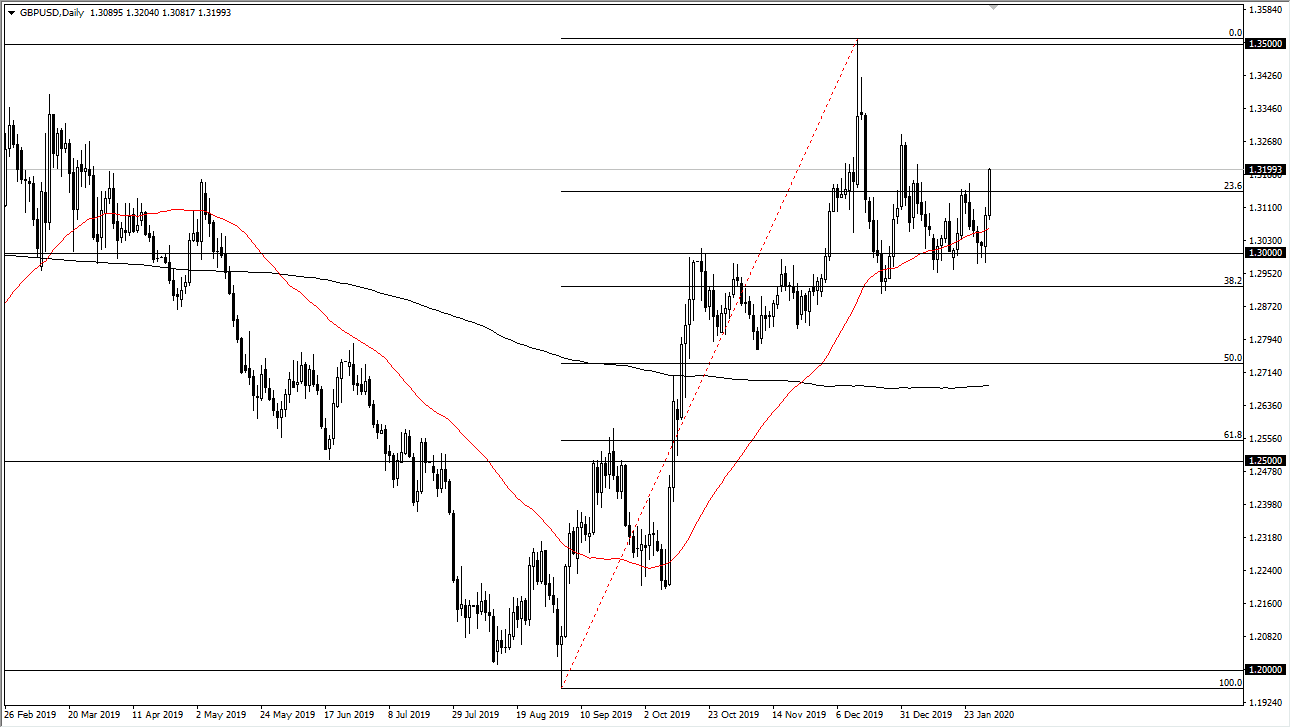

The British pound went much higher during the trading session on Friday in reaction to the Thursday session when the Bank of England decided not to cut rates. The British pound has rallied significantly since then, which is not a huge surprise considering that a lot of short covering would have happened on Thursday. Furthermore though, the British pound is now trading near the 1.32 level, an area that signifies a “higher high” from the recent pullbacks that we had seen. Now that the United Kingdom is out of the EU, it seems as if a lot of the drama is behind us. That being said, we still plenty of negotiations to go going forward.

That being said, to me it looks as if the market is deciding to break out to the upside so it’s very difficult to imagine a scenario where the British pound breaks down drastically, and at this point it’s likely that the market goes looking towards the 1.35 handle given enough time. At this point, pullback should continue to be supported closer to the 50 day EMA below, which is grinding higher as the overall trend is to the upside. The 1.30 level underneath is massive support due to the fact that it is psychologically important being a large, round whole number.

I don’t know that we can break above the 1.35 level, at least not in the short term. When you look at the daily chart you don’t recognize that there are several long wicks on the weekly candlesticks, but we did break through the first one. That being the case, it looks as if we are going to continue to grind higher, and the key here of course is the word “grind.”

I do believe that ultimately this is a market that will go back and forth with the latest headline, but it’s clear that the Bank of England holding rates set is much more bullish than whatever kind of pseudo-soft statement Jerome Powell had for the Federal Reserve. Ultimately, the uncertainty coming out of Washington DC will probably weigh upon the greenback when it comes to the British pound. That may not be the case in other currencies, but at this point it certainly looks as if the British pound has made it statement. Look for pullbacks as buying opportunities, and don’t bother shorting this pair until we get well below the 1.30 level.