The British pound has gone back and forth during the trading session on Thursday, as we continue to see a lot of confusion when it comes to the global markets. The coronavirus of course has been throwing the market around for some time, and as a result it has an effect on this pair as well. Ultimately, this is a market that has a multitude of various issues going on right now. The coronavirus obviously is one of them, but longer-term issues continue as far as the withdrawal of Great Britain from the European Union.

Ultimately, this is a market that has to worry about various issues, not the least of which was Boris Johnson stating that unless the UK gets a Canada style free-trade agreement from the EU, and unless there is some type of sign of that before June, he was willing to walk away from the negotiations. That obviously causes a lot of headaches for British pound traders, but at this point that’s probably a minor headline, believe it or not.

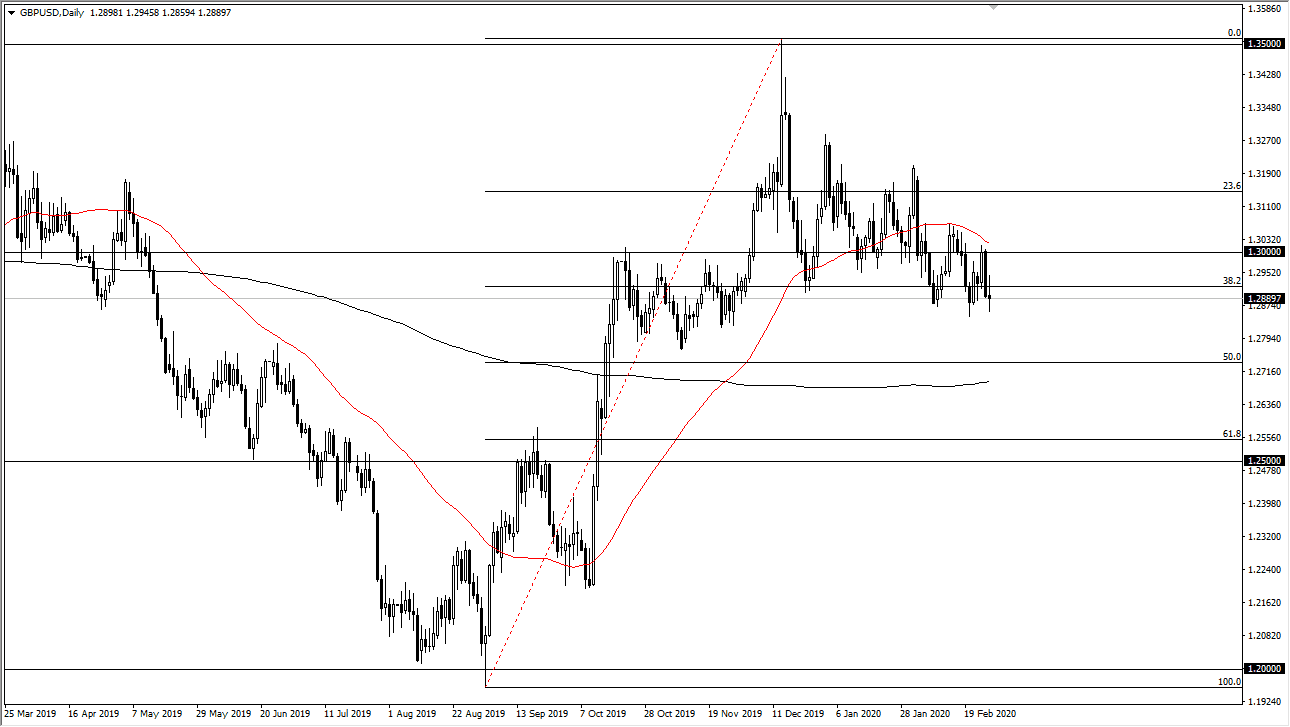

The 1.2850 level has been supportive more than once, so it’s not a huge surprise to see the market hang just above that level. The market is likely to go looking towards the 1.30 level above, which is a major resistance barrier. It’s a large, round, psychologically significant figure as well, so that of course comes into play as well. The 50 day EMA is just above there as well, so it obviously could cause some resistance. At this point though, it’s very likely that there is much more in the way of bullish pressure than bearish, but it should also be noted that the market breaking down below the 1.2850 level could open up the door to the 200 day EMA underneath, closer to the 1.27 handle. All things being equal, I believe that this market is trying to form of basing pattern over the longer term, but it is going to take some time to make that happen. I expect to see a lot of choppy and noisy trading, but I do prefer the upside more than anything else. In other words, I think that eventually this market will turn around and go looking towards the 1.35 handle above, which was the most recent high. Obviously though, we need some type of catalyst to kick that off to the upside and quite a bit of follow-through.