The British pound has fallen pretty hard after Boris Johnson suggested that he was willing to walk away from the European Union negotiations without a deal. This would have the UK and the EU dealing with each other through the WTO more than anything else, which leaves open the possibility of tariffs. That being said, we have seen enough drama over the last three years to suggest that perhaps that will never happen. The European Union won’t be able to play the same type of hardball that they were before the most recent election, as the United Kingdom has more of a unified government now. With that being the case, I fully anticipate that the United Kingdom should get some type of deal out of the European Union. After all, the European Union has just lost its second largest economy.

Furthermore, it’s very likely that the United Kingdom will get trade deals with other parts of the world, most notably the United States. This will almost certainly have a positive effect on the currency longer-term, and therefore I do believe that eventually the British pound goes higher. In the short term though, people are reacting to the latest headlines, which of course is very defiant coming out of London.

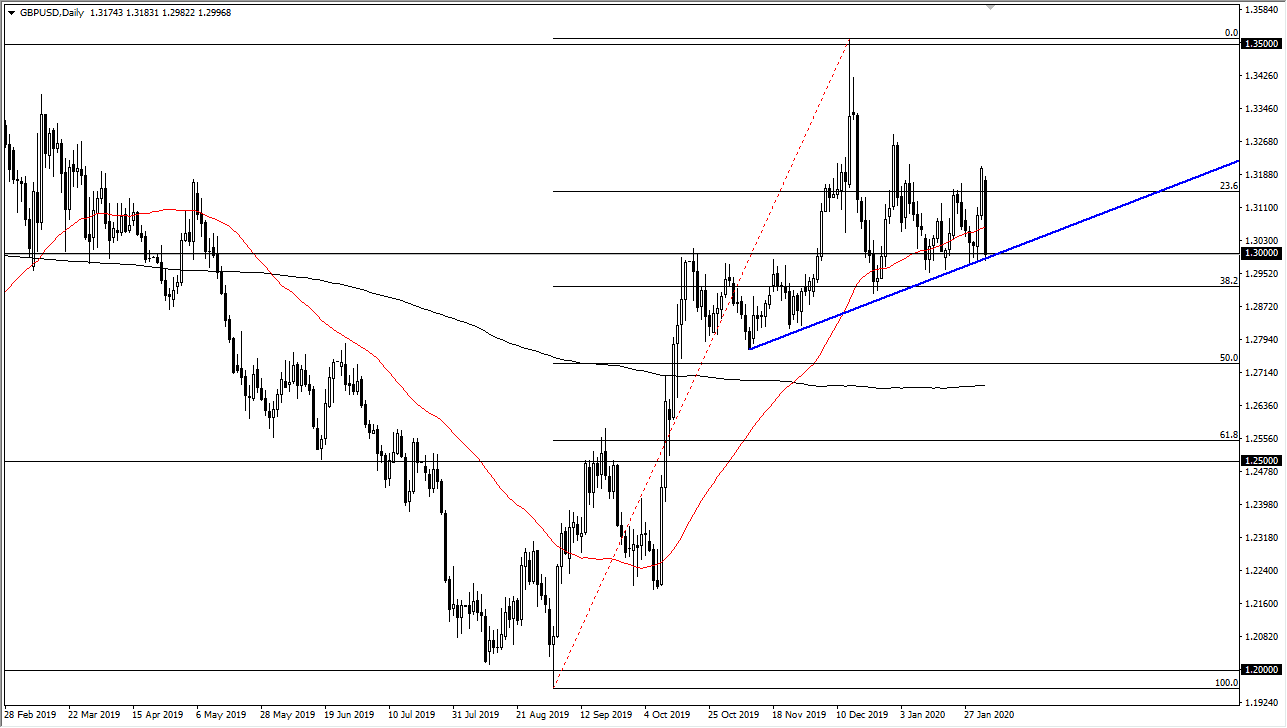

The 1.30 level of course attracts a lot of attention, as it is a large, round, psychologically significant figure and the scene of the uptrend line that I have marked on the chart. With that being the case, the market is very likely that we have had a certain amount of value hunting as we have recently made a “higher high”, which is the first sign of some type of break out. However, if we were to break down below the 1.2950 level it could open up the door down to the 1.28 handle.

On the other side of the equation we had the US dollar gained mainly due to the ISM Manufacturing PMI figures coming out much better than anticipated. This course shows that the US economy is likely to continue growing, and thereby the greenback should stiffen its resolve as a bit of an effect as well. All things being equal, the 50 day EMA is currently sitting right around where we are trading so that should attract a certain amount of attention as well. To the upside, I believe that the 1.32 level will be significant resistance that people will be paying attention to.