For two trading sessions in a row, the EUR/USD price attempted to correct higher, but gains did not exceed the 1.1095 resistance, then the correction returned lower, reaching the 1.1034 level in the beginning of this week’s trading. Global concerns due to the outbreak of the Corona virus support the strength of the US dollar as a safe haven, and at the same time, the return of skirmishes between the two sides of Brexit over future trade negotiations has negatively affected the Euro as well.

The Eurozone manufacturing PMI reading added to pressure on the pair, as the index rose to a reading of 47.9 from 46.3 in December. The expected reading was 47.8. The reading remained below the 50 level which separates growth from deflation for 12 months, but the latest result was the highest since April 2019.

It is the United States. Manufacturing activity witnessed unexpected growth for the first time in several months in January, as the ISM Manufacturing PMI increased to 50.9 in January after dropping to a revised 47.8 in December. Any reading of the index above the 50 level indicates a growth in manufacturing activity. Economists had expected the index to show a more modest increase at 48.5, which was still indicating a contraction.

With a much larger increase than expected, the index returned to the growth area for the first time since July 2019.

The latest updates on Corona, The talk of global financial markets, as the virus have killed more than 360 people and infected at least 17,238 people in China since late December - and the epidemic of the rapid spread of the virus could outpace SARS. There are 150 cases spread in about twenty countries around the world. Governments are tightening their procedures for traveling to China, airlines have suspended flights and Chinese citizens fear an escalation of xenophobia for their country.

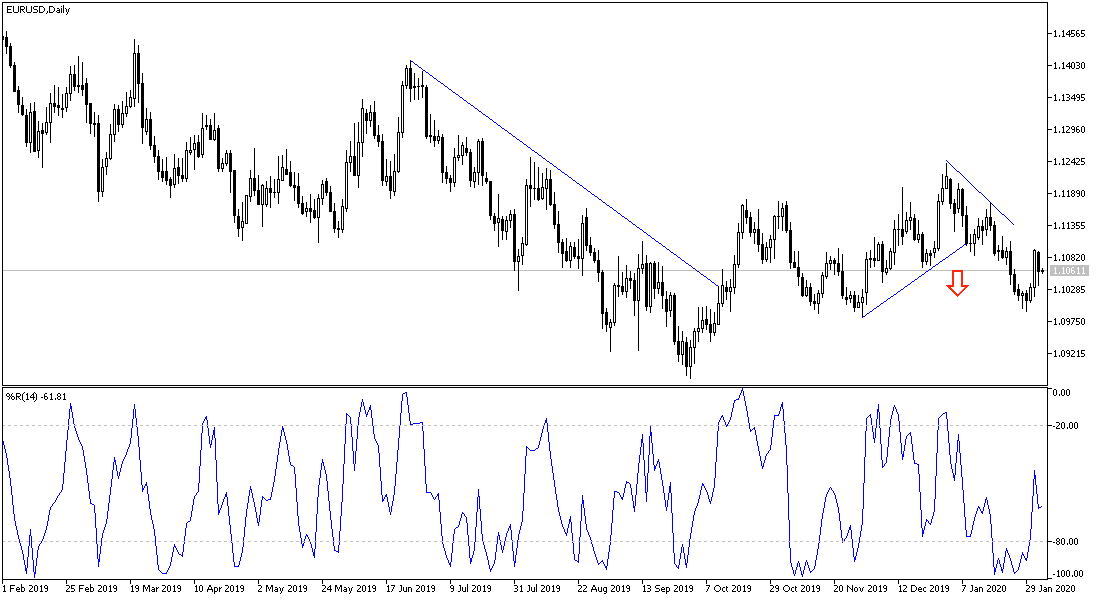

According to the technical analysis of the pair: Bulls still need more incentives to reverse the general trend of the EUR/USD pair, which is still bearish, and a shift may occur if the pair moves towards the 1.1200 psychological resistance. Otherwise, the biggest control of performance will remain with the bears, and their closest goals will remain support levels at 1.1010 and 1.0945 and 1.0880 respectively.

As for the economic calendar data: the Euro will react to the announcement of the rate of change in Spanish employment and the producer price index in the Eurozone. From the United States, factory orders will be announced.