With the Federal Reserve Governor Jerome Powell's expressing concerns about the continued outbreak of the Coronavirus and its impact on the US and global economies, the price of the EUR/USD pair found the opportunity to correct higher, but with a limited gain that did not exceed the 1.0925 level after losses in the same session yesterday to the 1.0891 support, the lowest level in four months. As usual, Powell expressed confidence that the American economy appeared to be solid, with continued growth and unemployment near the lowest levels in half a century.

Powell also said that the Federal Reserve is satisfied with current levels of interest rates, which confirms that it will not consider any further rate cuts unless economic conditions change significantly. Since last fall, the Federal Reserve has kept interest rates in a low range from 1.5% to 1.75%, well below the usual levels during previous economic growth periods.

Powell made his remarks yesterday before the House Financial Services Committee in the first of two days of a bi-annual testimony to Congress.

Powell added that the Federal Reserve monitors the developments caused by the outbreak of the Coronavirus, and warned that "it could lead to turmoil in China and extend to the rest of the global economy." In response to questions, Powell said it was too early to assess the extent of the threat the virus poses to the US economy. But he noted that the economy was "very well positioned", with strong job opportunities and a continued, albeit modest, rate of growth.

"We will watch it carefully," he said regarding the virus's impact. "The question we will ask is whether its effects will be continuous and could lead to a physical reassessment of expectations" in the United States.

Before Powell's remarks. The EUR/USD pair was also on a date with statements by European Central Bank Governor, Lagarde, in which she urged governments to participate more in supporting the weak Eurozone economy through targeted spending and business reforms. Lagarde said that "other areas of politics ... should play their part" in helping the economy. It warned that monetary policy "cannot and should not be the only influential player." Her comments to the European Parliament contributed to a discussion about the bank's low interest rates and bond purchases, which were criticized in Germany for its effect on savers and the potential role of asset inflation.

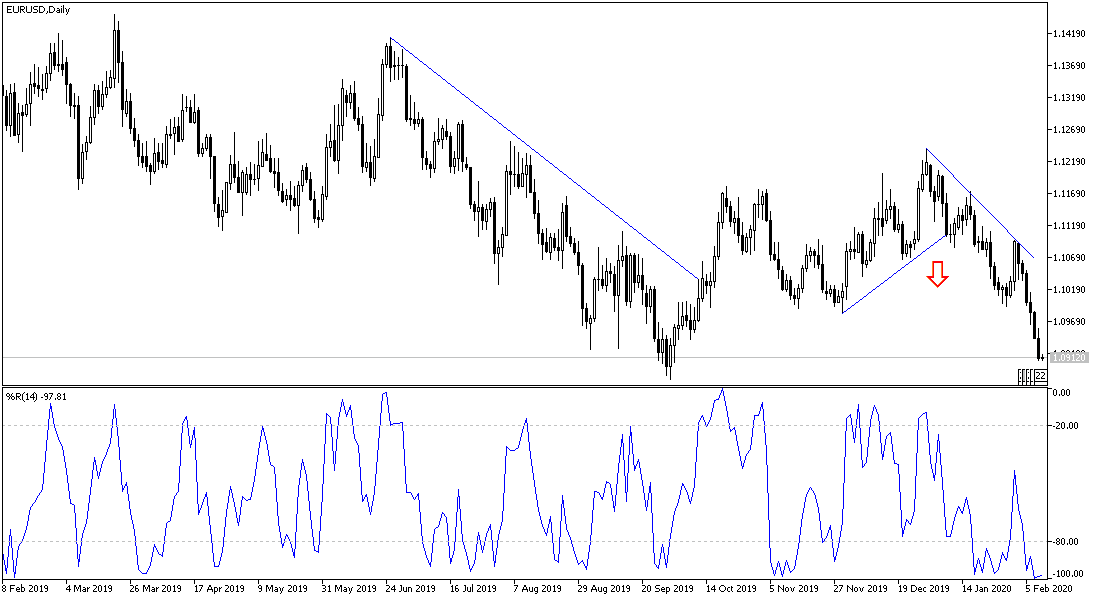

According to the technical analysis of the pair: attempts for an upward correction for the EUR/USD pair are still weak and the general trend is still down and invested pessimism about the European Central Bank policy, which did not provide anything new despite the poor economic performance of the Eurozone and the increased external and internal risks that contribute to further weakness. The bears are still in control of the performance despite the technical indicators reaching strong oversold areas, and their closest targets are currently the support levels at 1.0880 and 1.0800 respectively.

As for the economic calendar data: The Eurozone industrial production data will be announced. During the American session, we will have the second day of the testimony by the Governor of the US Central Bank, Powell, which is not expected to provide anything new from what was announced by yesterday's testimony.