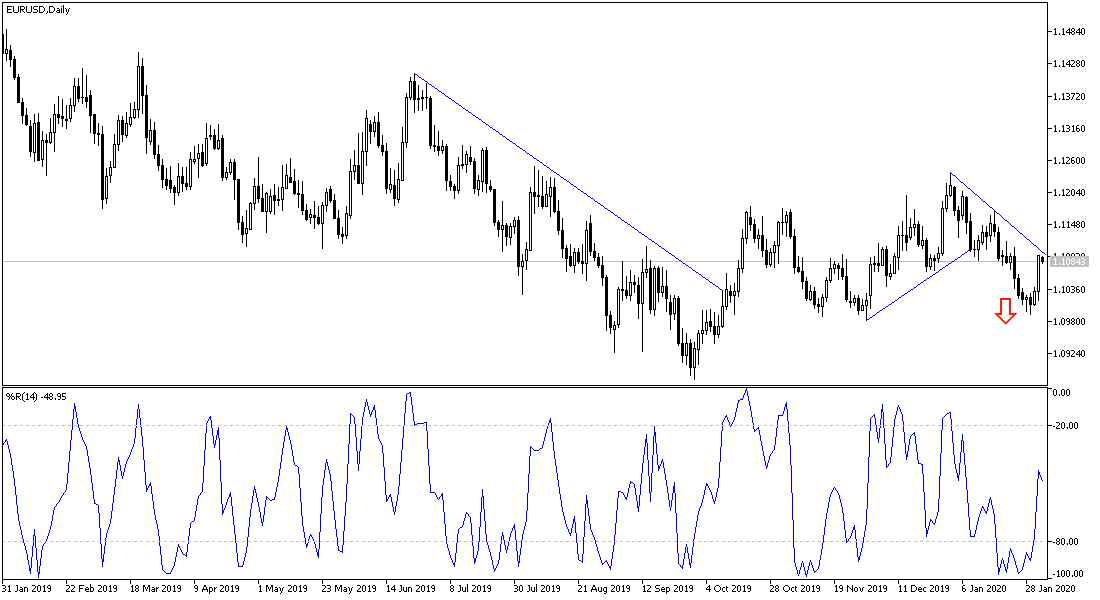

For the second consecutive dayو the price of the EUR/USD pair is trying to maintain its recent gainsو as the pair bounced from the 1.0992 support, the lowest level in more than two months, to the 1.1095 resistance, and since the beginning of trading this week the pair is stable around 1.1090 awaiting new incentives to complete the correction towards the top, or to get back in the path of his descending channel. The Euro rose sharply at the end of last week’s trading, amid a major collapse and a gap in emerging market currencies such as the South African Rand, which offset the losses from the negative news flow that emerged from the Eurozone recently.

Markets move cautiously with the developments of the Coronavirus, which has become a threat to the whole world, not only China. Despite the pair’s recent gains, the US dollar is one of the safe-haven currencies, so investors may return to buy it to hedge against risks of corona.

Increasing pressure on China prompted the People's Bank of China (PBOC) at the end of the week to announce that it would pump 1.2 trillion Yuan (130 billion pounds) of cash into the financial system through reverse purchases in an attempt to ease any "liquidity" or shortage of cash, however, this stimulus does not go beyond the financial sector.

For economic news. The Eurozone economy recorded its weakest growth in more than six years in the last quarter of 2019, as France and Italy contracted unexpectedly. Separate data showed that headline inflation accelerated further at the beginning of this year, while core price growth declined. According to the initial preliminary estimates released by the European Statistical Office (Eurostat), the GDP of the 19-nation bloc increased by only 0.1%, the slowest since early 2013. The quarterly growth was expected to slow marginally to 0.2% from 0.3% in the third quarter.

On an annual basis, economic growth fell to 1% from 1.2%. This was also 1.1 %weaker than economists expected.

According to the technical analysis of the pair: Despite the EUR/USD recent, on the long run, the pair is still moving in a bearish channel supported by the move around and below the 1.1000 support. As we mentioned before, we confirm now that there will not be a strong opportunity for the bulls to control the performance and start the bullish correction, strongly, without penetrating the 1.1200 psychological resistance, otherwise the decline will have the strongest chance.

As for the economic calendar data today: From the Eurozone, the Manufacturing PMI for the bloc will be announced. From the United States, the ISM Manufacturing PMI will be released.