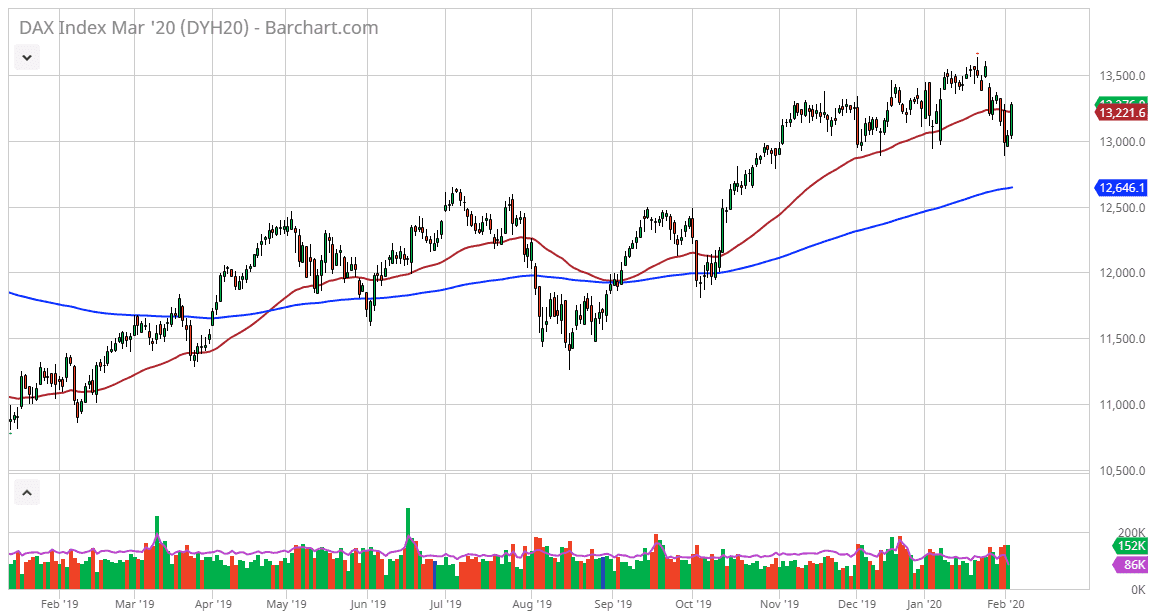

The German DAX futures reached as low as €13,000 over the last couple of days but have recovered quite nicely during trading on Tuesday. In fact, the market has recaptured the 50 day EMA, suggesting that perhaps the worst of the selling is over. This market has been very noisy as of late, as economic numbers out of the European Union have been a bit of a mixed bag, and as the DAX is considered to be the “blue-chip index” when it comes to the European Union, it is typically the first stock market on the continent to get hit with either buying or selling.

The €13,000 level of course has a certain amount of psychological importance built into it, as it is a large, round, psychologically significant figure. Furthermore though, we have seen several attempts to break below it turned around by the bullish traders, and at this point we are starting to form a widening pattern that shows that volatility is starting to pick up in this market. To the upside, the top of the pattern is at roughly €13,600 as we have seen the market rollover from there recently. That being said, it should be noted that we are starting to see the market try to make higher highs, so that is something worth paying attention to.

If we do in fact break out above the €13,600 level, one would have to think that the longer-term target is probably closer to €14,000. Pullbacks at this point should continue to find plenty of buyers at the €13,000 level, but even lower than that the 200 day EMA could come into the picture as it is currently at the €12,646 handle. As things stand right now, it looks like the market is waiting for the 200 day EMA to catch up, and then perhaps longer-term traders will come into start buying again.

It is worth noting that recently Christine Largarde suggested that the European Central Bank was going to keep monetary policy loose for an extended amount of time, and that should help boost demand for equities on the continent. If that’s the case, then the DAX will continue to attract quite a bit of flow as it is much “safer” than other indices in the EU such as the IBEX, MIB, or even CAC. However, keep in mind that this market breaks down below the 200 day EMA it will send the rest of the continent reeling.