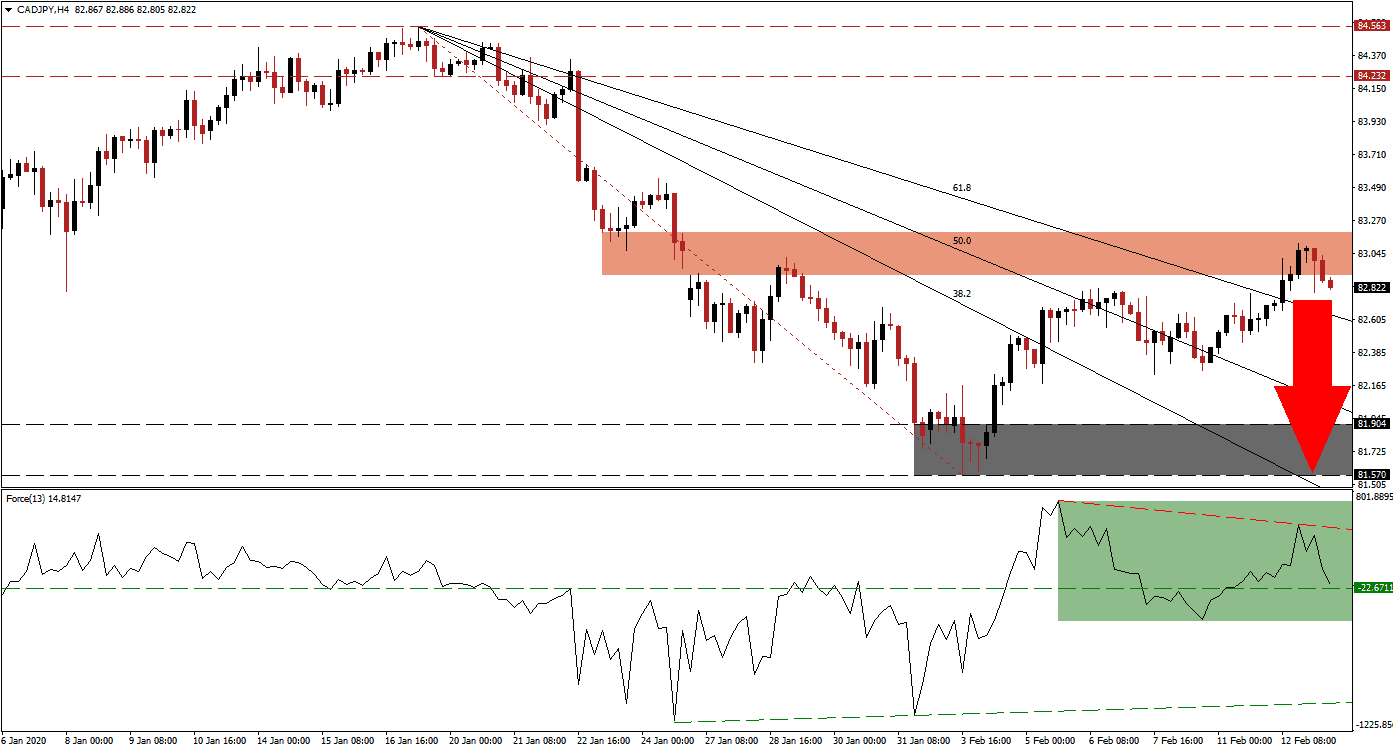

A surge in new cases of Covid-19 over the past twelve hours reminded financial markets that the threat to the fragile global economy is persistent. US equity markets recorded fresh all-time highs as investors opted to ignore a plethora of red flags. During the Asian trading session, safe-haven demand sparked, lifting the Japanese Yen. This resulted in a breakdown in the CAD/JPY below its short-term resistance zone. Bullish momentum is contracting, exposing this currency pair to more downside.

The Force Index, a next-generation technical indicator, provided the first sign that price action is vulnerable to a reversal. As the CAD/JPY extended its advance, the Force Index recorded a lower high. A negative divergence formed, and the descending resistance level is adding downside pressures, as marked by the green rectangle. A breakdown below its horizontal support level is expected to convert it into resistance. It will place this technical indicator into negative territory from where bears will take control of this currency pair, clearing the path into its shallow ascending support level.

A previous price gap to the downside was filled following the breakdown in the CAD/JPY below its resistance zone located between 82.899 and 83.189, as marked by the red rectangle. A profit-taking sell-off is now pending, which will take this currency pair below its descending 61.8 Fibonacci Retracement Fan Support Level, converting it into resistance. Forex traders are advised to monitor the intra-day low of 82.238, the low of a reversed correction, which led to the most recent push higher. A breakdown is favored to initiate another wave of net sell positions.

With the 38.2 Fibonacci Retracement Fan Support Level below its support zone, and the 50.0 Fibonacci Retracement Fan Support Level closing in on the top range of it, a more massive corrective phase cannot be ruled out. This zone is located between 81.570 and 81.904, as marked by the grey rectangle. Due to the safe-haven demand for the Japanese Yen and the negative impact of depressed oil prices on the Canadian Dollar, the CAD/JPY is positioned for a breakdown. The next support zone awaits this currency pair between 79.814 and 80.153. You can learn more about a breakdown here.

CAD/JPY Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 82.800

Take Profit @ 80.000

Stop Loss @ 83.400

Downside Potential: 280 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 4.67

Should the Force Index reverse above its descending resistance level, the CAD/JPY is anticipated to accelerate into its long-term resistance zone. Price action will reach this zone between 84.232 and 84.563. Fundamental developments out of Canada and Japan have been mixed with a bearish bias, favoring a correction in this currency pair. Any short-term price spike will represent a sound selling opportunity to Forex traders.

CAD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 83.600

Take Profit @ 84.500

Stop Loss @ 83.200

Upside Potential: 90 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 2.25