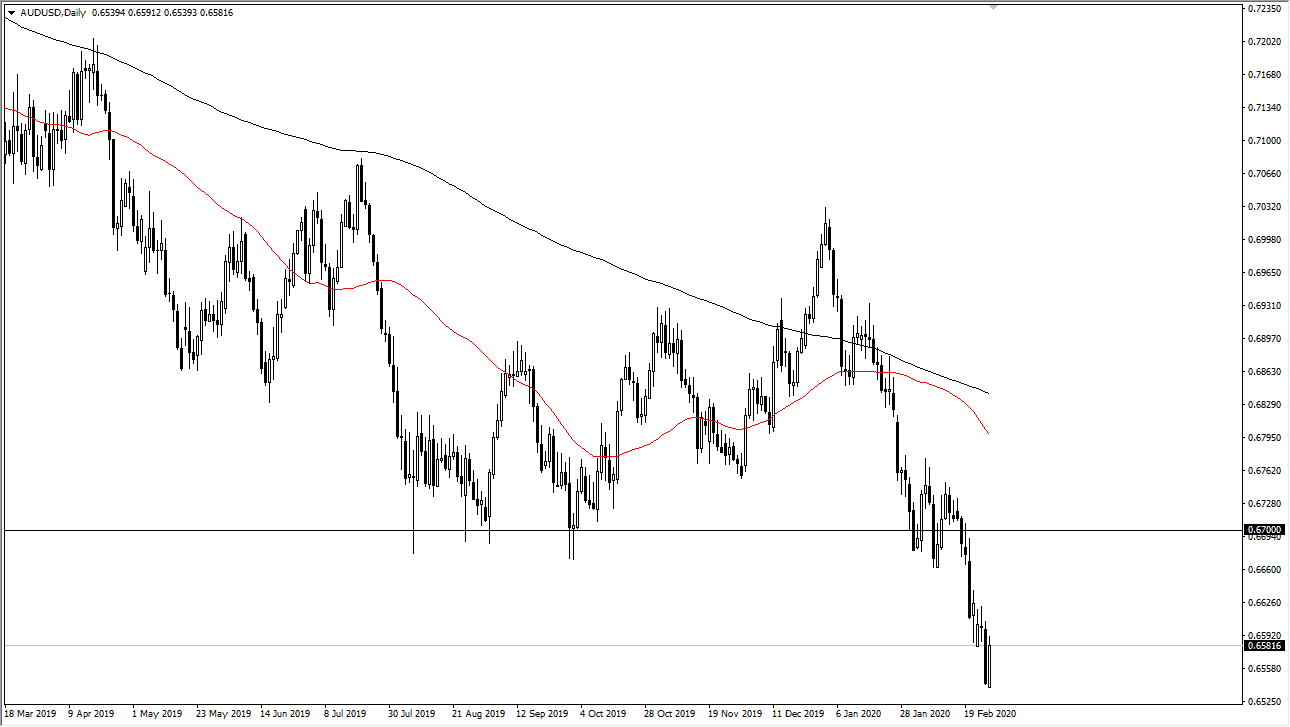

The Australian dollar has rallied significantly during the trading session on Thursday, but as you can see the rest of the world fell apart. This is more than likely going to be due to the fact that the US stock markets got absolutely crushed, and as a result the US dollar got sold off. That being said though, the Australian dollar has a huge list of problems ahead of it, and those problems will more than likely only continue going forward. Because of this, I think it’s only a matter of time before you an opportunity to start shorting this market again, especially at couple of levels coming up.

The 0.66 level shows a significant amount of resistance, based upon the most recent clustering, but I think there’s even more resistance closer to the 0.67 handle above where we had broken down from. That should continue to cause major issues and I think it will function as a bit of a short-term “ceiling” in the market. Any signs of exhaustion in that area I will be jumping on to start shorting, because Asia is still a bit of a mess. I think that there is a lot of negativity in this market that could push it down to the 0.63 level underneath, which was the bottom of consolidation during the financial crisis. Yes, I recognize that the Australian dollar is at extreme lows, but I truly think that things are starting to get that far out of hand.

If we break down below the 0.63 level over the next couple of weeks that will be extraordinarily destructive for the Aussie, but I think in the short term we are likely to see a little bit more of a push to the upside right before selling pressure begins. We are nowhere near any of the major moving averages, so even that isn’t coming into play at this point. We are most certainly in a downtrend, so you are wise to wait for selling opportunities instead of trying to get cute and by the Australian dollar down at these low levels. Because of this, a simple matter of patience will be needed but I anticipate that we should get a selling opportunity in the next day or two. Things are overextended, and I think this bounce is simply just a reaction to that massive amount of energy expended.