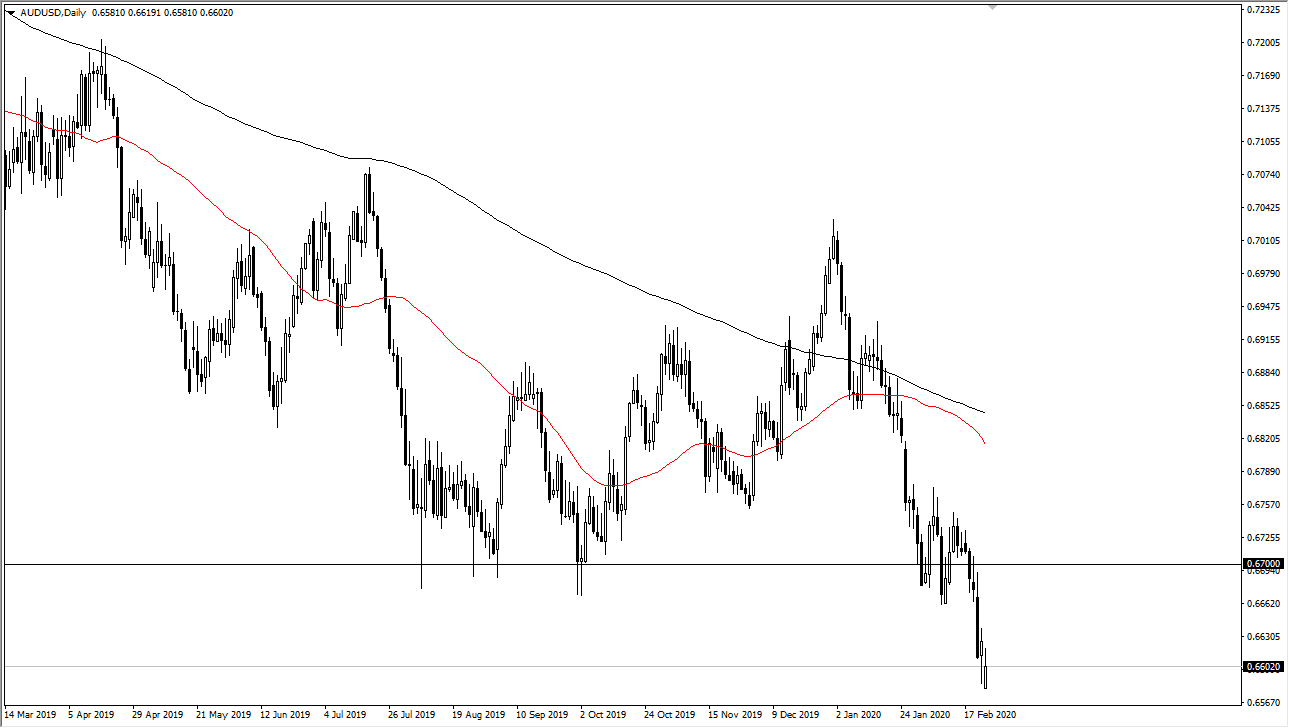

The Australian dollar gapped a bit lower during the open on Monday, but then turned around to fill the gap. By doing so, it shows signs of exhaustion before turning around and dropping again. Ultimately, this is a market that probably goes down to the 0.63 level, which is the lows that we had seen during the financial crisis. Keep in mind that the market had been a bit oversold, but at this point it’s only likely that the selling continues as the Australian dollar is so highly sensitive to the Chinese economy, which quite frankly doesn’t look like it’s going to take off anytime soon. Copper markets have been slaughtered, and that of course works against the value of the Australian dollar.

The US dollar should continue to find plenty of buyers, so this market will continue to struggle against it. To the downside, the 0.63 level was the bottom of the consolidation area during the financial crisis, and I think that could be where we are going over the longer term. That doesn’t mean that we get there overnight, but clearly this is a market that cannot hang on to gains. The 0.67 level seems to be a magnet for the market anyway, so having said that it’s likely that we would see quite a bit of resistance. At this point, the market needs to break above the 0.6775 level in order to go long, because it would show a significant break down of resistance. I don’t think that happens anytime soon though, and quite frankly I continue to look at pullbacks as an opportunity to pick up “cheap US dollars.”

If we did break out to the upside, I believe that point the market will probably go looking towards the 0.70 level eventually. That being said though, this is a very strong downtrend so I would be a bit surprised if that happens. I like fading rallies, because I think eventually the market will continue to reach lower levels. We are a long way away from massive global growth, and of course a calming of fears when it comes to the coronavirus. At this point, the Australian dollar is not a currency that I would be interested in owning, as it is not only sensitive to the Chinese economy, but it is used as a proxy for the Chinese Yuan as well.