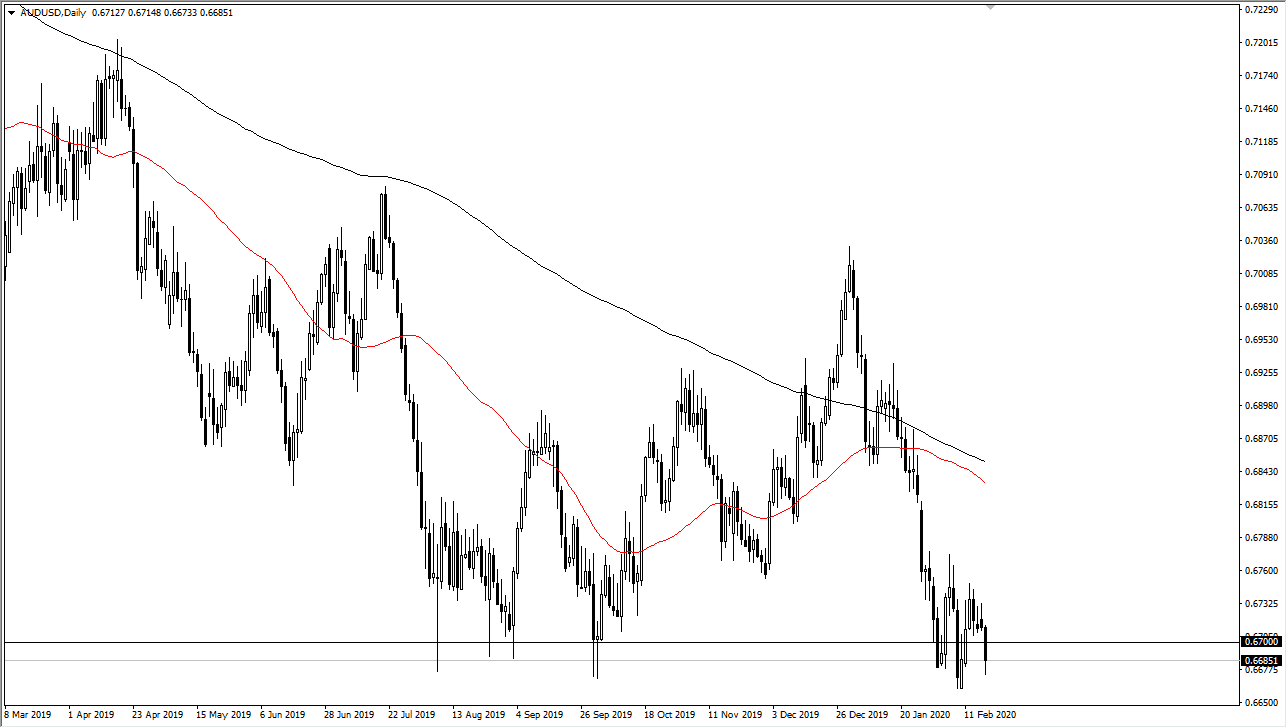

The Australian dollar broke down significantly during the trading session on Tuesday, slicing through the 0.67 level yet again. At this point, the market is trying to consolidate in this general vicinity, but this is a market that looks very sick. The Australian dollar is highly levered to the Chinese economy, and unless you’ve been living under a rock you know that the coronavirus continues to cause major issues. The slowing down of the Chinese economy could continue to work against the Aussie dollar going forward, but I would also point out that the area below the 0.67 level extends down to the 0.63 level with a lot of noise in the past. That noise of course is going to be very difficult to chew through, especially considering that it was during the financial crisis that noise had been made. In other words, we are at extreme lows when it comes to the Aussie.

Looking at this chart, it’s obvious to me that the 0.6775 level is major resistance, so if we can break above there then the market goes looking towards the 0.6875 level. Otherwise, I think that we will eventually grind lower, but it is possible that we will find some type of bottoming pattern underneath. With that being the case, it’s very likely that a longer-term signal may form, but I’m not willing to buy the Australian dollar until we break above the 0.6775 level on a daily close or get a bounce from a deeper level. I would look for something like a hammer on the weekly chart, that kind of thing. If China does in fact start to recover from the coronavirus slowdown, that should translate directly into the Australian dollar rallying. However, keep in mind that the Reserve Bank of Australia is possibly looking to cut rates as well, so that of course works against the value of the Aussie dollar going forward.

All things being equal, I believe that we will see a lot of noise and I think that short-term traders will continue to short this market after signs of exhaustion on shorter term time frames. Australia has been crushed when it comes to the Chinese issues not only with coronavirus but also the trade war tariffs, and as a result it continues to be one of the favorite ways for currency traders to express their concern about the global markets.