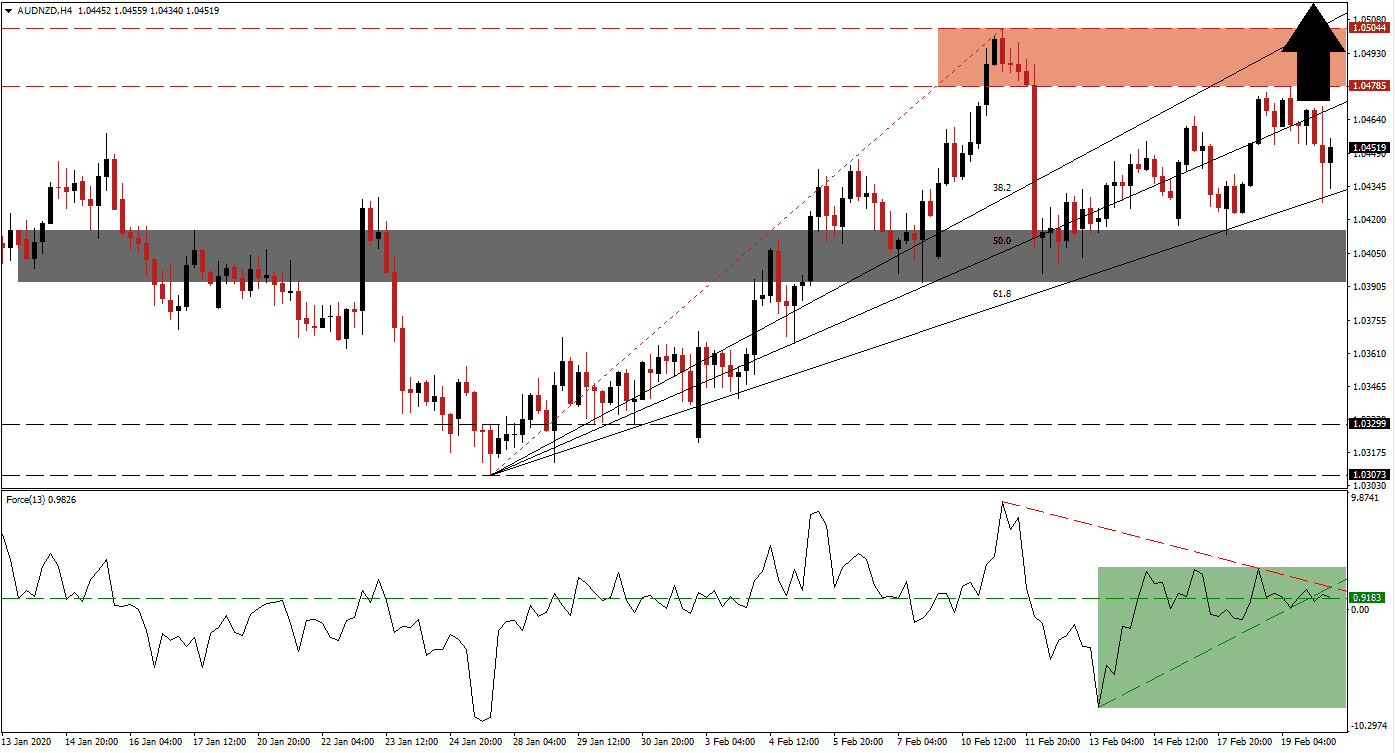

Following the release of the Australian employment report for January, the Australian Dollar regained stability with a bullish bias. Solid full-time employment figures calmed concerns over the lasting damage from the deadly bush fires. An interest rate cut by the People’s Bank of China in response to Covid-19 added to positive sentiment, as the Australian Dollar is the primary Chinese Yuan proxy currency. The AUD/NZD bounced higher off of its ascending 61.8 Fibonacci Retracement Fan Support Level and more upside pending.

The Force Index, a next-generation technical indicator, recovered from a higher low, which resulted from the breakdown in price action below its resistance zone. It allowed for the conversion of its horizontal resistance level into support. The Force Index is now challenging its descending resistance level, as marked by the green rectangle, while the ascending support level is adding to upside pressures. Bulls gained control of the AUD/NZD after this technical indicator drifted into positive territory.

Adding to bullish pressures in this currency pair is the conversion of its short-term resistance zone into support after the entire Fibonacci Retracement Fan crossed above it. This zone is located between 1.03926 and 1.04155, as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level reversed the AUD/NZD on three occasions, establishing a dominant bullish chart pattern, expected to guide price action to another breakout. You can learn more about the support and resistance zones here.

Price action is well-positioned from a fundamental perspective, supported by technical conditions, to accelerate to the upside. A breakout above its resistance zone located between 1.04785 and 1.0504, as marked by the red rectangle, is anticipated. Weak fourth-quarter PPI data out of New Zealand may entice the Reserve Bank of New Zealand to lower interest rates, especially if the economic fallout from Covid-19 will be greater than the central bank predicts. The AUD/NZD will face its next resistance zone between 1.06048 and 1.06504.

AUD/NZD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.04500

Take Profit @ 1.06300

Stop Loss @ 1.03900

Upside Potential: 180 pips

Downside Risk: 60 pips

Risk/Reward Ratio: 3.00

In case of more downside in the Force Index, enforced by its descending resistance level, the AUD/NZD could be pressured into a breakdown. Due to the long-term bullish fundamental outlook for this currency pair, any spike lower from current levels should be considered an excellent trading opportunity for Forex traders to consider. The downside potential is limited to its support zone located between 1.03073 and 1.03299.

AUD/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.03650

Take Profit @ 1.03100

Stop Loss @ 1.03900

Downside Potential: 55 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.20