Amid renewed global geopolitical tensions, particularly from North Korea and the Middle East region, it was natural to have a strong demand for safe havens, the most important of which is the Japanese Yen, and accordingly, the USD/JPY price declined for six consecutive trading sessions, reaching the 107.86 support in the beginning of this week’s trading. The US dollar experienced a sharp decline in the last days of 2019, as investors welcomed the US claims that the "first phase" of the trade agreement with China will be signed in the middle of this month. The demand for the dollar returned again, as tensions with Iran increased.

US President Donald Trump said on New Year's Eve that he would sign the first-stage trade agreement with China at the White House on January 15, 2020 before a visit to Beijing shortly after to start negotiations of the second phase, which would be more ambitious than the first. The deal will see a reduction in some customs duties imposed on exports from both sides in the past year, and will prevent further hostilities as long as conditions are met and talks continue between the two sides.

This announcement is supportive to the turbulent global economy and encouraged investors to take risks despite the positive mood being increasingly undermined by tensions between the United States and Iran, which increased after the White House claimed responsibility for a missile attack on an Iranian-backed armed group in Iraq that led to protests outside the US embassy in Baghdad, and culminated after the killing of the Iranian general Qassem Soleimani with an American air strike.

Concern increased after Trump's recent tweet that the United States has identified 52 locations inside Iran that would be attacked if Iran targets any of its bases or employees elsewhere. This situation will continue to support more gains for the Japanese yen as one of the most important safe havens.

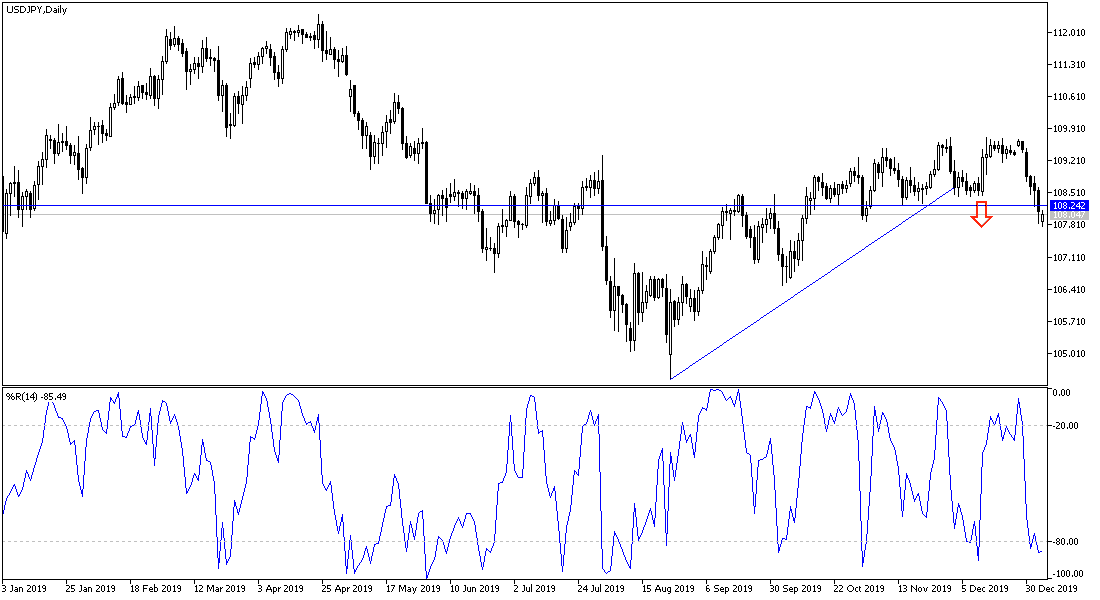

According to the technical analysis of the pair: The USD/JPY pair will have no real opportunity to reverse the current situation without moving towards the 110.00 psychological resistance. On the other hand, the general trend will remain bearish, as is the situation now, as long as it remains stable around and below the 108.00 support. The closest support levels for the pair are currently at 107.70, 106.90 and 106.00, respectively. The pair's losses may subside with the formal signing of the US-China trade agreement and the calming of fears of an escalation toward war in the Middle East region.