Today, US dollar pairs will interact strongly with the announcement of monetary policy decisions from the US Federal Reserve Bank, and although forecasts strongly indicate that the bank will not change interest rates, the greatest focus will be on the content of the monetary policy statement and the comments of Governor Jerome Powell, as any change in the bank’s tone will set the course of expectations for its policy in the coming months. The price of the USD/JPY suffered a setback recently due to the Corona virus, which supported the pair's decline to the 108.72 support, with strong demand for the Japanese yen as a safe haven, as the virus threatens the second largest economy in the world. Adding to global financial markets’ fears, was the epidemic spreading to 10 other global countries.

The Chinese authorities are still trying to better understand the new virus. It is from the Corona virus family, which can also cause colds as well as more serious diseases such as SARS. China has so far confirmed more than 4,500 cases of coronavirus and more than 100 deaths. The Chinese government closed Wuhan and 16 other cities in Hubei Province, isolating more than 50 million people. On Tuesday, the United States and other countries prepared to fly their citizens from Wuhan. The spread of the disease has resulted in daily work stoppages and the closure of famous tourist attractions such as the former Imperial Palace in Beijing, Shanghai Disneyland, Hong Kong Disneyland and the city's ocean park. The situation is disastrous for China by all accounts.

The International Monetary Fund predicts that China's growth will drop from 6.1% in 2019, which is already the slowest since 1990, to 6% this year and 5.8% next year. The slowdown reflects China's difficult transition from rapid, unsustainable growth based on often wasted investment to stable growth. China did not breathe a sigh of relief after a temporary halt to the tariff war between them and the United States. The signing of the Phase 1 trade agreement is only a temporary truce.

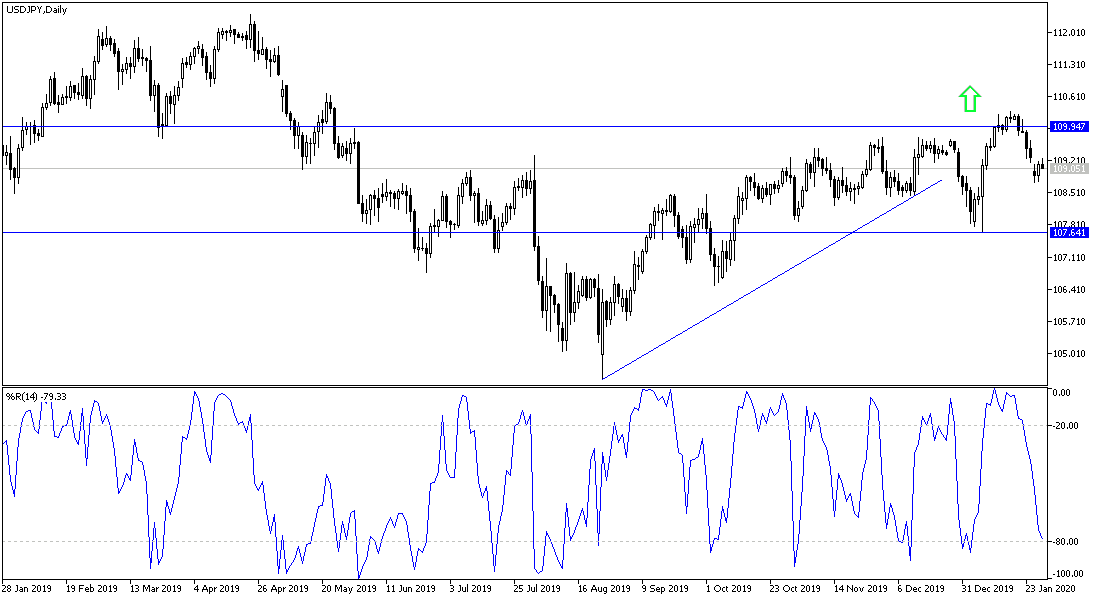

According to the technical analysis of the pair: The stability of the USD/JPY below the 109.00 support will remain supportive to breaking the general trend, as shown on the daily chart below, and the closest support levels for the pair are currently at 108.80 and 108.00 and 107.45 respectively and the second and third levels are preferred to start buying the pair again. On the upside, the chance of an upward correction will not materialized without stability above 110.00 psychological resistance. The pair will remain in a limited move until the US central bank announces its monetary policy and learn about the statements of its Governor Jerome Powell, as well as developments on the ground for the course of the outbreak of the Corona virus.