We did not notice a significant change in the USD/JPY movements despite the weak results of the US job numbers by the end of 2019. The pair’s gains extended the 109.68 resistance and closed the week’s trading around 109.50. The pair got strong support from calming fears of worsening matters in the Middle East, which were on the brink of war threatening one of the most important energy sources in the world. The United States of America only imposed more sanctions on Iran after its missile attack on an Iraqi military base used by the American forces, which did not result in strong casualties, which came in response to the United States assassination of Qassem Soleimani, the most prominent Iranian military commander.

The US dollar ignored the negative US job numbers and remained in a good position amid optimism that the official signing of the Phase 1 trade agreement between the U.S and China scheduled for this week. Details of this agreement and accelerating the coming phases will be good for the global economy as a whole, especially for the American economy, and will be a catalyst for US President Trump in the presidential elections this year.

The new trade agreement violates WTO rules, which seek to avoid narrow preferential treaties. As according to the agreement, the U.S share in the Chinese import market will rise and increase significantly at the expense of the market share of other countries. During most of 2019, China's imports declined. The Trump administration wants to only apply America First principle to all economies of the world. The compass of tariffs that Trump is using to pressure others may turn to the European Union, which could restore anxiety to global financial markets.

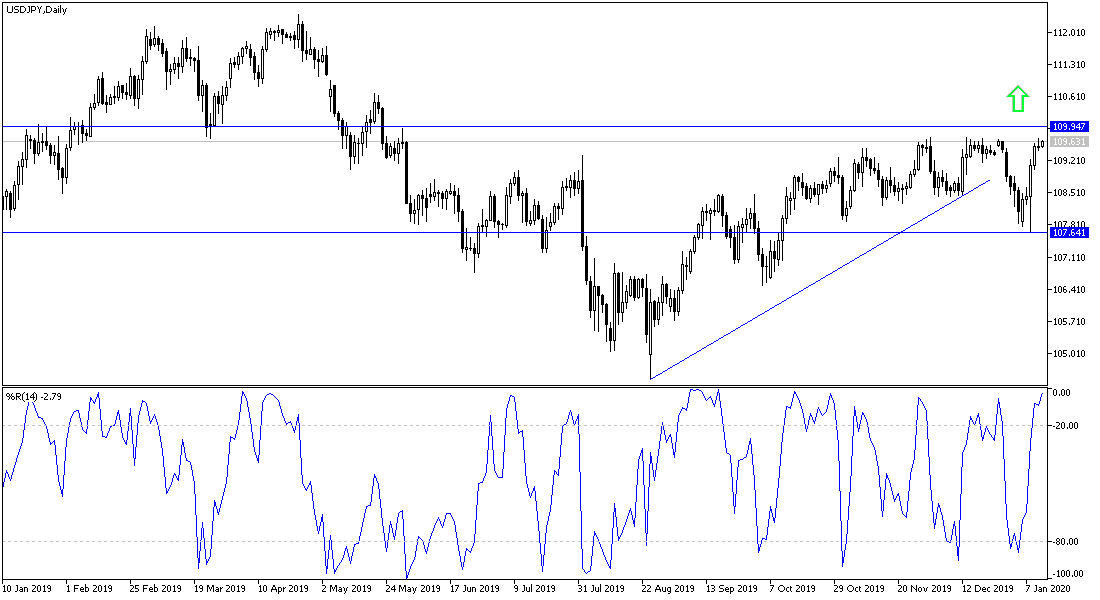

According to the technical analysis of the pair: On the daily chart, the bullish momentum for the USD/JPY increases, and the bulls are waiting to push it above the 110.00 psychological resistance to confirm their control. Hopes of the bears evaporated last week after the pair surged from the 107.64 support to achieve its recent gains. Without the renewed global trade and geopolitical tensions, there will be no return to the Japanese yen gains.

Today's economic calendar contains no important economic data, either from Japan or the United States of America.