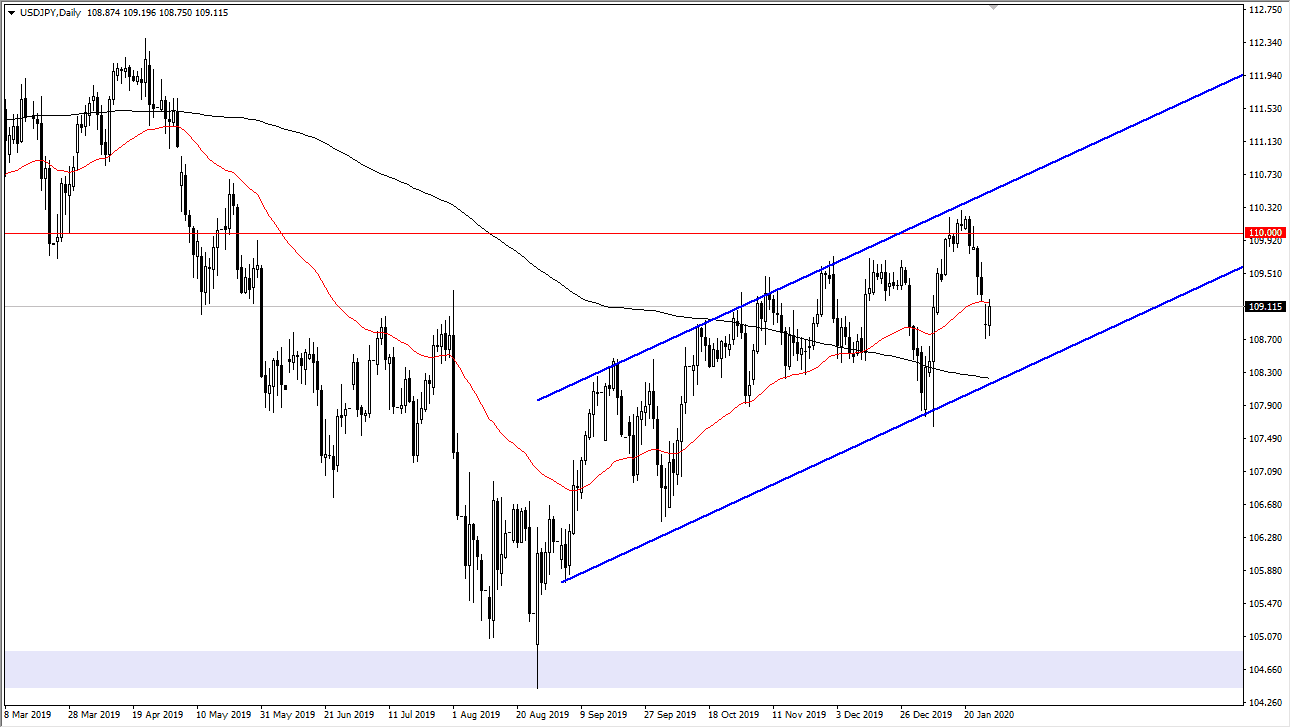

The US dollar has rallied a bit during the trading session on Tuesday, reaching towards the 50 day EMA during the end of the session. If we can break above the top of the range for Tuesday, it’s likely that the market could go looking towards the ¥110 level, which was the most recent highs. To the downside, if we were to break down below the last 48 hours low, then the market is likely to go looking towards the 200 day EMA underneath which is currently at the uptrend line that makes of the bottom of the up trending channel. Keep in mind that this pair is highly sensitive to the stock markets and tend to follow the S&P 500 as well. After all, it is a market that is very sensitive to risk appetite and therefore we need to pay attention to not only this pair, but the S&P 500 but on Wednesday it’s even more important to pay attention to the FOMC.

The Federal Reserve releasing a statement during the trading session on Wednesday will of course put this pair into focus as it is so highly sensitive to risk as well as interest rate situations. The pair does move a bit in verse though, because at this point it’s likely that the market will rally if the FOMC is very loose with monetary policy or even suggest that they may expand monetary policy, because it should drive the stock markets higher as a result.

All things being equal though, the ¥108 level is an area where I would anticipate value hunters come back in. Ironically, the Federal Reserve tightly and monetary policy or suggesting that they were going to do something to cut back monetary supply could push this market much lower. To the upside, if we were to break above the ¥110.30 level, it’s likely that we will continue to grind towards the ¥111 level, and then eventually the ¥112.30 level. As things stand right now, we are still very much within the tolerance of the up trending channel, and therefore it’s likely that we will find buyers sooner than later. At this point, expect a lot of volatility but I do think that this pair favors the upside, but at 2:00 PM Eastern Standard Time the FOMC Statement could cause quite a bit of noise and then therefore it’s likely that the market will make its intention known after that.