The persistence and exacerbation of the recent global geopolitical tensions will naturally support further gains in gold prices, as it is one of the most important safe havens for investors in times of uncertainty, which happened after renewed skirmishes between the United States and North Korea on one hand, and between the United States and Iran on the other. It was natural for gold prices to move to the $1582 resistance, the highest level for the yellow metal more than six years, before settling around $1573 at the time of writing, while awaiting any developments. The yellow metal ignored what was announced in the minutes of the December meeting of the US Federal Reserve, which made it clear that Fed officials preferred to keep interest rates in a low range between 1.5% and 1.75% to relieve pressure on the US economy from slowing global growth and trade wars of the Trump administration. Officials were also concerned that inflation had not yet reached the Fed's 2% target level.

Financial markets and investors are waiting carefully for the Iranian response to the recent killing of Qassem Soleimani by the United States. Economists believe that the increased turmoil in the Middle East will lead to continuous sales of shares, which weakens the confidence of companies and consumers to the extent that the concerns of the labor market and inflation become secondary.

Although the US central bank's policy-setting committee voted unanimously last month to keep interest rates unchanged, many members expressed concern about the long-term consequences of extremely low interest rates. A few participants warned that keeping interest rates too low could increase risk on Wall Street, which could lead to serious asset bubbles. If these bubbles erupt, it might "make the next economic recession worse."

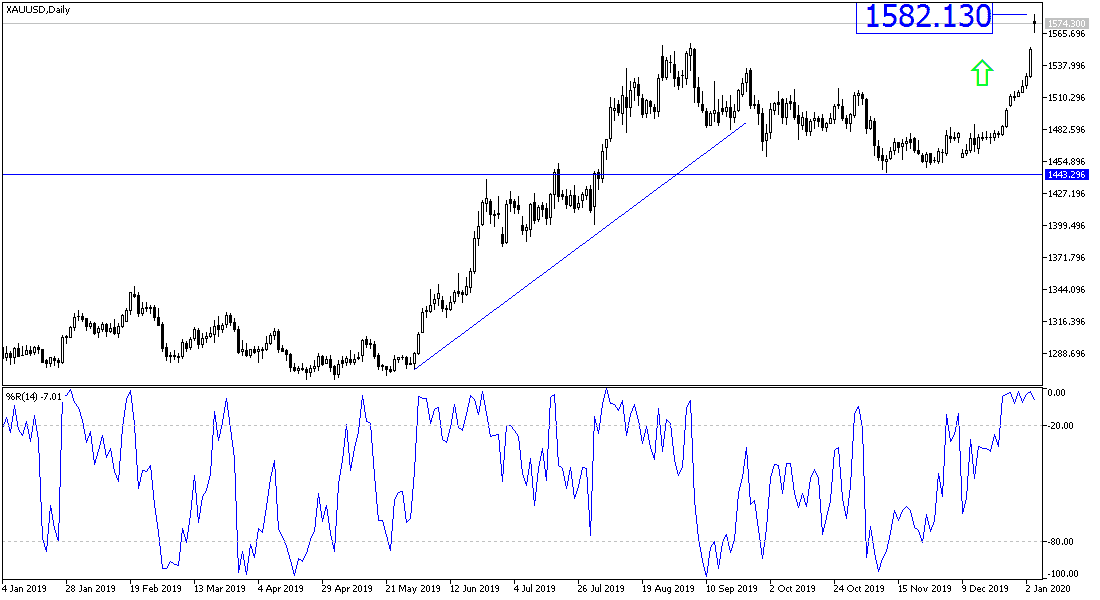

According to the technical analysis of gold prices: The general trend is getting stronger towards the rise as long as gold prices stabilizes above the $1500 psychological resistance of. With his gains reaching $1580 dollars, the next psychological resistance will be $1600 in the range of the next goal, and it may be more than that if things get worse than the current situation. On the downside, the closest support levels for gold are currently at 1565, 1550 and 1535, respectively. I still prefer to buy gold from every drop as long as global geopolitical and trade tensions persist. We may see a quick collapse of gains if things calm down, especially with the United States and Iran, and the agreement between China and the United States was signed.