Gold ounces lost more than 70 dollars from its gains during last week's trading with easing global geopolitical tensions. Gold prices retreated from the $1611 resistance, which was recorded at the beginning of the week, and the highest for the yellow metal in seven years ago, up to the $1540 level, after things calmed down in the Gulf, since there were no indications that a large-scale war would erupt there after military operations between the U.S and Iran, on Iraqi territories. The US administration was satisfied with imposing more sanctions on Iran, who already suffer bad economic conditions, and the sanctions will worsen them further. For its part, Iran announced that it stopped militarily actions after its missile attack on the Iraqi base used by the American forces, which came in response to the killing of Qassem Soleimani, a prominent Iranian military commander, with a drone strike. Gold prices closed last week's trading around $1562 an ounce.

Gold gains this week may be subject to more pressure as the world's two largest economies will sign the Phase 1 agreement, which halts the tariff war between the two, which has strained the global economy so much in the past months. This week, a Chinese delegation, headed by Vice Premier Liu He, who led the negotiations, will participate in the signing ceremony on January 15. Under the agreement, China would agree to purchase $200 billion of American goods over the next two years, and such an agreement was prepared more than a year ago by Treasury Secretary Manuchin, but was rejected by President Trump. The features of the agreement and the timetable for the coming phases will support the moves of the yellow metal in the days after the signing.

Gold gains ceased during the Friday session after the announcement of lower-than-expected results for the US jobs report. During the month of December, the US economy succeeded in creating a total of 145,000 jobs in the non-farm sector, and expectations were for an increase of 162,000 jobs from the 266,000 jobs recorded in November. Average hourly wages fell to 0.1%, and expectations were for an increase of 0.3% from 0.2% recorded in the previous month. Despite the decline, the country's unemployment rate remained stable around 3.5 percent, the lowest in 50 years.

It was clear from the Labor Department report that employment fell from strong gains of 256,000 in November, which got a boost by the end of the GM strike. Employers for this year added about 175,000 jobs per month, compared to about 223,250 jobs per month in 2018. Annual wage growth in December fell to 2.9%, down from the annual average of 3.3% in the previous year, in a possible indication that some recession still exists in the labor market and that unemployment may decrease more than its current historical level.

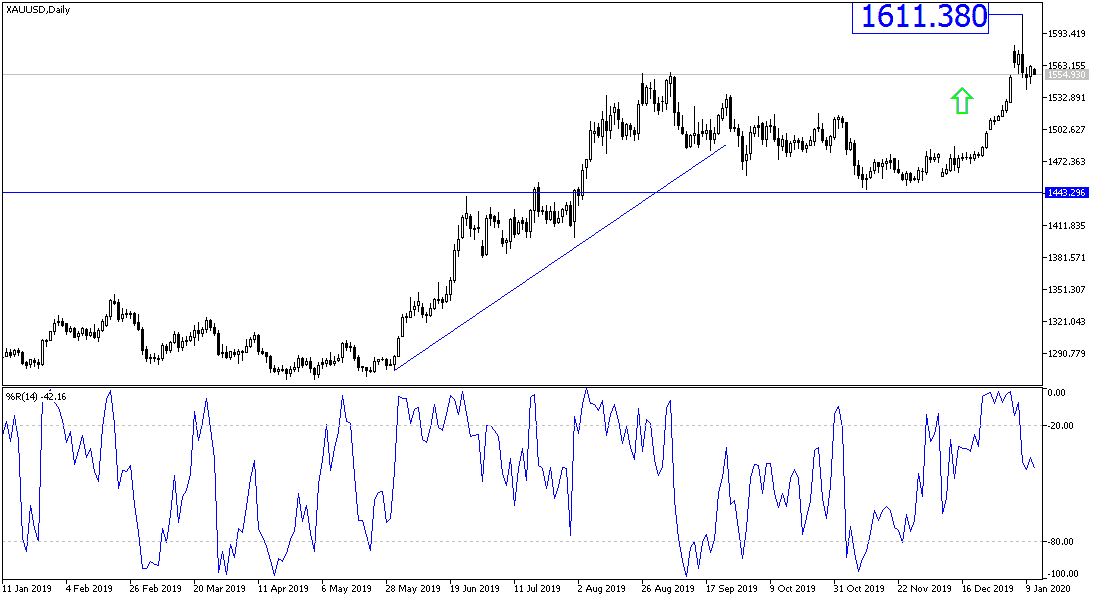

According to the technical analysis of gold: The general trend of the yellow metal is still bullish as long as it is stable above the $1500 psychological resistance. During this week’s trading, we expect more price drop to below $1540 reached last week, amid increased optimism in financial markets with the Phase 1 agreement Between the United States and China after tomorrow. The closest support levels for gold are now at 1547, 1535 and 1515, respectively. For bulls, they are looking forward to returning to the next historical psychological resistance at $1600 again.

Gold will react today to the release of the British economic data, as the economic calendar has no important US economic data. It will also be affected if global geopolitical tensions renew.