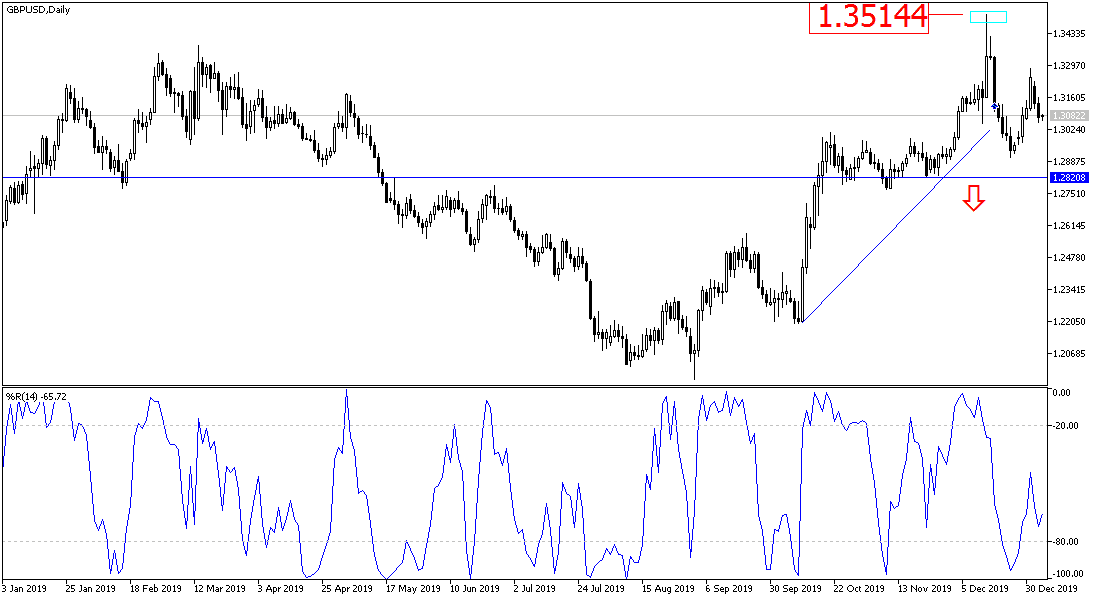

In the first trading sessions for the new year 2020, the GBP/USD price returned to decline again, reaching the 1.3053 support, after attempts to rebound before the New Year holidays to the 1.3284 resistance, with investors returning to buy the dollar as a safe haven after the recent tensions in The Middle East region and amid fears of retaliation from Iran for the actions of the United States of America. Moving below the 1.3000 psychological support is a strong threat to the upside correction expectations. Concerns about the future of the Pound returned after Boris Johnson's recent threats about the future of Brexit, and as a result, gains evaporated after the recent British early elections that supported gains to the 1.3514 resistance.

The Brexit track will continue to be the most influencing factor on the sterling’s movements in the coming months, and will be formally implemented on January 31, 2020, but focus afterwards will be on developments in the transition period talks between the two sides of Brexit; the UK and the European Union. The complexity of the negotiations may eventually lead to a no-deal Brexit.

And on the American side. At a meeting of the Federal Reserve's monetary policy committee, US central bank officials pointed out that the US economy "showed flexibility" despite trade wars and the weakening global economy, according to the minutes announced last Friday. The rise in long-term rates indicates that the likelihood of a recession in the medium term has decreased significantly in recent months.

Since last month’s meeting, tensions have escalated in the Middle East, as the Trump administration has confronted Iranian-backed forces in Iraq. On Friday, US stocks fell on Wall Street and oil prices jumped after US forces in Iraq killed a prominent Iranian general. However, many analysts say that higher oil prices could benefit the American economy due to the sharp increase in American oil production in the past decade.

According to the technical analysis of the pair: There is no change of our technical view for the GBP/USD pair: Breaking the 1.3000 psychological support will strengthen the downtrend again and foreshadows a stronger downward move. The 1.3300 resistance will give strength to the bullish correction again, and we still prefer to buy the pair from every lower level. Given that the course of Brexit and the US trade wars will be the most influencing factor on the pair's performance in the coming months.

As for the economic calendar data: All focus will be on the announcement of the PMI index for British services sector. There are no significant US economic releases today.