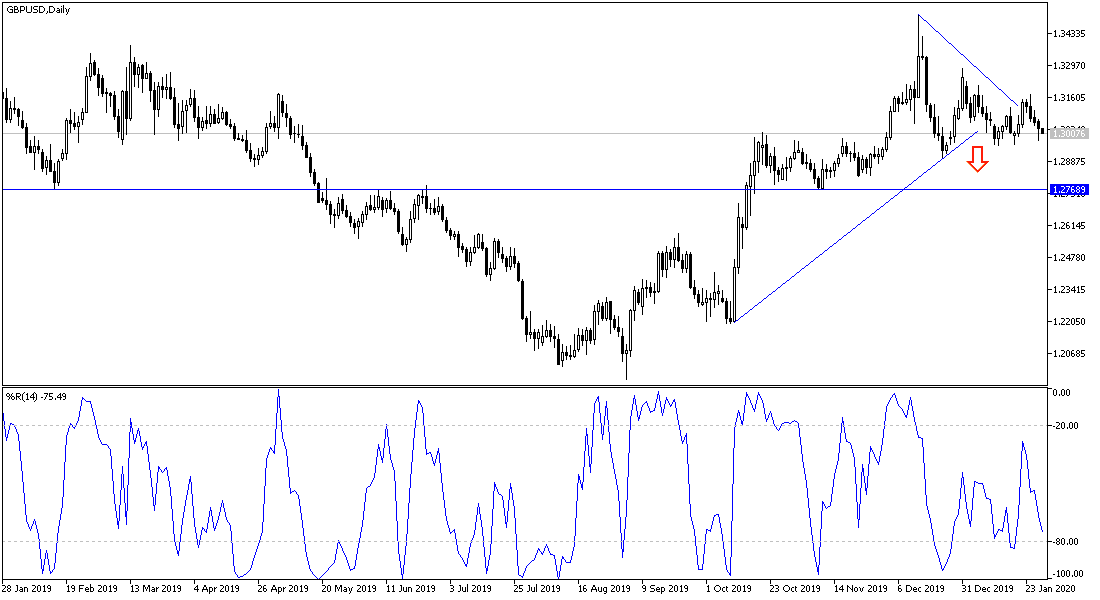

Ahead of the three most important events for this week, the GBP/USD price fell to the 1.2975 support, confirming the break of the general trend and is now stable around 1.3025 at the time of writing. The three events in order are: The US Federal Reserve announcement today of the monetary policy decisions and the statements of its Governor Jerome Powell, tomorrow the Bank of England will announce its monetary policy decisions, and Brexit on Friday. These three events will have a strong affect to the pair's performance. Today, no significant change is expected in the Fed's policy, as the US economic performance still supports the bank's reassurance and recent statements by monetary policy members, including Jerome Powell, supporting the survival of the bank's policy for a longer period of time.

The basic rule in foreign exchange markets is that the currency depreciates when the issuing central bank lows interest rates, and ascends when interest rates are raised. A long time ago, expectations indicate a cut by the Bank of England, and the markets have priced the GBP on that basis. However, some positive UK economic issues have recently supported 50/50expectations. Regardless, the bank’s decisions will move the pound against other major currencies, and after the Brexit, the results of the country's economic data will be monitored continuously to analyze the economic situation after this historic event. The transition period negotiations will have the strongest influence on the pound’s performance in the coming months.

Corona is the topic of the world. The Coruna virus attracts comparisons with the outbreak of SARS, which paralyzed the economies of China and Hong Kong for weeks in 2003. But what is happening in China carries a lot. In 2003, China accounted for 4% of global output. Now its share is 16%, according to the World Bank. "The slowdown in growth in China can have major impacts across Asia and the rest of the world, given the scale of the Chinese economy and its role as a major driver of global growth in recent years," said Eswar Prasad, economist at Cornell University and former head of the China section at the International Monetary Fund.

According to the technical analysis of the pair: By the GBP/USD moving below the 1.3000 psychological support, the downtrend strength will increase, and accordingly, the closest support levels may be 1.2960 and 1.2880, with the last level being ideal for returning to buying the pair again. There will be no return to the bulls' control of the performance without moving towards the 1.3300 resistance. Events from today to Friday will form the pair's technical performance for the month of February.

As for the economic calendar data: All focus will be on the US session data, with the announcement of pending US home sales, then the Federal Reserve's monetary policy decisions and the statements of its Governor Jerome Powell.