In the beginning of this week’s trading, the pound will react to the results of important economic releases, led by the UK's GDP growth and the important industrial production rate. Prior to the announcements, the GBP/USD pair stabilized around the 1.3063 level, and its losses last week reached the 1.3013 support, with Bank of England Governor Mark Carney hinting at the possibility of lowering interest rates if the country's economic performance continued to weaken, which was against the desire of the financial markets and analyst aspirations. After 18 days from now, Britain will officially exit the European Union, and the currency trading market is pricing this event for a while now, which will be the most influential on the Pound after that marathon negotiations between the two sides of Brexit on the transitional period. Boris Johnson wants 2020 to be the end of all arrangements, and the European Union believes that time will be limited and wants to extend to 2022.

The skirmishes between them will negatively affect any gains for sterling in the coming months because the incompatibility will support a no-deal Brexit, which will be damaging to both sides and increase the uncertainty of the global economy as a whole.

The continued weak economic performance of the United Kingdom, especially in the daily releases throughout this week, will increase the pressure on the pound because it will support the recent comments from Mark Carney on the possibility of reducing interest rates. In contrast, the economic performance of the U.S is still the best, and the policy of the Federal Reserve Bank led by Jerome Powell will remain unchanged in the coming period. The strong growth in employment during the record period of US economic growth, contributed to gains in consumer spending, where retail sales during the holiday shopping period improved by 3.4% compared to the previous year, this probably contribute to the increase in employment in retail trade, as this sector added 41,200 jobs in December 2019.

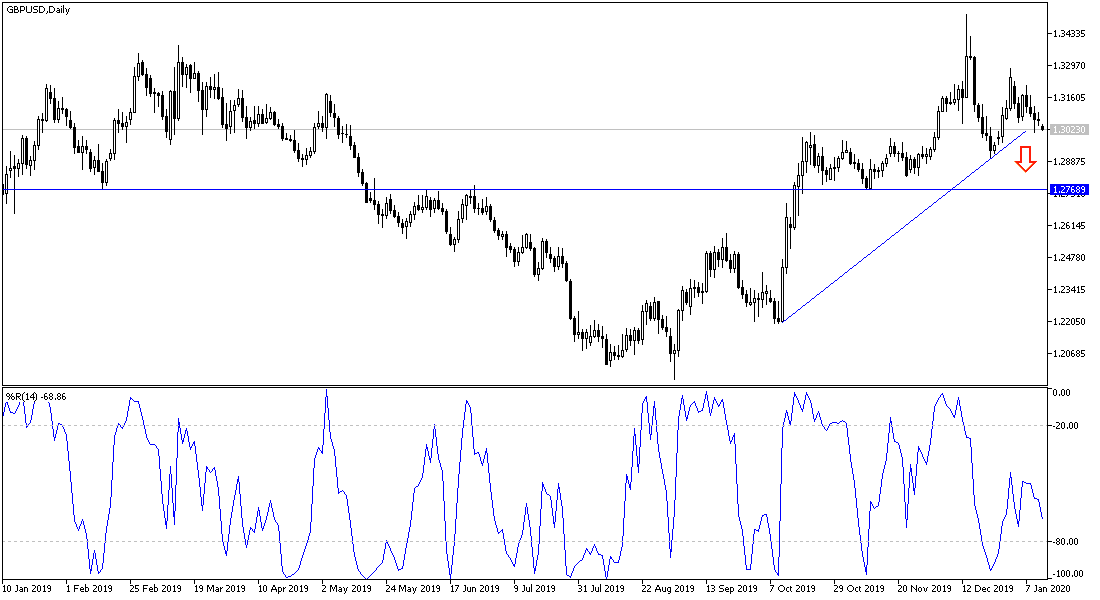

According to the technical analysis of the pair: If the price of the GBP/USD pair declines towards the 1.3000 psychological support, and settled below it, the pair's downward momentum will increase to move towards stronger support levels, and the closest ones are currently at 1.2980 and 1.2880 respectively, which are levels confirming the bear's control, as is the case right now. On the upside, as we mentioned in recent technical analyzes, we now confirm that there is no return to bulls' control over performance without the pair moving above the 1.3300 resistance. I still prefer to sell the pair from every upside level, as concerns about the Brexit will not end until January 31, the official exit date.

As for the economic calendar data today: From the UK, the GDP growth rate and the industrial production index data will be announced, and industrial production and commodity trade balance will be read. There are no US economic releases today.