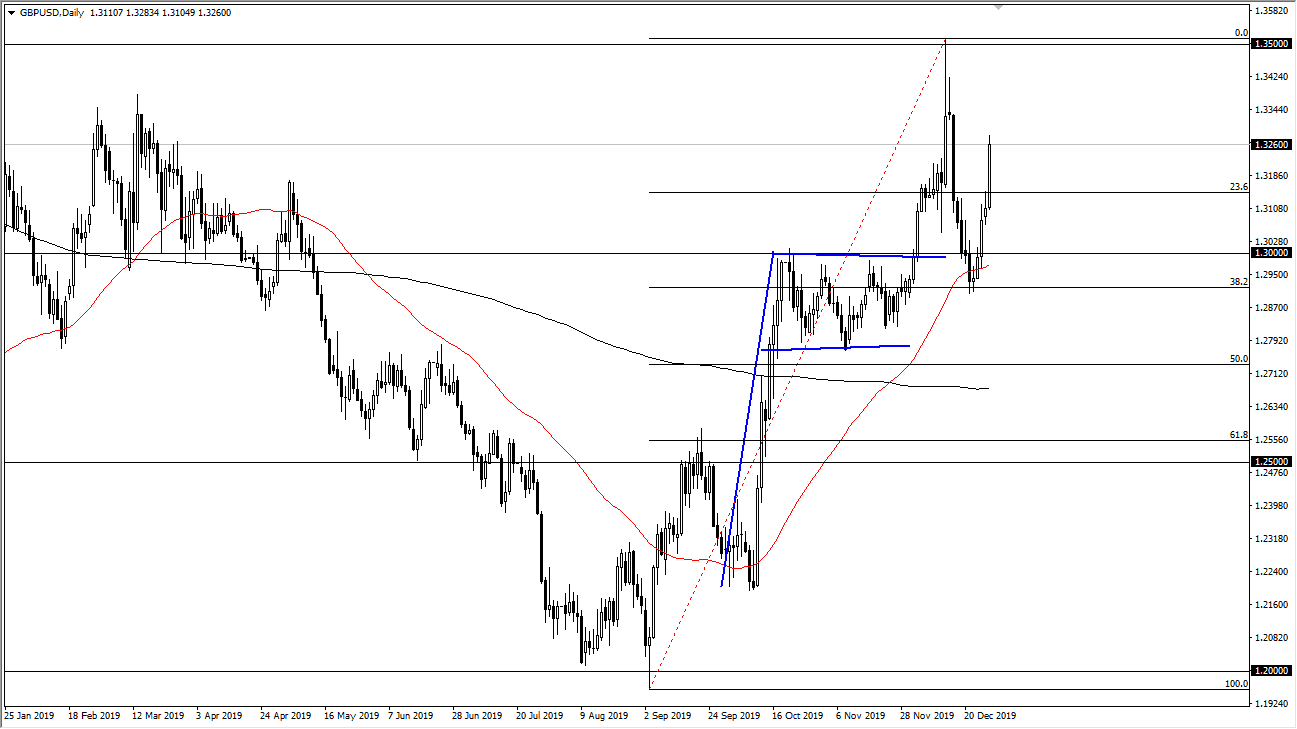

The British pound has rallied nicely during the trading session on New Year’s Eve, breaking above the resistance at the 1.32 handle before getting a bit more sluggish near the 1.3250 level. I think a pullback makes quite a bit of sense, but that pullback should offer plenty of buying opportunities as the momentum’s clearly on the side of the buyers. At this point, I like the idea of buying the British pound because it is not only historically cheap, but it is also forming a lot of technical signs of strengthening to the upside.

The bullish flag has offered support now that we have reach back towards it, just as the 50 day EMA as. At this point, the market is likely to continue reaching towards the 1.35 handle, which of course is the highs that the market recently had after the election. Beyond that though, the bullish flag measures for a move to the 1.38 handle above, so keep that in mind as well. I think that it will take a significant amount of momentum to finally break above there so I would anticipate that it will take several attempts to get through it. That being said though, it certainly looks as if the market is strong and I think it will continue to go going forward.

To the downside, I believe that the bottom of the flag at the 1.28 level is massive support, so if we were to break down below there, it’s likely that the 1.25 level underneath will be the next target. I think at this point in time though, it’s likely that we will see several attempts to finally break out so don’t be surprised at all if we rally from here only to pull back yet again. Remember, there are a lot of questions out there when it comes to the Brexit still, and that will be reflected in the charts. Although I have more of an upward bias in 2020, unfortunately we will continue to have a lot of volatility, so keep your position size small yet again as this market will have quite a bit of headline risk going forward. Ultimately, this is a market that has an upward bias but can buy you occasionally and therefore this will be one of the more difficult pairs to trade going forward yet again.