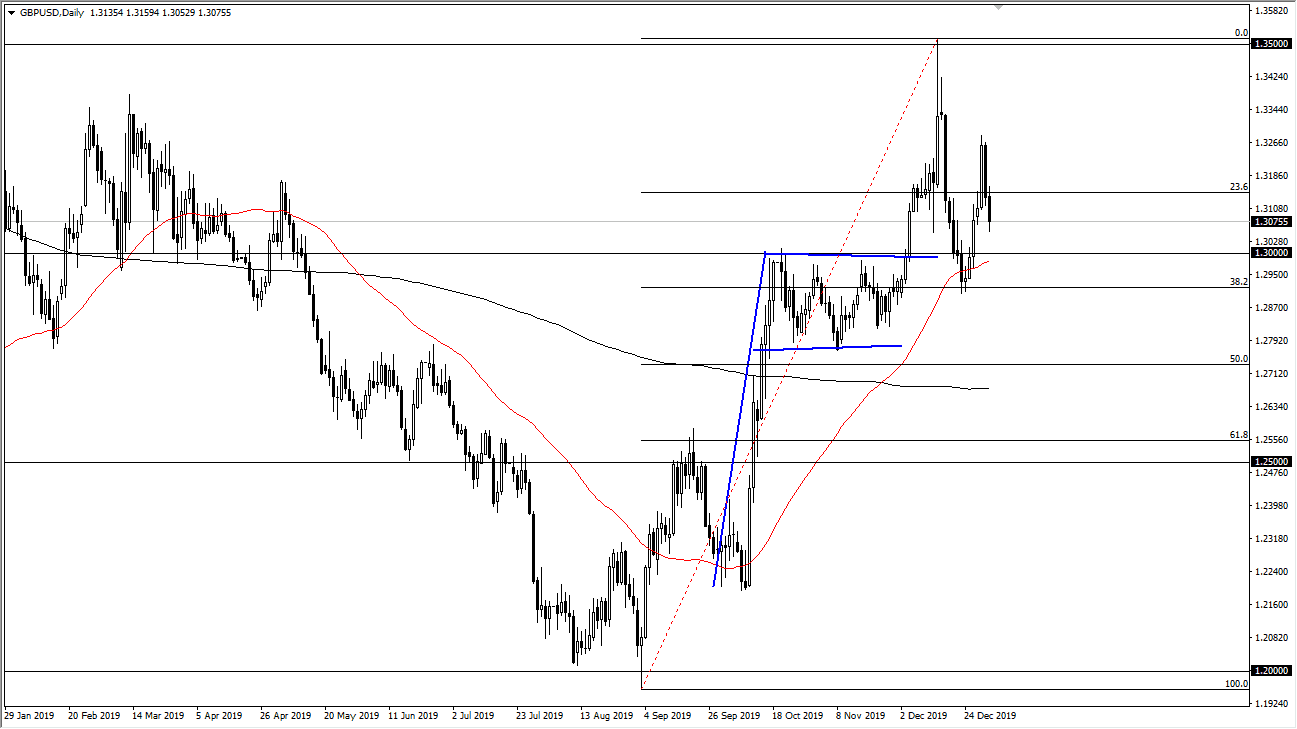

The British pound fell during the trading session on Friday, slicing through the 1.31 handle. At this point, the market looks very likely to reach down towards 1.30 level as we have seen a bit of pullback, mainly due to a major “risk off” type of move. Ultimately, the Americans killing an Iranian general of course have people running for cover, and based upon the fact that the British pound has to deal with the Brexit situation and the fact that a lot of people will throw money into the treasury market in the US, this move makes quite a bit of sense.

The 50 day EMA is sitting just below the 1.30 level, and that of course will have a certain amount of influence as well. The 50 day EMA is something that traders pay attention to from a longer-term standpoint, and it can often cause dynamic support and resistance. That being said, if we break down below the 50 day EMA it could have the market challenging the depth underneath, and then perhaps as low as the 1.28 handle. If the market were to break down below the 1.28 handle, then it would completely unwind the overall bullish move.

I anticipate that the British pound is going to be just as obnoxious as it was last year, only this time are probably going to have more of an upward proclivity than anything else. Looking at this market, I believe that we will eventually find buyers, but we will probably need to continue looking for value underneath. At this point, the 1.35 level is the obvious resistance barrier, and if we can break above there then we can finally fulfill that potential move based upon the bullish flag which suggested that the British pound was going to go to the 1.38 handle. I like the British pound longer-term, but we have a lot of noise to chew through, not the least of which is going to be the Brexit itself and all of the nonsense headlines will almost certainly be coming out above London and the European Union. At this point, I like the idea of going long on dips because they offer value but that’s about it. I don’t have any interest in shorting this market, at least not until we break down below that 1.28 handle underneath. Expect volatility, but I do prefer the upside.