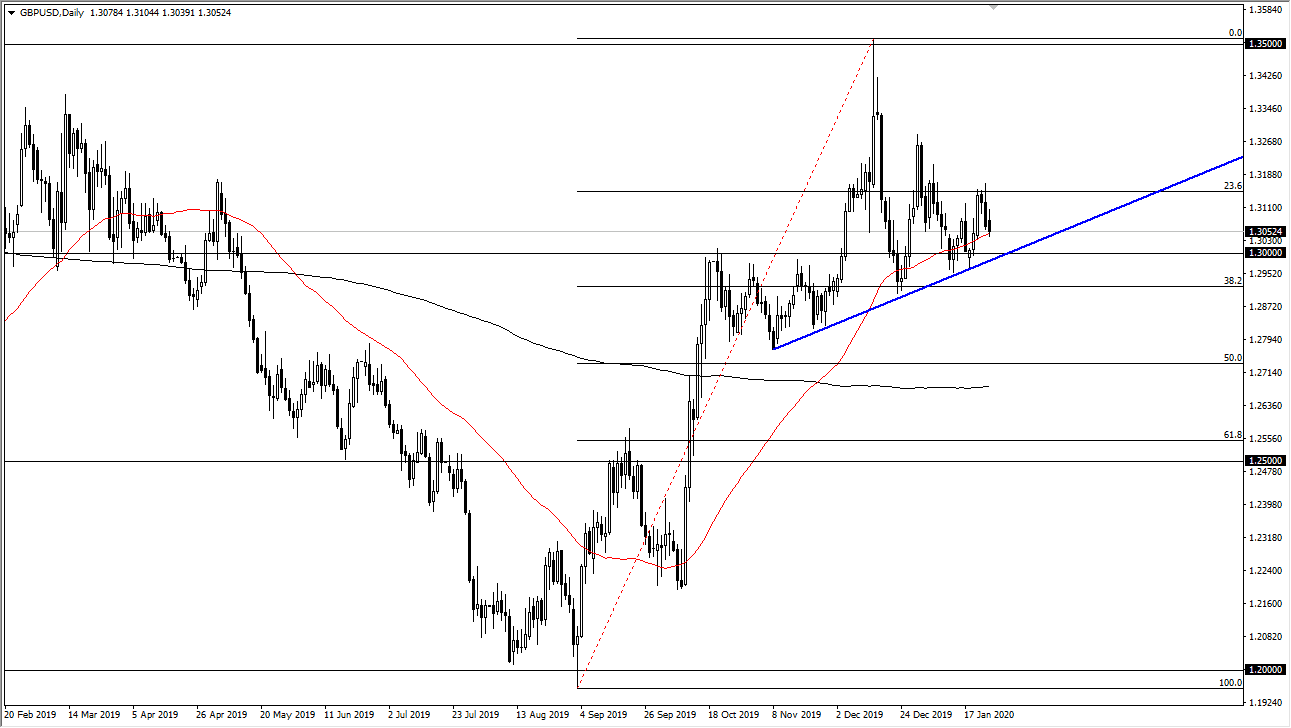

The British pound has initially tried to rally during the trading session on Monday but sold off in reached towards the 50 day EMA as there was a general “risk off” attitude in markets around the world. At this point, the market looks a little bit sluggish, and it’s likely that we could break down a little bit further. Even if we do, I think there is an excellent opportunity to buy the British pound near the 1.30 level that coincides nicely with the trendline that I have marked on the chart. Ultimately, these large, round, psychologically significant numbers do offer an opportunity for buyers and sellers to get involved.

If the market does break down below there, it’s very likely that the British pound could go down to the 1.28 level, which is the next horizontal support level. However, the pullback has almost nothing to do with Great Britain itself, and therefore it’s thought to be a reaction to the general “risk off sentiment” that we are seen around the world. In other words, eventually market participants will start to differentiate between currencies, and therefore it’s likely that the British pound gets a bit of a boost.

From a technical analysis standpoint, it makes quite a bit of sense to see a little bit of interest in this area, as we have been grinding higher for some time, but now we have the hard work of actually getting the Brexit situation done. It will become law, and the United Kingdom is getting ready to leave the European Union. Quite frankly, that’s probably a good thing for the UK longer-term, and it’s only a matter of time before traders begin to realize this. The bullish candle from last week was largely in part due to a better than anticipated employment figure coming out the United Kingdom, which of course is a very bullish sign. With this, I like buying dips but reaching towards the uptrend line is very likely to be the best way to go going forward, as it offers plenty of value and markets will more than likely react to that. There are plenty of wicks in that area to the downside, so it shows that there has been numerous support underneath that traders have paid attention to. All things being equal, it’s very likely that we will continue to see that be the case.