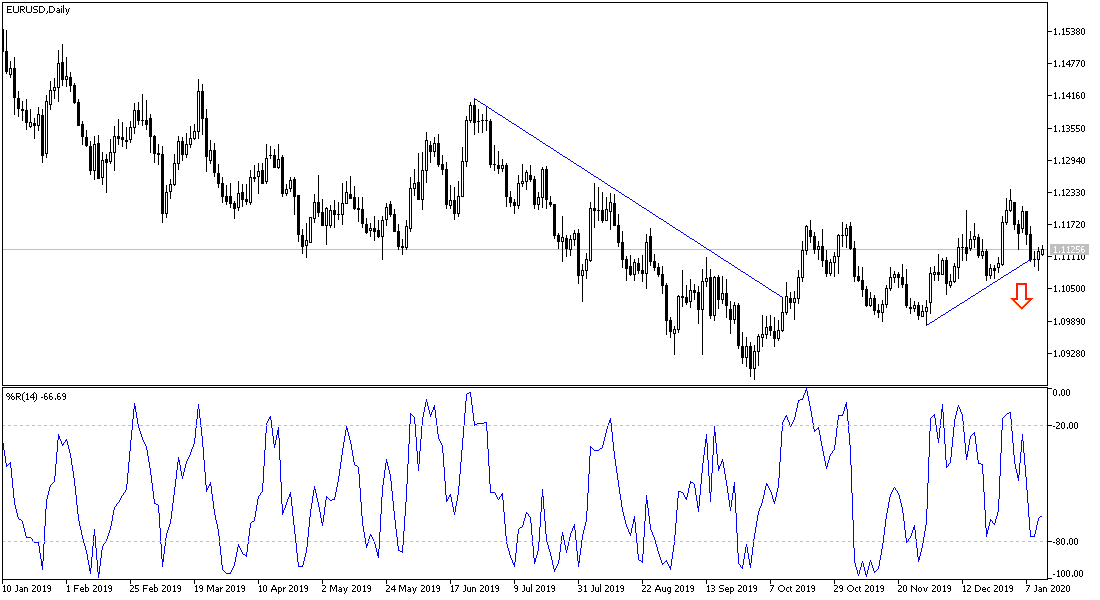

On the daily chart, there was a new breakdown in the EUR/USD direction, testing the 1.1085 support. What helped the pair close at the 1.1122 level of is the weak US job numbers for December 2019. The general trend will strengthen downward, as we expected before, in the event of a movement towards the 1.1000 psychological support. The single European currency received little support from the improved IHS Markit PMI numbers indicating a temporary recovery in the manufacturing sector for December, and from reports by European Statistics Agency Destatis showing a strong recovery in German industrial production for November. None of other positive releases was enough to prevent the single European currency from falling further.

As we expected before, and we now confirm, the continuation of the pessimistic outlook towards the Eurozone economy performance will remain a negative factor for any gains achieved by the Euro against other major currencies.

This week, a Chinese delegation, headed by Vice Premier Liu He, who led the negotiations, will participate in the official signing ceremony slated for January 15 for the Phase 1 trade agreement. According to this agreement, China agreed to purchase $200 billion of American goods over the next two years, and it was prepared to do so, or something similar to that, more than a year ago by the trade deal concluded by Treasury Secretary Manuchin, but President Trump later rejected it.

On the economic level. The US economy created 145,000 new jobs in December 2019. The forecast was for 162,000 jobs from 266,000 in November. The US unemployment rate held steady at 3.5%, and despite results below expectations, the job market remains strong at the beginning of 2020, even if employment and wage gains have slowed somewhat, the US economic growth remains strong.

The US economy added a total of 2.1 million jobs last year, down from gains of about 2.7 million in 2018. Employment slowed because the number of unemployed job seekers decreased by 540,000 people during the past year to 5.75 million. With fewer unemployed looking for work, there is a potential limit to employment gains.

According to the technical analysis of the pair: The EUR/USD pair is now in a neutral position, and closest to turning lower in the event of a move towards the 1.1000 psychological support. There would be no bullish strength controlling the performance of an upward correction without stability above the 1.1200 resistance. I still prefer to sell the pair from every upside level.

Today's economic calendar has no important data from the Eurozone or from the United States of America.